It was not a very happy start to the year for most bulls, as the market looked like a slaughterhouse, and crash after crash affected investor sentiment. Sentiments might not seem like a big deal in the crypto industry, but they can often indicate changing fortunes. It is therefore time to take a look at the two main crypto-assets.

Sigmund Freud, analyze this

The crypto-analytics platform Santiment recently noted that despite mild rallies, traders have been opting for caution as fear still hangs heavy in the air. Looking at weighted sentiment for Bitcoin and Ethereum, both were in the “Fear Zone” below -0.5 at press time.

Although it may seem dark, Santiment reminded observers that negative sentiments can sometimes trigger a price increase.

According to CoinMarketCap, Bitcoin saw a price increase of 6.07% over the past seven days. For Ethereum, this was 4.88%.

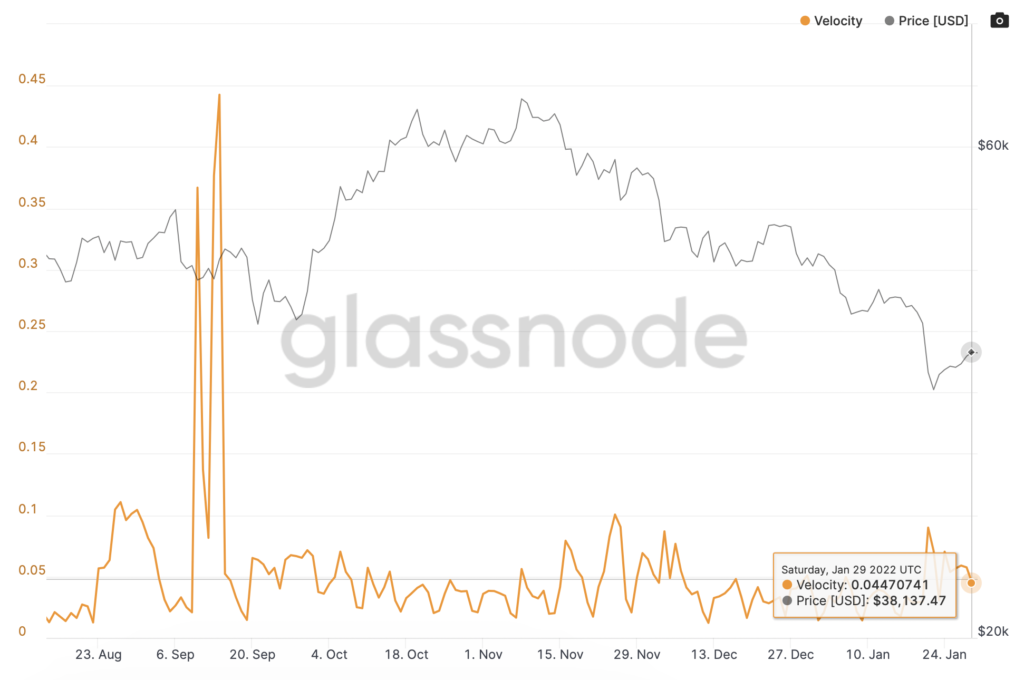

That being said, more measurement is needed to understand exactly how feelings translate into activity. Watching the speed is one way to do this.

On 29 January, Bitcoin’s velocity was around 0.044, meaning that the activity the asset was seeing was close to levels last seen in November 2021 before the crash. However, levels are still low when compared to the spikes seen in September 2021.

Regarding Ethereum, we can see that the speed on January 29 was around 0.020. This was after a significant spike several days ago. However, what is interesting to note here is that while the price of Ethereum recovered, the speed started to fall sharply again. This could be a sign that investors are not making hasty moves.

The Ethereum in the room

CoinShares’ Digital Asset Fund Flows weekly report helps us get a sharper image of BTC and Ether’s travels in and out of crypto-exchanges. After five weeks of overall outflows, the week ending 21 January finally saw slight inflows.

However, not all streams are equal. While Bitcoin saw inflows of around $13.8 million, Ethereum saw outflows of $15.6 million. The CoinShares report said,

“The current 7 week run of outflows now total US$245m, or2% of AuM, highlighting much of the recent bearishness amongst investors has been focussed on Ethereum rather than Bitcoin.”

What does this mean for investors? Well, while Bitcoin and Ethereum bulls might be feeling a bit weak in the knees right now, it seems Bitcoin investors are feeling more inclined to shop around than their Ethereum counterparts.