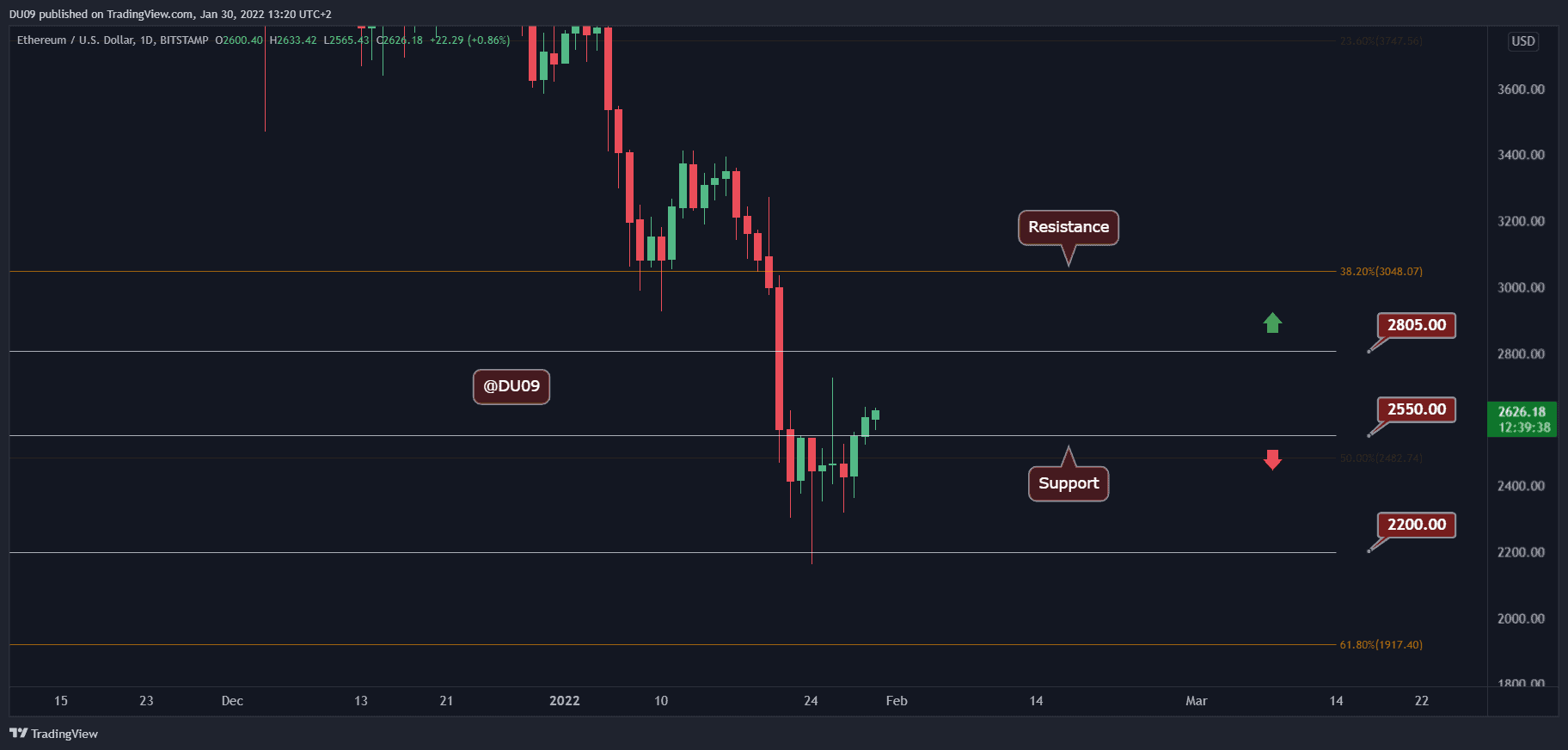

Ethereum managed to break above $2,600 after the buyers took control of the short-term price action. Since hitting a 6-month low on Monday ($2160), ETH has recovered over 20%.

Main levels of support: $2,550, $2,200

Key Resistance Levels: $2,805, $3,000

ETH had seen a positive weekend so far, managing to break and daily close above the critical resistance at $2,550 which has now turned into support. The immediate resistance is now found at $2,805 and if ETH maintains the bullish momentum, then the price might target the $3K milestone, which is a key psychological level.

Technical indicators

Trading volume: Decent volume in this most recent rally. However, weekend volume remains weak and it is best to wait until Monday to confirm the current price momentum.

RSI: The RSI has surged above the oversold area and is moving higher. The most important thing is for the RSI to make a higher high and break away from the downtrend that has lasted since November.

MACD: Good news for buyers as the daily MACD made a bullish crossover today. This may indicate the start of a major rally that may push ETH back towards $3,000.

Bias

The current bias for ETH is short-term bullish, as shown by the indicators.

Short term price prediction for ETH

ETH is giving clear bullish signals and looks ready to go even higher. If ETH can break the resistance at $2,805, then challenge the key psychological level at $3,000. The weekend momentum is not the strongest, so it is best to wait for Monday’s price action to confirm the current bias.