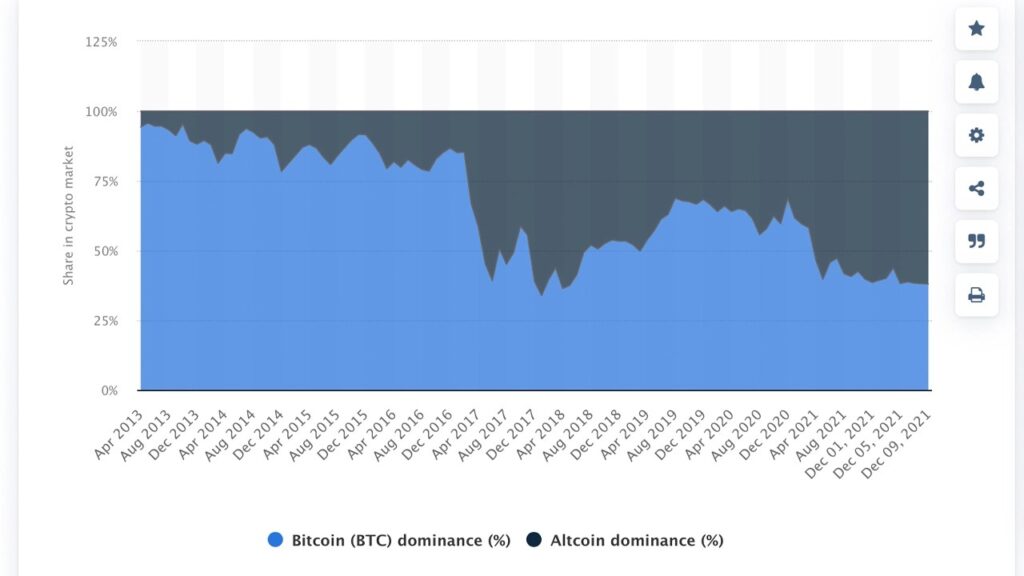

Bitcoin dominance has dropped to the lowest level in just over three and a half years since June 3, 2018, at 37%. Last year, at the end of March, bitcoin dominance hovered just above the 60% zone but since then, numerous digital asset market caps have swelled in value and gathered prominence in the market rankings along the way.

Bitcoin Dominance Plunges Below 38%

The crypto economy currently has around 12,247 crypto assets traded on 542 exchanges around the world. Crypto markets have lost more than 7% in the past 24 hours, falling to a low of $ 2.16 trillion at 8:00 a.m. EST.

While people measure the individual crypto market capitalizations regularly, bitcoin’s market valuation dominance, compared to the rest of the capitalizations, has been measured since the existence of multiple crypto markets.

In the early years, BTC’s dominance was well above the 90% range, in terms of market cap dominance. Dominance was recorded more during the month of May 2013, and at that time the dominance of BTC was 94%.

This was measured against crypto assets like namecoin, novacoin, litecoin, terracoin, feathercoin, and freicoin. Between May 2013 and February 2017, bitcoin’s market dominance remained above 80%.

However, since February 26, 2017, bitcoin has not been able to return above the 80% zone and only managed to reach 70% just over a year ago. , last January.

11 Coins Besides Bitcoin and Ethereum Command Over 20% of the Crypto Economy

BTC’s dominance is currently coasting along at 37.7% while ethereum (ETH) commands 18.6%. While ethereum is a formidable foe, many other crypto caps have been moving in on bitcoin’s dominance territory.

Tether, binance coin, solana, usd coin, cardano, and xrp command over 15% of the $ 2.18 trillion crypto economy. The aforementioned coins, plus terra, polkadot, avalanche, dogecoin, and shiba inu are equivalent to 20.63% of the crypto economy.

All of these coins, including ethereum and removing SHIB, hold more than 1% or more in crypto market valuation dominance. Since January 2021, when BTC’s dominance was 70%, a myriad of altcoins have been nipping at bitcoin’s market cap heels.