Abra is a complete crypto wallet app and much more. Abra was founded in 2014 by Bill Barhydt, a former Goldman Sachs software engineer and former director of Netscape. Since its inception, Abra has reached many milestones, and to date, it has raised a funding of more than $35 million from various venture capital funds. Since its inception, Abra has come a long way to secure its position as top tech companies in the crypto wallet space. In June 2018, the Wall Street Journal listed it on the “Top 25 Tech Companies to Watch in 2018”.

Now, let’s discuss the services offered by Abra and what makes it unique from other crypto wallets.

Abra Wallet Services

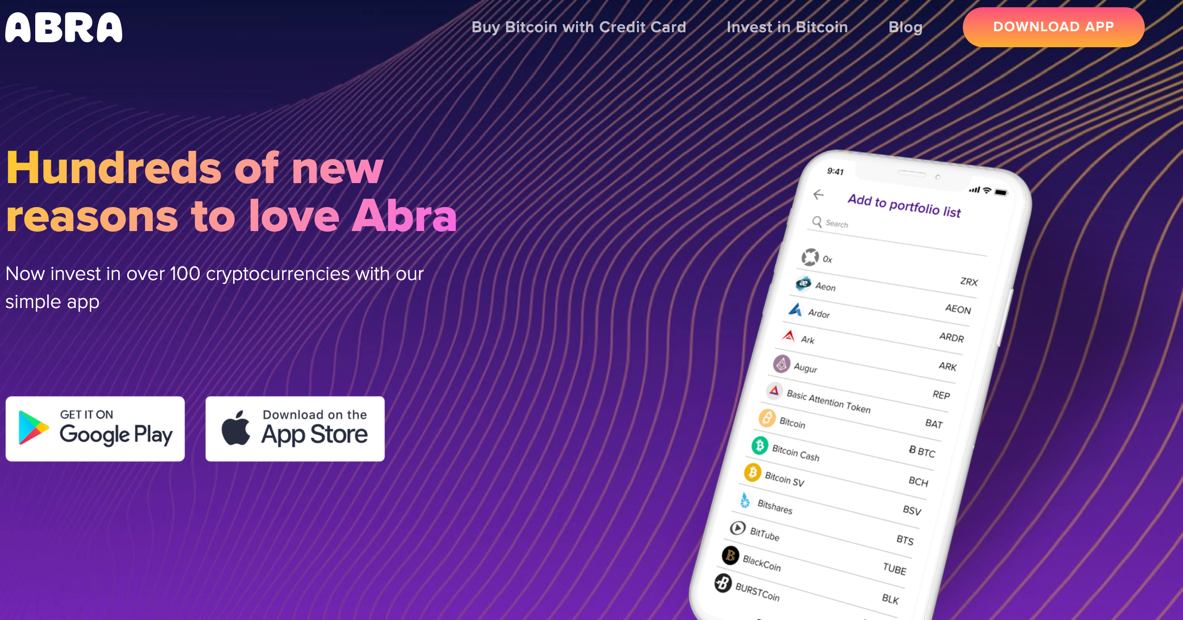

Abra is not just any other crypto wallet but is packed with unique features aimed to simplify crypto transactions. The wallet can be termed as a one-in-all tool, that helps to manage all your crypto holdings and fiat currencies.

Let’s check out some of the services offered in Abra wallet:

- Through its mobile app, Abra allows you to transact in over 90 cryptocurrencies in the US and more than 200 for users internationally directly through its wallet

- It also acts as a money transfer app, which will enable you to send funds to other and switch your crypto balance to any of the supported fiat currencies on demand

- All your fiat balance on the app wallet are held as Bitcoin balance and is secured against any form of volatility. For example, your wallet is having a fiat balance of $7,000, which is represented as 1 BTC. Suppose the BTC price cracks by 20%; then your wallet balance will be updated as 1.25 BTC. In the same way, if BTC prices go up by 20%, your new balance will be 0.833 BTC.

- It offers a convenient way to fund your wallet through bank wire transfer, credit & debit cards, teller service (only available in the Philippines), and cryptocurrencies.

- Allows investment in US stocks, ETFs, indices without even living in the United States

- Also, it allows you earn interest on your cryptocurrencies and stablecoins as well as get a loan against your crypto holdings.

How To Get Start With Abra?

Setting up your Abra wallet is very easy and is like setting up an online shopping application.

The following are the steps involved in a successful set-up of Abra wallet.

- Download the Abra mobile app from Google Play Store or Apple store

- After successful installation, the app requires you to provide your basic details like your name, email address, and mobile number

- You will receive a one-time verification on your mobile number to validate your app installation. Following which you will be prompted to create a four-digit PIN to protect your Abra wallet.

- In the next step, confirm whether you are a resident of the United States of America or not

- Following this, you will be provided with the recovery seed phrase of your wallet

And, once your wallet set-up process is complete, and you can add funds to your wallet and start investing in different cryptocurrencies.

Abra Supported Payment Methods

- Bank: Abra support a variety of major and regional banks in the US

- American Express: US only. Eligible consumer cards include Amex cards, Bluebird, and Serve

- Visa or Mastercard: Debit and credit cards issued globally

- Crypto: Bitcoin, Ethereum, Litecoin, or Bitcoin Cash, which can be easily transferred globally from any exchange or wallet.

While adding funds to your Abra wallet, you need to give a little attention to your country of residence because not all countries accept all payment modes.

For the United States, users have the option to link their bank account, use Visa, Master or AMEX debit/credit card, set up wire transfer through US-based bank, or deposit cryptocurrencies from an external wallet.

For users in Europe, they have the option to link a Single European Payment Area (SEPA) bank account or use Coinify, use Visa or Master debit/credit card, or deposit cryptocurrencies from an external wallet.

Users in the Philippines have more or less the same option as users of the US and Europe. And, users in other parts of the world can only add funds either through VISA or Master credit/debit card or make external wallet transfer. In case of local bank transfers, check the deposit and withdrawal limit allowed in respective countries.

Abra Fees

Abra has the following fee structure on the deposits, withdrawals, and exchanges.

Deposits

- External wallet transfer- Nil

- Add funds via US bank or PH bank- Nil

- Via wire transfer (US)- Nil

- Add funds via EU bank (SEPA)- 0.25%

- Add funds via US-issued AMEX card- 4%

- Add funds via MasterCard- 4% or $10 flat

- Teller service- up to 2%

Withdrawals

- Withdrawing of cryptocurrencies including altcoins- Nil

- Withdrawing via US or PH bank- Nil

- Teller service- up to 2%

Abra does not impose any fee on exchanging two currencies within the app and for sending funds to another Abra wallet. Your Abra wallet is global and flexible. You can deposit and withdraw from your wallet in many different ways: via banks, tellers, or any cryptocurrency.

Bottom Line

Lots have been discussed and said about Abra, and by now, you should be pretty clear if you are going to use it or not. Currently, it looks as easy as it can be at first sight. Other features like anonymous trading, support of more cryptocurrencies, adding more number of countries in deposit and withdrawal of funds through fiat currency would add punch to Abra. With its straightforward and easy to use functionality, Abra looks suitable for those who want to invest and hold digital assets for a long period as well as for those who are beginners.