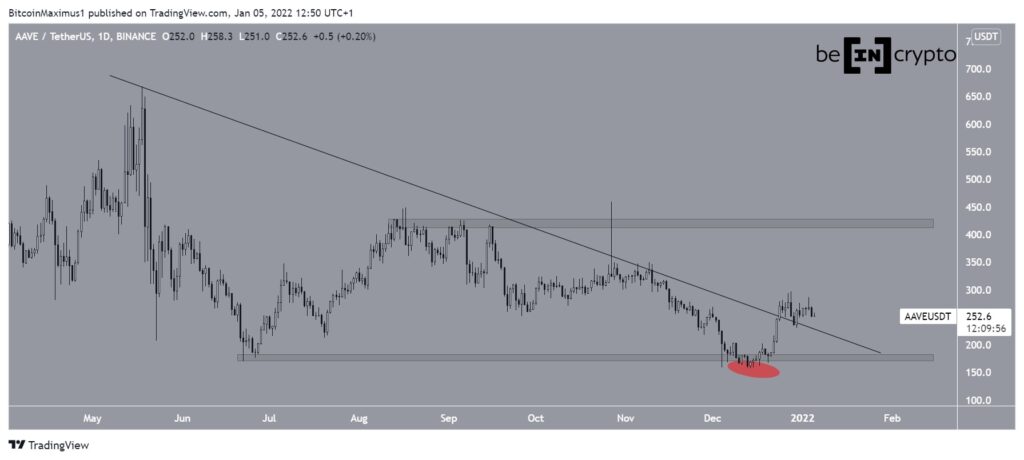

Aave (AAVE) has been increasing since Dec 20 and has confirmed that its short-term correction is complete.

Between December 13 and December 20 (red circle), the AAVE fell below the horizontal area of $ 178, which was to serve as support. However, it rebounded on December 20 and recovered the $ 178 area in the process. This is a very bullish development as it makes the previous breakout as a deviation only.

Furthermore, it continued increasing and broke out from a descending resistance line on Dec 24. The line had previously been in place since May 18, and the breakout confirmed that the correction is complete. The closest resistance area is at $420.

Current breakthrough

The daily AAVE technical indicators support the continuation of the bullish movement. This is visible in both the RSI and the MACD.

The RSI, which is a momentum indicator, has crossed above 50, while the MACD has moved into positive territory (blue). Both of these are considered bullish signs and often precede upward movements.

The previous time, these two events occurred (green circles) in early August and preceded a 47% bullish move. A 52% upward move would currently be required for the AAVE to reach the resistance zone of $ 422.

Market analyst @Incomesharks tweeted an AAVE chart, stating that the token is likely to increase to $250. Since the tweet, the token has already reached this level.

AAVE / BTC

The AAVE / BTC pair is also showing a bullish chart, as the token broke out of a descending resistance line. However, it is currently facing resistance at ₿0.0058.

This is a crucial resistance area since it previously acted as support for 196 days. A breakout above it could greatly accelerate the rate of increase.