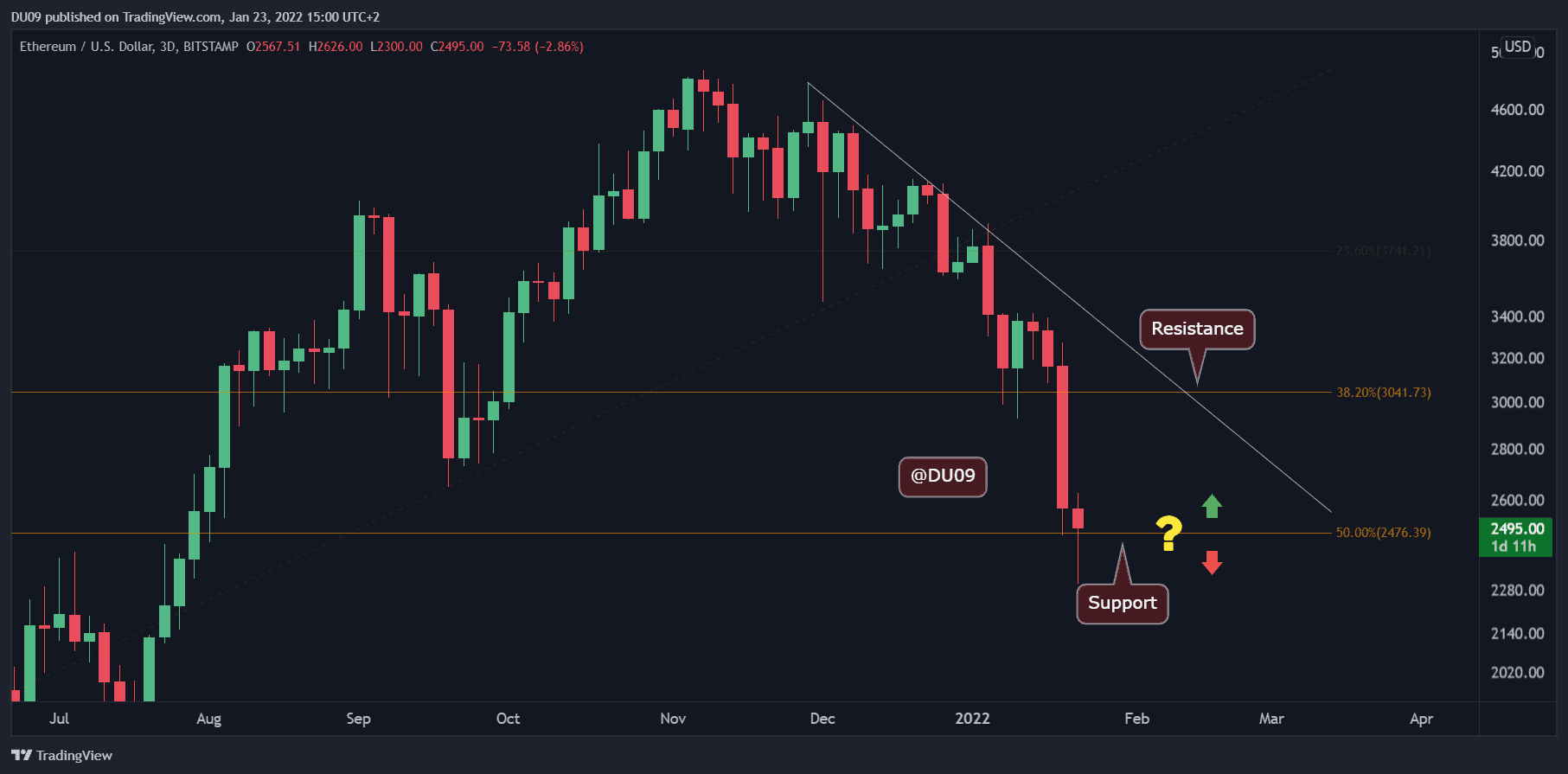

Friday’s crash had driven ETH below $2,500, rising to $2,300 — a price not seen since July 2021.

Main levels of support: $2,300, $2,000.

Key Resistance Levels: $2,500, $2,750, $3,000

This week’s market carnage was not kind to ETH, which recorded a daily close below $3,000 for the first time since the end of September. Furthermore, ETH saw a low of $2,300 on Bitstamp, at the peak of the collapse.

Since yesterday, ETH was able to rebound until the $2,500 support turned into resistance. After losing the $3,000 support, ETH likely entered a major correction that could take months to recover.

Technical Indicators

Trading Volume: Very high volume was recorded during the selloff on Friday. The bears are in control.

IRS: The daily RSI has also been criticized in line with the price, reaching 21 points and just like Bitcoin, the RSI is currently deep in the oversold zone. The price may enter a relief rally, but the medium-term correction is unlikely to end even if it does.

MACD: Daily MACD quickly fell into the bearish territory with the histogram and moving averages expanding on the negative side. A reversal appears unlikely in the short term, as sellers completely control the market.

bias

The bias for ETH is currently bearish. With the breakdown of $3,000 support, ETH entered an intense correction.

Short-Term Price Prediction for ETH

It is unlikely that the correction will end anytime soon and any relief rally will only be temporary as ETH seeks a bottom. Until that is found, the next support level, should $2,300 fail, is located at $2,000. The next major resistance is $2500, followed by September lows at $2750.