One of the biggest explosions into the top 10 crypto market cap is Solana, the most menacing “Eth Killer” out there amongst the pile of candidates that are chomping at the bit. Since its meteoric price rise from June 2021, there has been huge interest in the project and what it could bring to the future development of the crypto world. At the time of writing, it sits comfortably at #5, having flipped Cardano to be the second-biggest Layer 1 project after Ethereum. This means that those SOL tokens are starting to get just a bit precious. And that means you NEED a proper SOL wallet to hold those tokens.

The following piece describes the top four Solana wallets:

- Phantom

- Solflare

- Atomic Wallet

- Math Wallet

Assuming you haven’t found a nice home for them yet, maybe this article would be able to help you in your house-hunting mission. Even if the tokens have moved in, a leaky roof or a drafty window might want you to send them packing to a better abode. Or you could even be like me: find the house first before buying the tokens. Right then, let’s proceed onwards.

The Phantom wallet is a native Solana wallet designed exclusively for the Solana ecosystem. It is non-custodial, ie you safeguard your own assets and be your own bank, and works on known browsers such as Chrome, Brave (crypto-friendly with a Chrome base), Firefox and (Microsoft) Edge. The design is user-friendly, clean, and simple. Don’t be fooled by its simplicity because it packs a number of features:

- Swap tokens with instant prices and low gas fees through its integration with Raydium, Solana’s version of Uniswap. Tokens supported include: SOL, USDC, USDT, ETH, BTC, renBTC. Transaction fee is 0.85%

- Store your NFTs and collectibles in a separate section in the wallet. It’s worth noting that NFTs listed on a marketplace will not show up here. These NFTs are placed in an escrow account until they are sold or delisted.

- Integrates with the Ledger cold wallet to provide added protection for your SOL.

- Stake SOL within the wallet by selecting a validator to stake your tokens with. The APY usually ranges from 5-6% for the majority of them with a handful falling below 5%. Staking is like lending someone your tokens. You still own them while they are being staked.

- Supports SPL tokens that are used in Solana’s DeFi applications. These tokens are like the ERC20 tokens in the Ethereum blockchain.

2. Solflare

Developed by Solana Labs, Solflare is one of the first wallets designed for the Solana ecosystem. Its popularity is neck-and-neck with Phantom and it bests Phantom in supporting more platforms. Aside from the browser extension, it also has its own web and mobile app, giving it added convenience for those on the go.

The wallet has identical functionality with Phantom when it comes to swapping tokens, storing visual and audio NFTs, integrating with Ledger for extra security, and staking SOL. However, it also has a few twists of its own:

- When it comes to swapping tokens, this works on the web application and browser extension but doing it in mobile is something that is only available in the future.

- An upcoming integration with the Solrise investment platformallows users to manage their investment funds through the wallet. This is quite a handy feature, especially considering that both products are built by the same team.

- Unlike the 12-word mnemonic phrase used by Phantom, Solflare uses a 24-word mnemonic phrase, making it a more secure option.

- Its staking function prevents the user from staking 100% of their tokens, accounting for the inevitable transaction fees accompanying this action.

Based on the points above, I would say that Solflare is more suitable for those looking to get more out of a wallet than just the basics. The team behind it is as solid as it comes, which means that the wallet is fairly secure and there is strong support from the community on Discord.

One of the more established 3rd-party wallets in the crypto community is the Atomic wallet. It offers support for more than 300 cryptocurrencies together with staking options for many of them, including SOL tokens. Just like with the native ones, you can choose a validator and stake your SOL with them. However, if you choose to stake with the Atomic validator node, you can get a tempting 7% as a reward, higher than the 5-6% one usually gets with validators.

3rd-party wallets like Atomic also has on-ramp capabilities. This means you can use your credit card or wire transfer to buy crypto from the wallet and have it be sent there. This makes it easy for newbies to get into the crypto game. The rates may be a bit steep but not unbearable. Not all tokens can be purchased directly with fiat money though, including SOL. To get SOL into Atomic, you will need to buy some other token like Bitcoin or Ethereum with your credit card, then exchange it for SOL within the wallet.

Atomic offers a variety of platforms, ranging from desktop applications for PC, Mac and even Linux (via Ubuntu) to mobile apps, there’s a version for everyone. But not everything is peachy with them. Here are some of the risks:

- Only a 12-word seed phrase is used. Not the best in security.

- NFTs cannot be displayed in the wallet.

- No support for SPL tokens (yet).

There are some Reddit comments about tokens disappearing or frozen, ie cannot be accessed, especially during peak times. While the comments could be from a minority, it still pays to be cautious as it could happen to you.

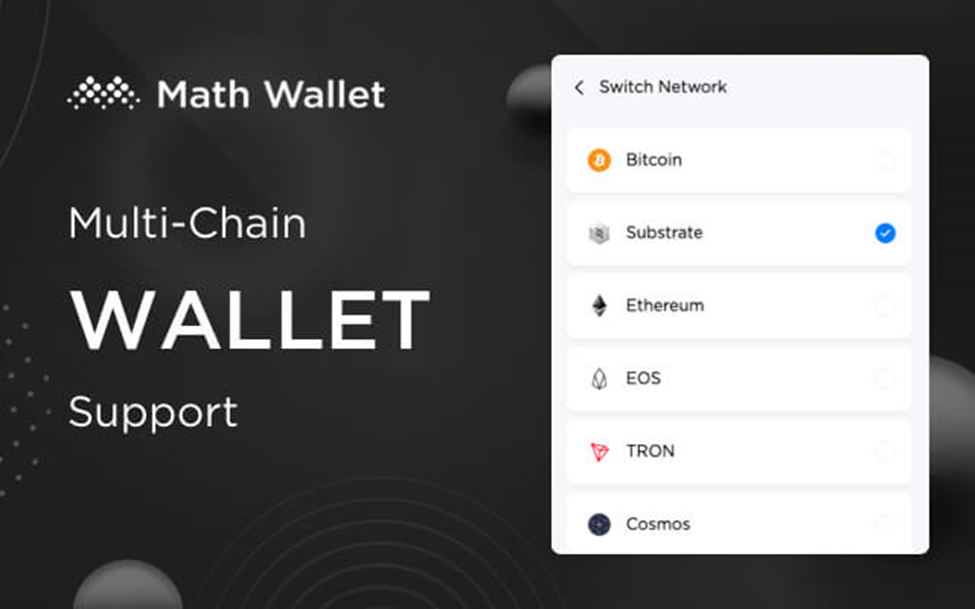

Slightly less well-known than the other two but by no means a laggard is Math Wallet. A multi-platform wallet (mobile, desktop, browser extension, hardware integration with Ledger) with cross-chain support for more than 86 blockchains, it also has:

- Math DApp – a DApp store that allows users to interact with the services built on the major chains through the wallet.

- MathVault – where staking and DeFi activities take place, including staking SOL. The general APR rates advertised could be up to 30% (although it didn’t say which tokens would yield that kind of rate). They also encourage participation by:

1. Issuing MATH tokens as rewards. These tokens can be used throughout the MATH ecosystem.

2. Friend referral program earns the referrer an extra 20% from the friend’s earnings.

- MATHGas – track the gas fees of major chains through this app.

While the highlight of this piece is about wallets that are good for staking Solana and general usage, it’s clear that MathWallet aims to be much more than just a 3rd-party wallet service. With the variety of services offered, it’s very interested in corralling users into its own fold and keep them engaged as much as possible.

The main risk associated with this wallet is that it’s custodial, meaning you don’t own the private keys to the wallet.

Bottom Line

Having given these wallets the once-over, I’d say that any one of them works well, depending on your needs. If you’re only focused on getting the most out of your Solana, then a native wallet might be the way to go. If safety is your number one concern, you can’t get any safer than a cold wallet. If Solana is not your main focus and you like having your fingers in as many pies as possible but not the hassle of owning one wallet per token, the 3rd-party ones serve their purpose well.