Ethereum is down 13.06% this month. However, this week the alt saw the first sign of consolidation as it barely noticed a price change. However, the net flows seen up to three days ago paint a more worrying picture for Ethereum investors.

Ethereum flows out

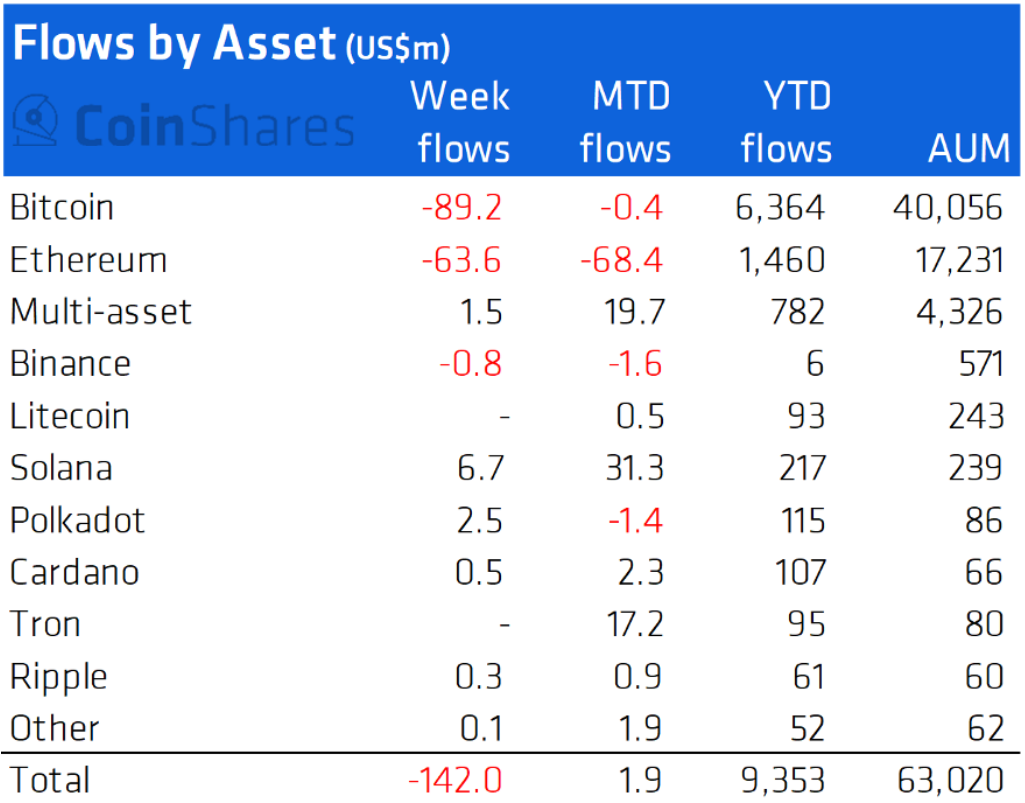

The week ending 17 December saw the biggest outflows in digital assets in a while, totaling $142 million. In fact, this was the first time in over 17 weeks that the overall netflows leaned toward negative.

However, Ethereum, in particular, stood out this week with its $ 63 million outflow that worsens the situation for ETH holders.

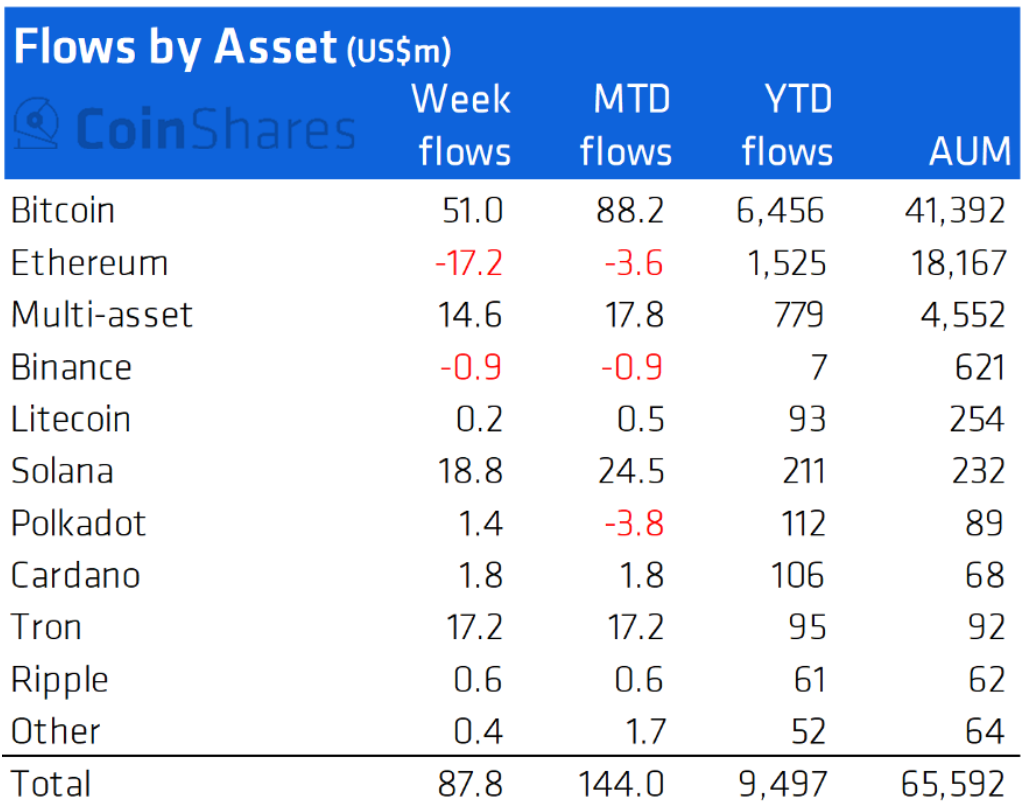

Throughout the month and until last week netflows maintained a balance between inflows and outflows, keeping Ethereum outflows at a low of $3.6 million. In fact, Month to Date (MTD), Polkdaot’s outflows were higher than Ethereum’s.

But this week’s development led Ethereum to take the crown from Polkadot with total MDT outflows of $ 68.4 million.

Even though Bitcoin lost $26 million more in inflows compared to Ethereum, its performance during the previous weeks helped the king coin keep its losses at a minimum.

The same cannot be said for Ethereum, however, as more than six million addresses are now seeing losses for the first time since July.

Furthermore, owing to the possibility of further losses, investors have become more cautious now, whales included. Their volumes on 14 December crossed $10 billion, the highest recorded volume since January 2018, after ETH fell by 8.5% the day before.

However, as we approach the biggest deadline of the year, we can hope to see some recovery soon.

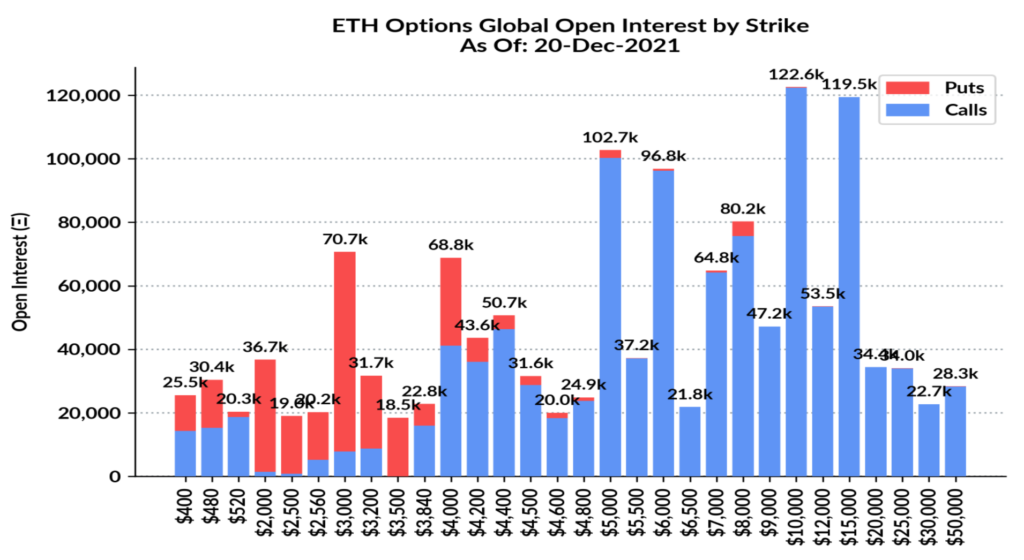

While 102k contracts are demanding Ethereum to close above $5k, another 122.6k and 119.5k investors are looking for a $10k and $15k close respectively.

However, even $ 5,000 doesn’t seem likely at the moment. If ETH were ever to rally, $ 5,000 is the closest level, because reaching $ 10,000 and $ 15,000 is out of the question. Well, even then ETH will need to increase 23.69% over the next 10 days to hit $ 5,000.

So it would be safe to say that going forward even if ETH recovers, a lot of investors are still going to suffer losses.