Coinbase Ventures, the investment arm to Coinbase, had a record year in 2021, deploying 90% of all its capital and signing a new deal every 2.5 days.

As the investment arm of its leading US-based crypto exchange, Coinbase, Coinbase Ventures has become one of the most active corporate venture capital funds in operation, continuing to inspire entrepreneurs and projects around the world, creating waves towards Web3 and digital currency. the spaces.

With an average new deal every 2.5 days, Coinbase Ventures had a record year in 2021, with just under 150 deals, according to its newly released annual review report.

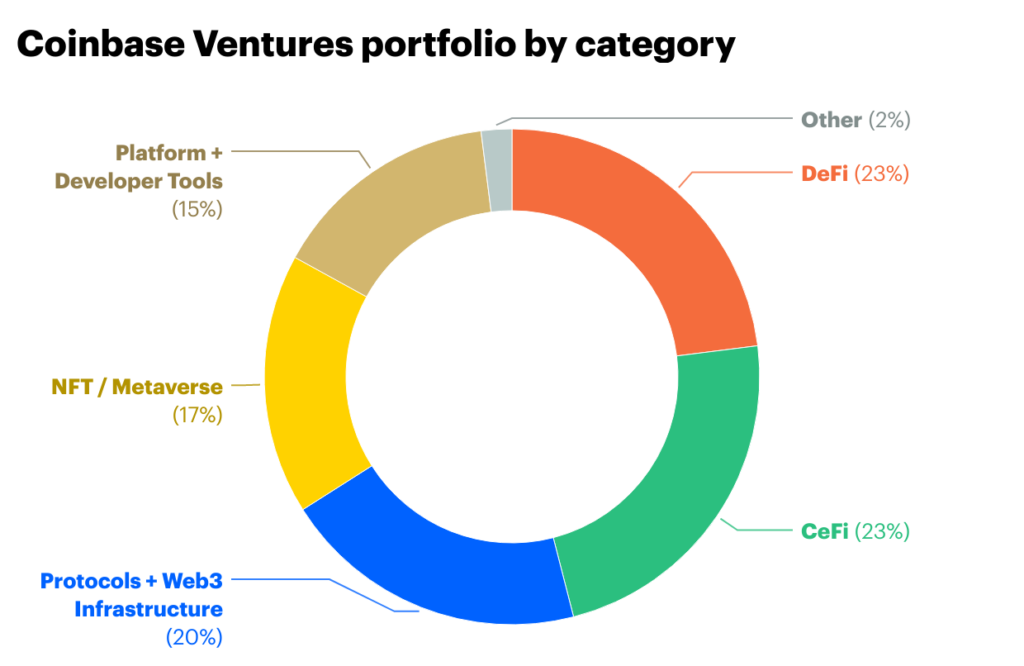

Nearly half of Coinbase Ventures’ investments were DeFi and CeFi

A breakdown of funding from the investment arm reveals that nearly half of the crypto exchange’s funded projects for 2021 were centered around DeFi (23%) and CeFi (23%). Undoubtedly, DeFi has witnessed significant growth in 2021 as the public has started to use contract-enabled smart protocols to perform services provided by traditional financial institutions.

DeFi

The space, at some point saw its TVL rise to as high as $259 billion. Per the report, Coinbase Ventures’ investment in DeFi was mostly for projects in the Ethereum ecosystem, including Layer 2 environments such as Arbitrum and Optimism – but it also funded projects on other non-EVM blockchain networks including Solana, Polkadot, NEAR, Algorand, and Cosmos.

Admittedly, DeFi has made a big name for itself in 2021, which is why Coinbase Ventures says it has prioritized user protection, supporting DeFi insurance financial protocols like Neptune Mutual, Risk Harbor, Cozy Finance and Nayms. The report recognizes the prevalence of hacking and the need for data incident response plans as smart contracts continue to evolve.

CeFi

Still, the need for localized platforms that serve as what Coinbase Ventures calls “onramps across distinct regulatory, banking, and infrastructure regimes,” is present, opening the investment doors to crypto-financial service providers in LatAm, Pan-Africa, MENA, South Asia, Europe, and North America.

NFTs and the Metaverse

Coming out of 2021 with a valuation of $25 billion, the NFT space has lit up the capabilities of marketplaces like OpenSea and Rarible, with successful projects like Bored Ape Yacht Club and CryptoPunks – all while shedding light on the gaming ecosystem to win as well as the continued focus on the metaverse.

While Coinbase has distanced itself from the activities of Coinbase Ventures, investments by its venture arm could open pathways for some of the firm’s future plans. One of such plans is the proposed Coinbase NFT platform, which seems almost ready.

Recently, Coinbase VP of Products, Sanchan Saxena, shared market insights and explained some features that would be available on the platform.

Although the NFT platform would be cross-chain, it’ll start on Ethereum, which remains the home of NFTs despite the heightened competition from other blockchains.

Coinbase Ventures’ influence within the network may come into play as it has already made significant investments in NFT projects. With the launch of this market, it will likely look to capitalize on these investments to gain an edge over its competitors in the space.