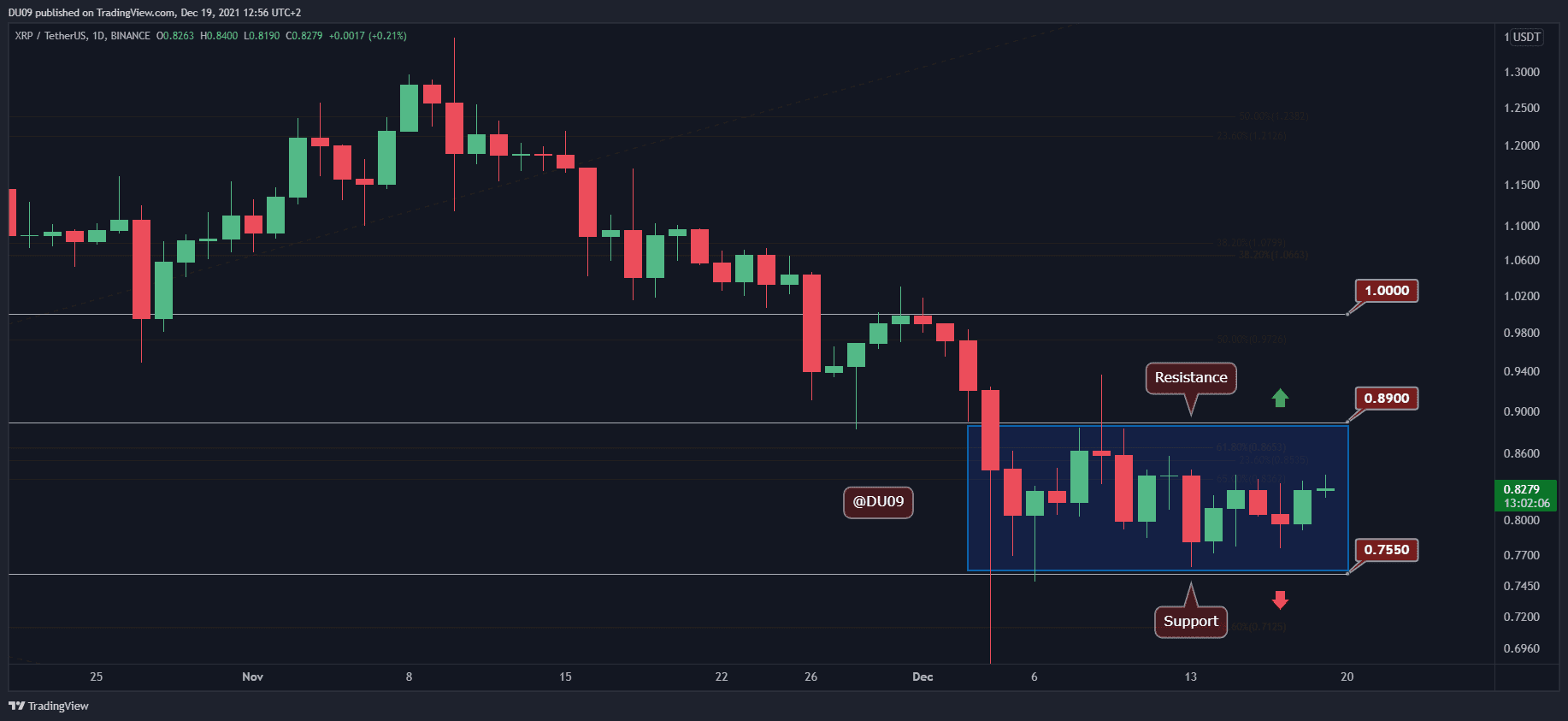

Over the past few days, XRP has consolidated within a narrow range, but finally there are some early signs that it is about to attempt a breakout of the range.

Key support levels: $ 0.75, $ 0.70

Key Resistance Level: $ 0.89, $ 1

XRP’s price recently maintained its trading range between the support line at $0.75 and the resistance at $0.89. This has allowed the price action to settle and consolidate, giving buyers more confidence in a possible bullish reversal, following months of bearish price action.

Technical indicators

Trade volume: The volume level remained stable and decreased at the start of the weekend (typical for weekends). If XRP attempts a break out of the current consolidation range, it will likely happen in the next few days of the week.

RSI: The daily RSI is making higher lows and higher highs. This might signal a reversal in the multi-month downtrend.

MACD: The daily MACD went through a bullish cross last week and momentum has only increased since then with the MACD histogram reaching higher highs. It is also bullish for XRP.

Bias

The current XRP bias is neutral. Once a breakout takes place – it will change this bias and decide the next direction for XRP.

Short term prediction of XRP price

XRP appears to be getting closer to its next direction decision, and the chances of a bullish breakout are higher. However, it probably depends on the overall dynamics of the crypto markets, which have been bearish lately.

If this momentum is maintained early next week and volume increases, then we may witness an attempt at breaking above the current resistance at $0.89 (top of the trading range). Until a clean break happens, XRP price action will continue under consolidation.