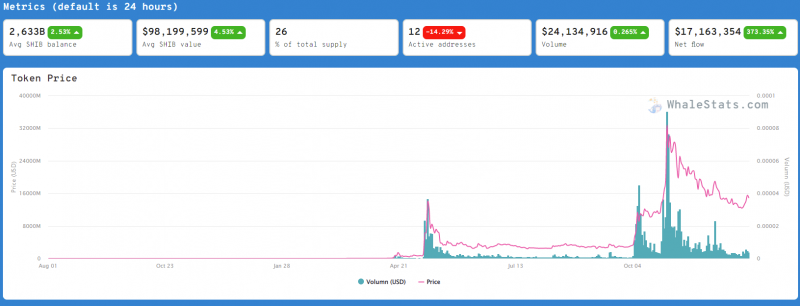

SHIB rally slows as net flow growth hits 176% and whales stop at 26% of token supply

Shiba Inu’s correction reversal trend has just shown the first signs of deceleration while the supply on whale-tier addresses has reached $2 billion. The net flow of the asset has also decreased but still remains at a significant 176% increase.

The net flow increases

Net flow is one of the primary indicators of the current flow of funds into an asset. In our case, the net flow reflects the movement of the fund over whale-level wallets on the Ethereum blockchain. The metric can be used to determine whether traders and investors are moving funds into or out of the asset.

During periods of correction or distribution, the net flow value of an asset stays negative. The negative net flow asset value indicates that whales are closing their positions and moving funds away from the asset, which was the case previously when SHIB lost more than 60% of its previously gained value.

Whale stocks remain stable

As the recovery rally on Shiba Inu slows down, the value of whale wallets remains the same, with whales owning more than a quarter of the token supply. The total value of their holdings remains at around $ 2 billion.

The total holdings of Shiba Inu whales have increased from $1.5 billion to $2 billion in less than a week. While it may seem that whales have bought $500 million worth of tokens, the real reason behind the spike in the value of their holdings is the 25% growth in the asset’s value.

At time of going to press, Shiba Inu is trading at $ 0.000037 while losing 6.5% from the peak of the rally. The total loss for Shiba Inu from the ATH is 57%.