Ethereum Dips Below $ 4,000 As $ 262 Million ETH Transactions Hit Binance

WhaleAlert reports that nearly $262 million worth of ETH tokens have been moved to Binance in recent hours. Ethereum dips below the $4,000 mark as the entire cryptocurrency market tumbles to selling pressure.

Three large transactions noted by WhaleAlert saw large Ethereum slices approaching 65,986 tokens transferred to Binance Exchange. The first one transaction of 27,205 ETH, or $ 109,887,570, appeared on the blockchain 13 hours ago, while the other two transactions of 26,665 ETH and 12,116 ETH, or $ 104,396,148 and $ 47,675,435, respectively, appeared six hours later.

Ethereum shows positive Netflow in the last 24 hours

As indicated by on-chain analytics firm Glassnode, Ethereum depicts a NetFlow of +$10 million as exchange inflows exceeded outflows.

Netflow displays the net quantity of a cryptocurrency entering and exiting centralized exchanges. The difference between inputs and outputs is used to calculate its value.

When NetFlow is negative, it indicates that outflows are surpassing inflows. In this instance, investors withdraw more ETH than they deposit, and this might be bullish for the cryptocurrency.

A positive NetFlow, on the other hand, indicates that exchanges are receiving more Ethereum than it is taking out. Investors typically transfer their coins to exchanges to withdraw cash or purchase other tokens, so the indicator’s sustained positive levels may turn negative.

Ethereum price action

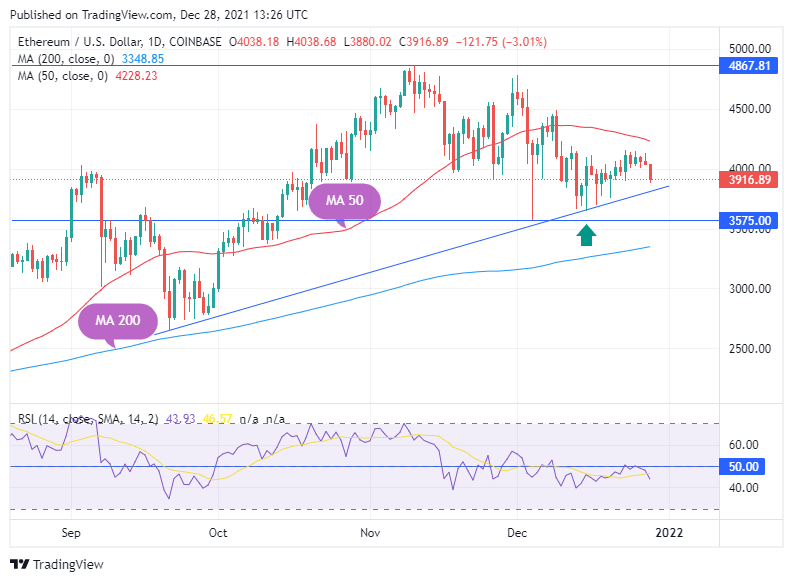

Ethereum’s price failed to break out after consolidating between the $4,250 and $3,575 levels recently. As a result, the ETH/USD pair is retracing to its crucial support levels while heading lower on Tuesday. The ETH price traded lower to an intraday low of $3,880 despite pushing for a recovery to $4,128 in the prior session.

ETH / USD is hovering around $ 4,000, defending much of its traction by its ascending trendline pattern. At the time of writing, the price of Ether has been rejected at an intraday high of $ 4,038 and is currently trading at around $ 3,916.

The Ethereum dominance index rose to 21.2% in 2021, acquiring more “territory” from Bitcoin, which saw its market share drop to 40.6%. BTC had a market share of 71.86% at the start of the year, while ETH had a share price of 10.63%.