Today’s BeInCrypto on-chain analysis looks at two global market indicators: futures open interest and funding rates. These determine the overall health of the Bitcoin market and can serve as signals for BTC price movements.

For nearly 3 months, the Bitcoin market has been in a downtrend since the all-time high (ATH) of $69,000 set on November 10, 2021. The current low was reached at $32,900 on January 24, 2022. This represents a 52% correction.

The value of open interest and funding rates can give an indication of which way the market is heading next and whether the downtrend can be stopped soon. To these two indicators, we add the ratio of long liquidations in recent months. The overall outlook suggests a prolonged but already weakening downtrend, which may be followed by a strong rebound and relief rally.

Open interest is falling

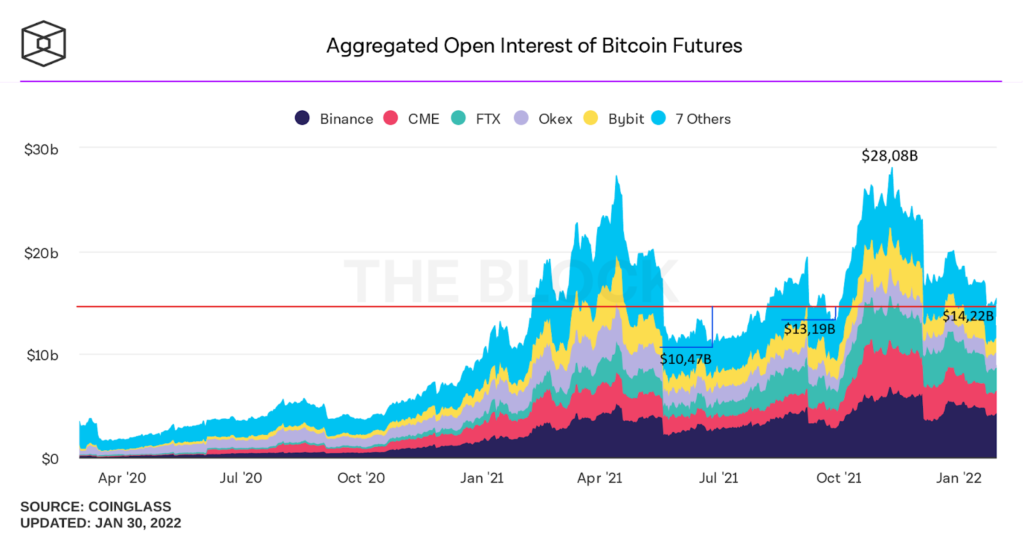

As the price of bitcoin declines, the total value of open interest on the futures contracts also steadily declines. The peak of open interest was reached on Nov. 11 at $28.08 billion near the Bitcoin price ATH, according to data from The Block. The current low was recorded at $14.22 billion, or 49% lower (red line).

Interestingly, today’s value of global open interest is larger (by 8% against $13.19 billion) than at the end of September 2021, when the BTC price bottomed at $39,600. At the same time, it is also significantly larger (by 36% against $10.47 billion) than in July 2021, when Bitcoin reached $29,000.

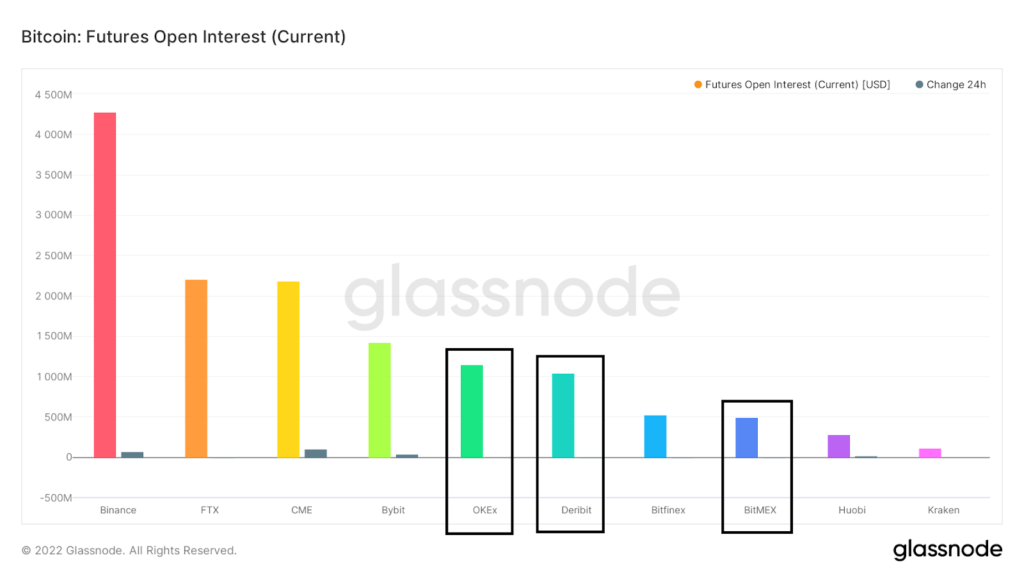

This is mainly due to Binance, the largest cryptocurrency exchange by trading volume. Here, the value of open interest is even higher today than during the December 4 flash crash. Traders on Binance don’t seem to be bothered by market volatility and as of today, the value of open interest on this exchange is $4.27 billion (red bar).

However, the situation on Binance today is the exception rather than the rule. Other major exchanges are currently reporting significantly fewer open interest than they did a few months ago. Examples are: Okex, Bitmex, Deribit (highlighted above).

In a recent series of tweets from @glassnodealerts, it can be seen that open positions on these exchanges are currently at multi-month lows (white dotted lines). For deribitate, for example, this is a 5-month low and open interest today is lower than it was during the September correction. An even weaker open interest is recorded by OKEX: a 9-month low and Bitmex: up to a 21-month low.

Negative funding rates

The second extremely important indicator of the Bitcoin market situation is the funding rates. It expresses the value of the additional amount of money that traders in the futures markets are obligated to pay in order to keep an open position.

Positive funding rates mean that traders with long positions are bound to pay a premium to those with short positions. The reverse is true for negative funding rates.

The level of funding rates can be used as a measure of trader sentiment in the market. Positive funding rates suggest that the sentiment is positive, as traders pay a premium to keep long positions open. Negative rates, on the other hand, reflect negative sentiment and expectations of further declines.

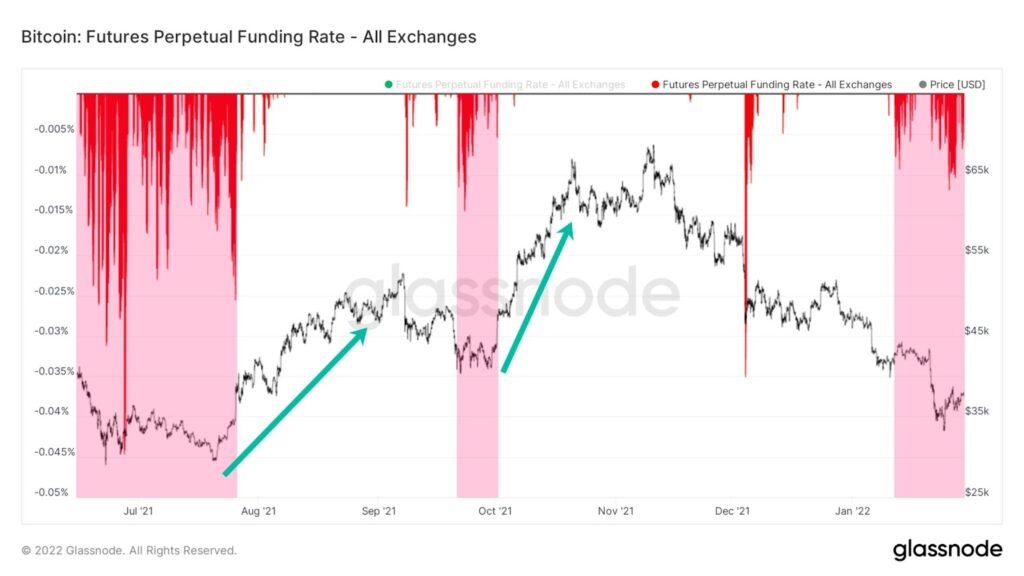

In a tweet yesterday, the crypto market analyst @TheRealPlanC published a chart of funding rates going back to June-July 2021. It noted that two previous periods of negative funding rate dominance (red areas) preceded dynamic increases in the price of BTC (green arrows).

If this scenario were to repeat itself, it is possible that the Bitcoin price is currently in the process of generating a bottom. This is confirmed by looking at the shorter time frame and the ongoing period of declines from the ATH at $69,000.

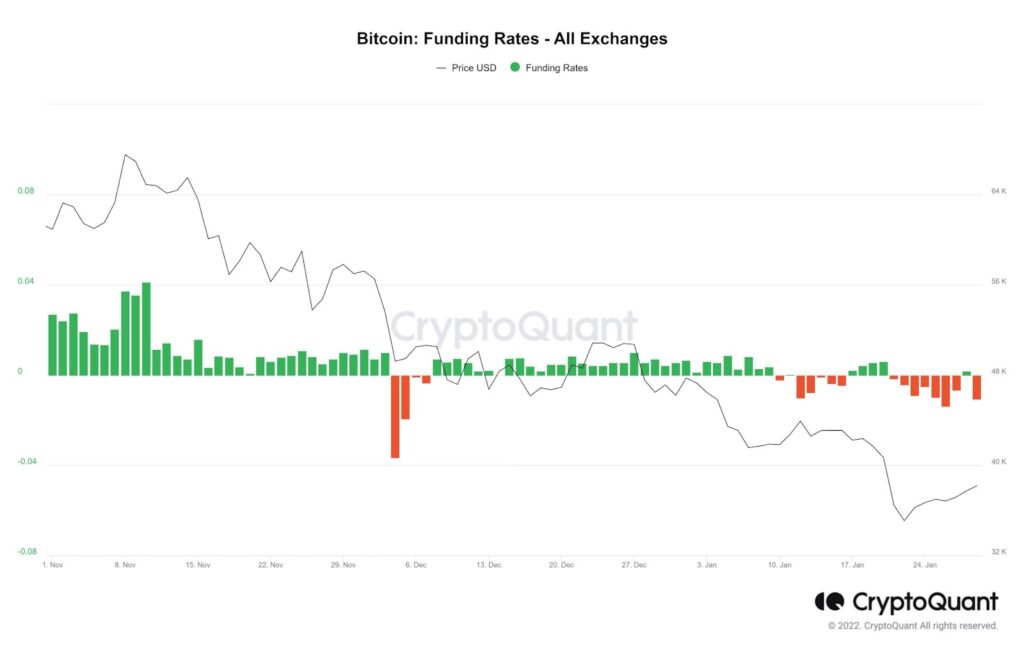

For most of this period, funding rates remained positive, with the exception of the aforementioned decline on December 4th. This means that traders, despite falling prices, continued to open long positions, believing in a quick rebound. However, the declines continued.

Nevertheless, in the second half of January, we already see a dominance of negative funding rates, which suggests a bias towards short positions in the market. Interestingly, the negative funding rates are deepening, despite the fact that the price has bounced off the bottom at $32,900 and is rising. Cryptocurrency trader @Crypt0Jed1 commented on the situation as follows:

“We printed another day of negative funding rates as the price rose. The exact reverse of the behavior that led to big sell-offs in September and December when the price fell while funding rates rose. It is very bullish.

Liquidation of long positions

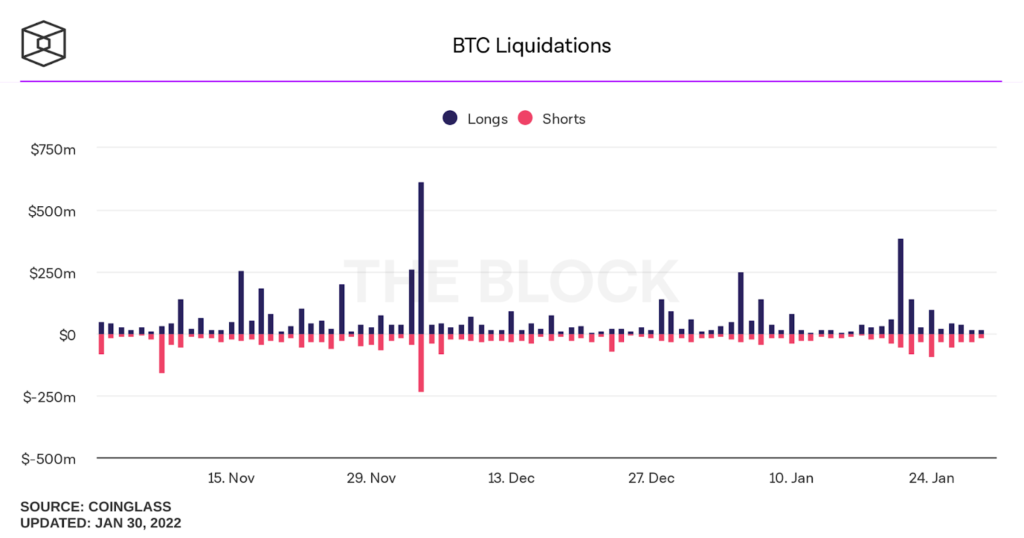

One more on-chain indicator that remains in line with the market sentiment outlined by open interest and funding rates is the number of liquidations of long positions. Looking at the data for the last 3 months from ATH, we see a clear dominance of liquidation of long positions over short positions.

During this period, up to 5 times the number of daily liquidations of long positions on all exchanges exceeded $250 million. On December 4, it even hit a record $615 million. At the same time, the number of daily short position liquidations never exceeded $250 million and only exceeded $100 million twice.

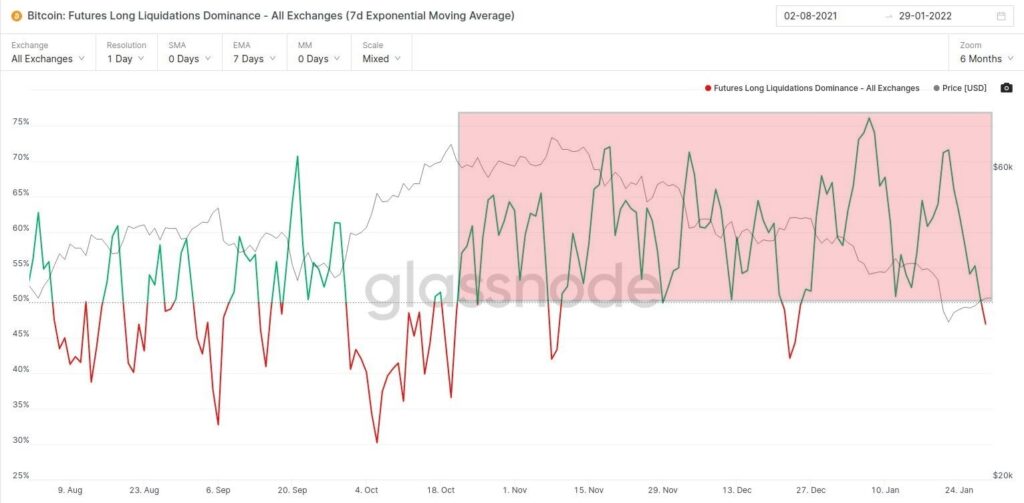

The huge losses of traders betting on the upside are illustrated by the chart of the 7-day EMA for the dominance of long liquidations. In this view, almost the entire period of Bitcoin reaching ATH and subsequent declines was filled with the dominance of long liquidations (red area).

Conclusion

Long positions in BTC futures have suffered losses and liquidations over the past 3 months. At the same time, funding rates are becoming increasingly negative and the value of open interest on many exchanges is experiencing a sharp correction.

These indicators show that the ongoing downtrend may be slowly coming to an end. Whether or not the $32,900 level of Jan 24, 2022 was the end of the correction, a relief rally for Bitcoin can be expected soon. It remains to be seen whether this will be just a correction before a long-term bear market or a continuation of the bull market.