Large Crypto Hedge Fund Continues to Sell Its Previously Received $ 400 Million Ethereum

Three Arrow Capital crypto hedge fund, notorious for “abandoning” Ethereum and then actively trading it, has deposited large sums on FTX centralized exchange as the asset continues to lose value on the crypto market.

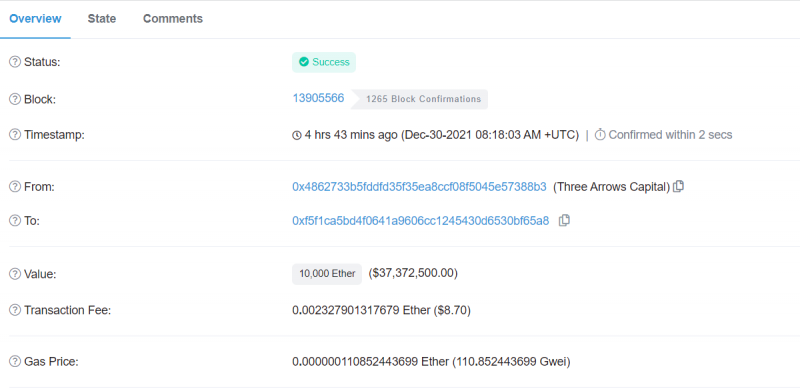

The big deal

The transaction was completed five hours before press time. The sender’s wallet currently holds $ 47 million of Ether while holding $ 84 million ahead of the big deal. Large trades were previously done using various stablecoins like USDC, USDT and others.

It is not yet clear whether assets were sold imminently on FTX or are currently being held on the hot wallets of the exchange. But since the fund could simply store assets on a cold wallet, the transacted funds will most likely be realized on the market.

$ 400 million received, $ 40 million remaining

As U.Today previously reported, the fund received $ 400 million from Ethereum after its CEO said it was going to “ditch” Ethereum for high fees that make it unusable for users who are unable to. pay extremely high fees in the event of severe network congestion. periods.

A total of $400 million was received by the fund in a series of large transactions made across a number of days. The fund received 14,000 and 27,000 ETH in approximately two days. The reason behind the strong sell-off of received funds remains undisclosed but is more likely tied to Ethereum’s market performance.

The Ethereum community did not warmly welcome receiving a large sum from a fund that had previously threatened to abandon the asset. To soften the community backlash, the fund’s CEO Zhu Su then posted a tweet explaining his previous statement and told the community that he still respects the L2 development community trying to make the network more scalable.