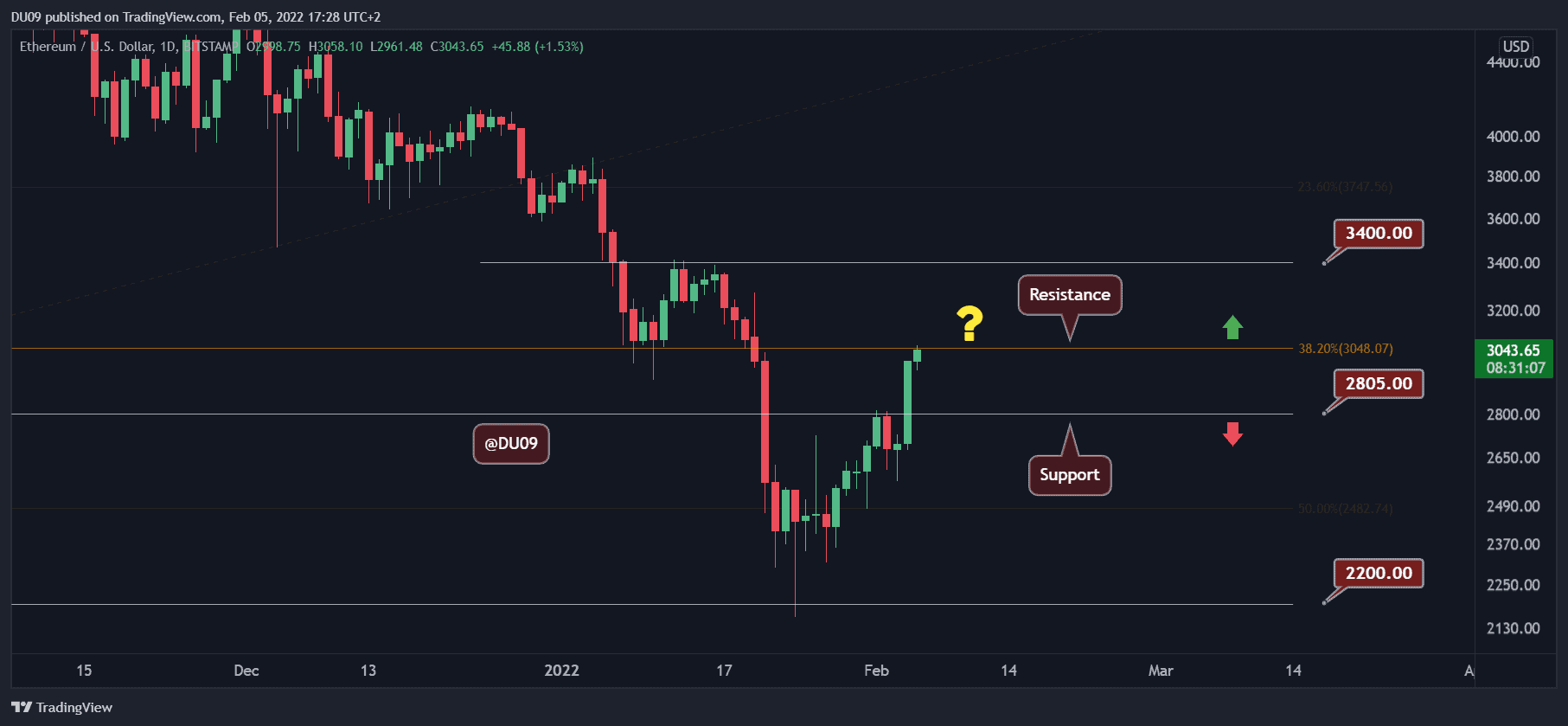

ETH broke above $3,000 and looks set to go even higher, ending the short-term downtrend. This comes less than two weeks since the low of $2160, according to Bitstamp.

Key Support levels: $2,805, $2,500

Key Resistance levels: $3K, $3,400, $3,750

After a decent 2-day rally, ETH broke above the key resistance at $3,000 today. If ETH can turn this level into support (retest and confirm), this impressive rally could continue much further. In addition, there is also significant support at $2,800 should ETH see a deeper pullback.

Looking at the big picture, ETH needs to break above the critical $3,400 level in order to reach a higher high on the daily timeframe. This would be the first confirmation of a sharp bullish reversal.

Technical Indicators

Trading Volume: High volume has propelled ETH higher with six green candles in the past week. This puts buyers in control.

IRS: The daily RSI broke above 50 points, making both a high and a low. This is a significant reversal, and there is plenty of room to move much higher.

MACD: The daily MACD is bullish, and momentum has intensified in the past two days, as indicated by the histogram and moving averages that are rushing higher. The trend is clearly bullish.

Bias

The current bias for ETH is bullish, and there are no signs of weakness.

Short term price prediction for ETH

ETH now faces two major challenges. The first is to confirm the breakout of $3,000 and turn it into support. The second is to break above the $3,400 level which would ensure a major trend reversal in the medium term.

The current momentum favors this scenario, but bears may always come back strong at the key resistance levels. Best to be cautious and watch the $2800 – $3000 support range.