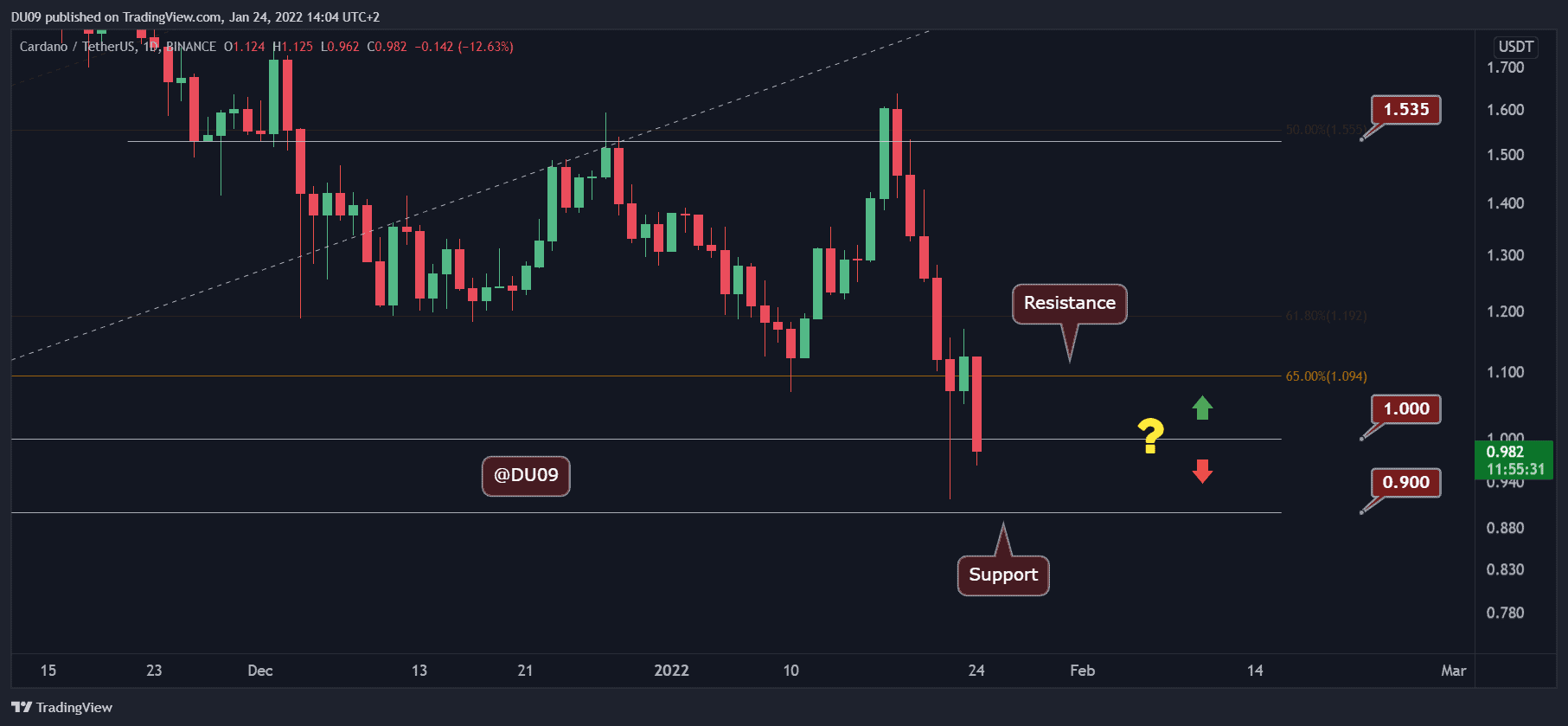

Following the negative sentiment in the crypto markets, ADA, the native token of Cardano, fell below the $1 mark. Despite a wick below on Saturday, this level is the lowest since April 2021. ADA is now 68% below its September ATH.

Main support levels: $0.9, $0.67-0.7

Key Resistance Levels: $1, $1.2

ADA seemed to find a temp relief over the weekend, but this quickly changed on Monday (as of writing this) when the price tanked.

The bears seem to have full control of the market as it looks like ADA is heading fast to reach the next support at $0.9. If the latter does not hold, the next major support zone is lower – $0.67-0.7 (Fib level + February low).

Technical Indicators

Trading Volume: High volume followed the most recent crash which is a bearish sign and a red flag. The last six out of seven daily candles were red.

IRS: The daily RSI slumped after the last high at $1.6, dropping 65 points to 36. This is indicative of sustained selling pressure. However, the RSI has not yet entered the oversold zone, indicating that the sell-off is not over yet.

MACD: Last Friday, the daily MACD made a bearish crossover, which only accelerated over the following days. There is no sign of a possible reversal at the moment.

bias

The current bias is bearish. ADA also saw a lower low in 2022, indicating a downtrend.

Short-Term Prediction for ADA Price

Due to a lack of buyers, and just like the negative sentiment of the crypto markets, ADA’s price has continued to decline over the past week with a very minor bounce that took place during the weekend.

Today, price continued south. For this reason, it is too early to expect a reversal and the most likely case for Cardano is a bearish continuation, turning $1 into strong resistance.