In this article, BeInCrypto will take a look at several potential Bitcoin (BTC) wave counts, in order to determine what is the most likely movement during the coming weeks.

Bearish scenario

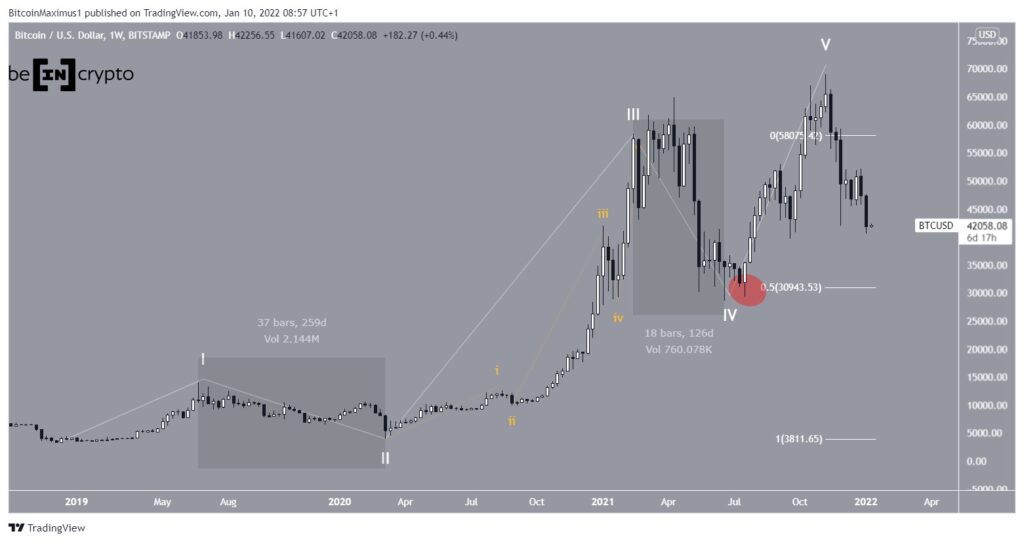

The most bearish BTC tally suggests that the five-wave bullish move that started in December 2018 ended with the all-time high of $ 69,000 in November 2021.

In the five wave formation (white), wave three is the one that is extended, hence being the longest. Wave four ended after a bounce (red circle) at the 0.5 Fib retracement support level at $31,000.

The main problem with this count is the difference in length between waves two and four (highlighted). While the first took 259 days to develop, the second developed in just half that time.

However, while this is not a textbook length ratio between the two waves, it is still a valid formation.

Bullish scenario

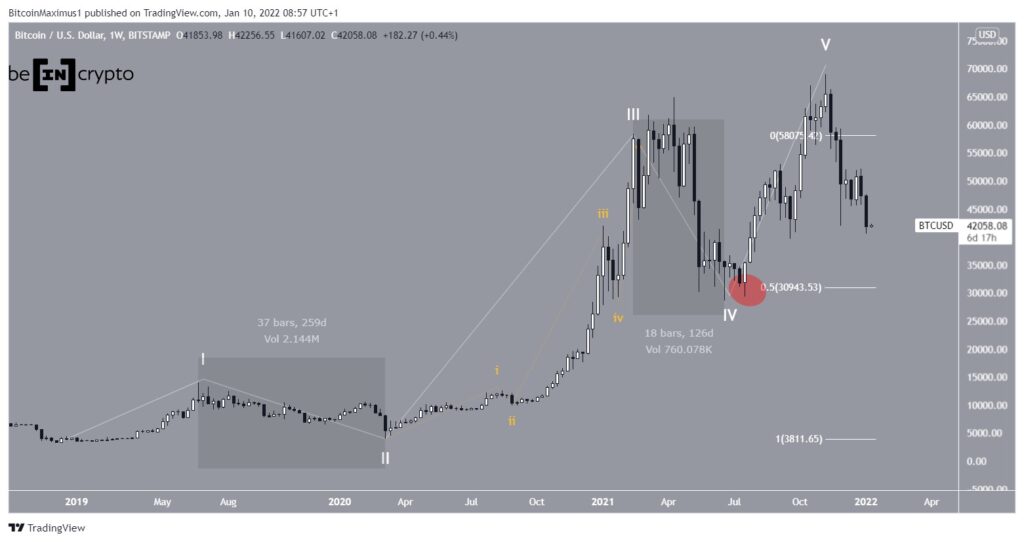

The most bullish scenario does in fact have several similarities with the most bearish one. In fact, the entire movement up to the beginning of wave five is identical.

However, just as wave three extended into the bearish scenario, wave five extended into this one. The number of subwaves is shown in yellow.

What this means is that the entire movement since July 2020 is part of sub-waves one and two. In this case, the rate of increase of BTC would greatly accelerate towards a new all-time high.

The main problem with this count is the length and shape of subwave two, which doesn’t look like a correction. Therefore, in order for this number to be the correct one, BTC still needs to create this sub-wave two.

So, it would mean that the decrease is wave A of an A-B-C corrective structure (red). Therefore, after a considerable bounce, BTC would fall and make yet another low.

The reason this is not a regular correction is that the motion is not contained within a descending parallel channel.

Most likely count

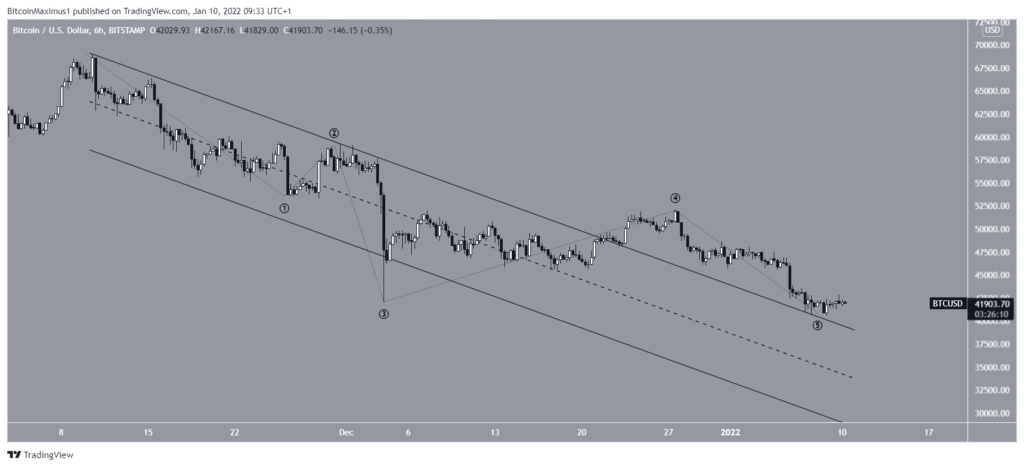

Cryptocurrency trader @TheTradingHubb tweeted a BTC chart, stating that the price has been mired in a correction since the Nov 2021 all-time high price.

Besides the scenario described earlier, there is another potential training that is still valid.

It would make sense that BTC would still be in the long-term wave four (white) as outlined in the first section. This would also fix the issue with the length between waves two and four.

in July, BTC rebounded off the resistance line of a previous ascending parallel channel (green icon). Another drop would validate the row again, completing the entire correction.

The shorter-term movement is presented below. In it, BTC has fallen below the middle of an ascending parallel channel (red circle).

In this scenario, BTC could drop as low as $ 30,000 before reversing the trend.