It is a sad truth that the majority of retail investors lose money, or underperform the market, whether it is in Forex, Crypto, Stocks etc. One of the main reasons is that retail investment behaviour is often emotionally fueled which has been proven time and time again to be a losing long-term strategy. One could argue accurately that there are a host of other reasons such as retail investors do not have access to the resources such as research teams, tools, and analytical data as the investment firms which is why they underperform, and I would agree with that as well, but for the purpose of this article, we are only going to be exploring the emotional side of investing. If the average retail investor could consistently outperform investment firms and fund managers, then there would be no use for fund managers, investment bankers, Wall Street and the lot of them.

What is the Fear and Greed Index?

There are different fear and greed indexes for different markets. CNNMoney was the first to create The Fear and Greed Index for the stock market to measure two of the primary emotions that influence how much investors are willing to pay for stocks. The index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index is used to gauge whether the stock market is fairly priced and examines seven different factors to establish how much fear and greed is in the market. The seven factors are measured on a scale from 0 to 100 and include market momentum, market strength, trading volume, put and call options, junk bond demand, market volatility and safe-haven demand.

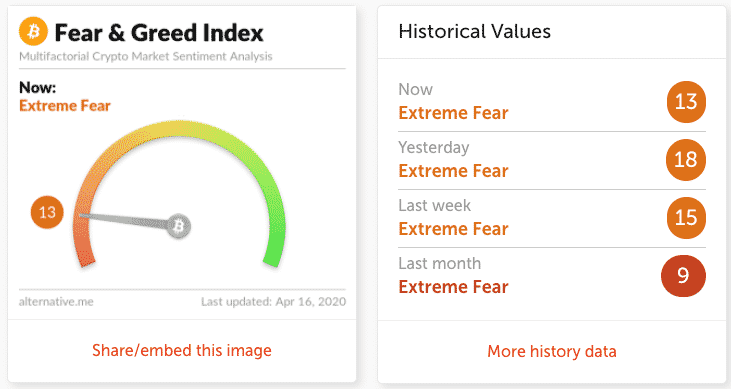

This became such a popular metric and useful tool that the same concept was applied to other markets such as our beloved crypto market. The Crypto Fear and Greed index was published by the website Alternative.me and measures the emotions and sentiment driving the crypto markets. According to the website, the index was created to try and save people from emotionally overreacting to FOMO as markets are rising and selling irrationally when they see red numbers. The Crypto Fear and Greed Index measures data from five Bitcoin-related sources, with each data point being valued the same as the day before in order to visualise progress in sentiment change. The current index is for Bitcoin and other large cryptocurrencies, but the team stated that they are working on separate indices for different altcoins soon.

The different factors measured in the Crypto Fear and Greed index are as follows:

- Volatility (25%)- The index measures the current volatility and max drawdowns of Bitcoin and compares it to the corresponding average values of the last 30 and 90 days.

- Market momentum/Volume (25%)- The index measures the current volume and market momentum and compares it with the last 30/90-day average values and puts those two values together.

- Social Media (15%)- The index is able to analyze market-related keywords across Reddit and Twitter to check how fast and how many interactions are related to Bitcoin. The team notes that this feature is still experimental, and they are optimizing how the function works.

- Surveys (15%)- Using strawpoll.com, which is a large public polling platform, there are weekly crypto polls asking people how they see and feel about the market. This metric is currently paused as the team doesn’t feel it is worth giving those results too much attention.

- Dominance (10%)- The dominance of a coin resembles the market cap share of the entire crypto market. A rise in Bitcoin dominance is often caused by fear as it is the “safe-haven,” for crypto investors, and when Bitcoin dominance shrinks people are more confident and therefore greedy and willing to speculate in smaller altcoins as investors are looking for the potential of higher gains as many altcoins can out-perform Bitcoin in the short term.

- Trends (10%)- The index pulls data from Google Trends for various Bitcoin-related search queries, focusing more on the changing of search volumes as well as other popular Bitcoin-related searches.

Benefits of the Fear and Greed Index

A common theory of contrarian investing goes back to the fact that most retail investors lose money so smart investors should do the opposite. While everyone tries to buy low and sell high and thinks they can do it, the statistics show that human emotion trumps logic and most investors end up buying high and selling low. The Fear and Greed index is a very simple yet useful tool that can provide us with a reminder to dismiss our emotions, or confirm our concerns about whether or not we are too emotionally driven, and look at the numbers. Numbers don’t lie and investing is a numbers game of probability, chance and trying to make well-informed and calculated bets. Proper investment decisions cannot be made without stats, numbers, figures, tools, reports, and data to support our directional biases on the markets and the Fear and Greed Index is one of those helpful tools that help ensure we aren’t investing based on emotions.

When the index shows extreme fear, this can be a sign that investors are worried and prices are likely down which could be a great buying opportunity (buying low). Conversely, when investors are too greedy, that can signal that the market may be overheated and is due for a correction, signaling that investors may want to consider taking profit (selling high). Of course, this index is just one tool and should be used in conjunction with other analysis metrics and tools and should not be relied on alone to make investment decisions.

Criticisms of the Fear and Greed Index

Some skeptics feel that investors rely too much on this index and it can encourage poor investment habits such as trying to time the markets, which has been shown statistically to be a losing strategy for many investors. Buy and hold strategies are often the best way to make money in the markets and by relying on tools such as the Fear and Greed Index, investors may sell when it would have been more advantageous to hold. The Crypto Fear and Greed Index can encourage investors to actively trade in and out of coins more often than they should, missing out on long term capital appreciation and having transaction fees eat away at profits.

Bottom Line

While the Fear and Greed Index gives us really valuable insight into the overall sentiment of the market, it should not be used as gospel and solely relied on for investment decisions. I think it is one of many important metrics to keep an eye on, and used in conjunction with other fantastic metrics like those that can be found on the website lookintobitcoin.com. In my opinion, The Fear and Greed Index is great for those of us so deep into crypto that we forget to look outside of our own bubble.

Just about everyone I socialize with is into crypto and sometimes we can get caught in our own echo chambers when we are only surrounded by other crypto enthusiasts. Sometimes it can be hard to remember that we are still early and most people are not here yet, so, while I may be feeling euphoric after a crypto conference and all my friends meet up and talk about Bitcoin, we may be all be feeling very confident in it and think we are nearing a top but the Fear and Greed Index could read that people are over-all still fearful and that our euphoria may be completely misplaced so it can act as a great “reality check.”