Ethereum, after emerging as the market’s top-performing asset over the last month, has once again tested its price levels under $4000. As Bitcoin slipped under $46k on 20 December, ETH too dropped by almost 5% and traded close to $3,817, at press time.

Over the past two days, however, Ethereum appeared to be recovering as stories of an ETH-BTC reversal were re-energized.

On 19 December, as Ethereum’s price finally pulled above the $4k-mark, the market anticipated a quicker recovery. In fact, there were speculations that if ETH falls below $4k, the next recovery could take time. With the same happening, when can we expect the recovery now?

Recovery pending?

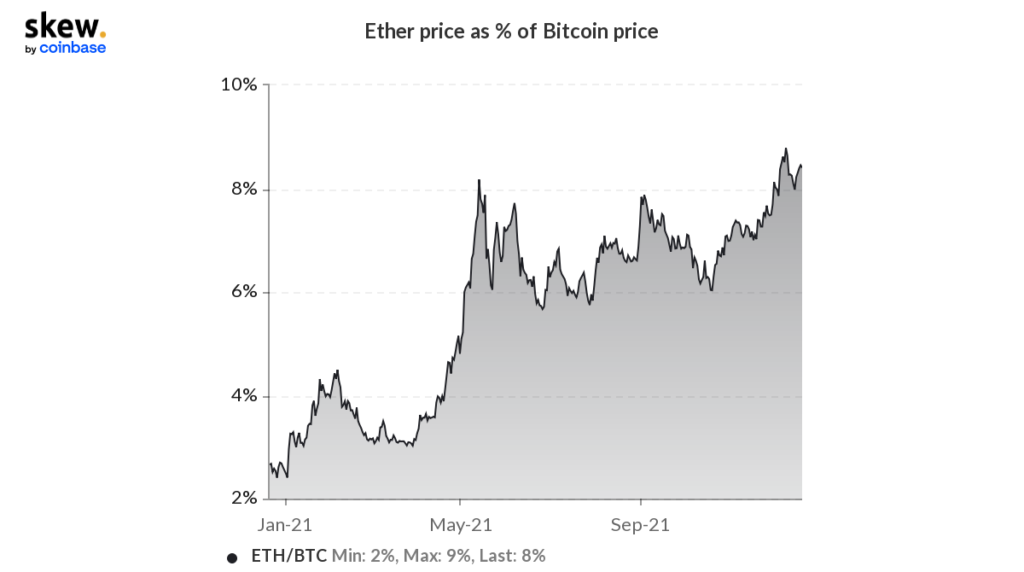

Even though ETH has fallen near the $ 3,800 range, Ethereum’s price as a percentage of BTC price is still on an uptrend, just 1% below the last high of 9%.

While one reason for the same can be the two coins’ simultaneously weakening price action, the percentage still keeping up means that ETH performed better than the king coin price-wise.

Additionally, the decline in the price of ETH at the time of writing seemed almost inevitable as Ethereum’s correlation with BTC increased. In fact, according to The data From Into The Block, ETH’s correlation with BTC rose to 0.75, at time of publication, from 0.65 on December 15.

Furthermore, over the last week, there was a spike in ETH supply on exchanges. This was a sign that a decent amount of sell pressure has been looming too.

So will the recovery have to wait?

Except the unexpected

Even if it looked different, the next ETH recovery might come sooner. The reason? Well, retail FOMO.

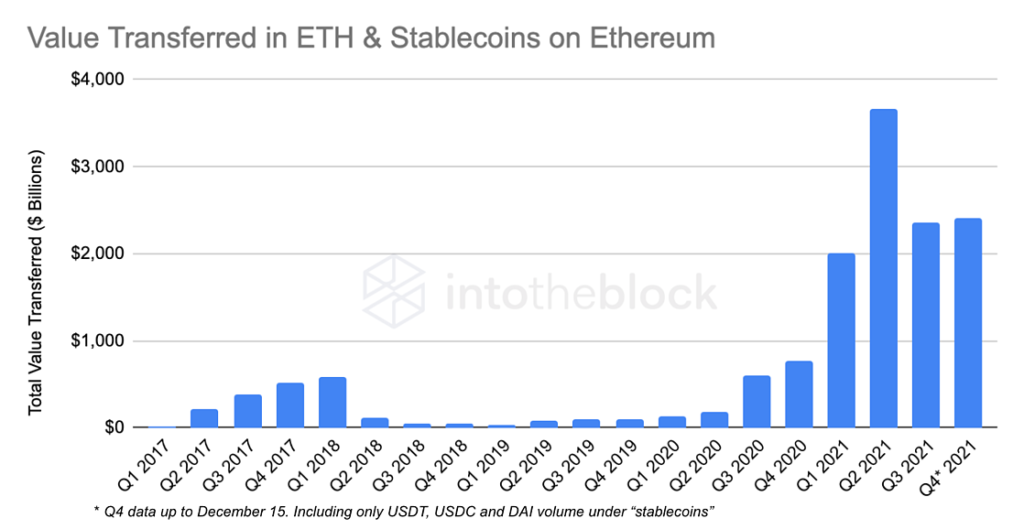

The value transferred in ETH and stablecoins on Ethereum is still skyrocketing. Without the quarter being done yet, the total amount of value settled on Ethereum has tripled relative to Q4 2020, and increased five-fold versus Q4 2017.

On top of that, the total amount of ETH paid in fees has increased more than 10 times from $ 430 million in Q4 2020 to $ 4.8 billion so far in Q4 2021. This indicates the high demand and the willingness to pay to use the Ethereum blockchain by participants.

What’s more, there has been an increase in Options calls for $7000 ETH by the end of January. What this means is that expectations from the king altcoin remain high, despite recent price pullbacks.

Finally, with HODLers and Whales acquiring ETH at a discount, if the price of BTC rises, ETH may rebound faster from these lower levels.