The positive momentum in the crypto markets is now clouded by a crossing of two major moving average lines.

A death cross occurs when the MA-50 crosses below the MA-200 line. This time, the cross was between the MA-100 crossing below the MA-200 line.

Reviewing historical incidents where this crossover took place, the market reacted negatively last time, causing a 15% correction in June-July 2021 following the previous incident of a fatal crossover.

Technical Analysis

Long-Term – The Daily

Bitcoin has been moving upwards in the past few days. The positive signaling point is that the BTC price has already broken above the major descending trendline and shortly attempting at the 50-days MA resistance line.

However, the negative point to highlight here is that the 100-day MA has moved below the 200-day MA. The last time this crossover occurred was during the final phase of the strong mid-2021 correction. The price was down more than 15% at the time – below $30,000, completing the final bearish leg before a major rally that ended at November’s Bitcoin ATH of $69,000.

Short term – 4 hours

On the 4-hour time frame, it is evident that the price is currently rejected at the $45,000 resistance zone. Additionally, the RSI indicator shows that bitcoin was “overbought” within the 4-hour timeframe, and a correction may be imminent.

From a technical perspective, there is a high chance for the price to experience a correction to the $39k range, completing the first-major pullback after breaking the major bearish trendline.

However, it is worth watching the price action as a deeper correction of the $33,000 range (January lows) is possible, especially with the MA100/200 daily crossover.

Onchain Analysis

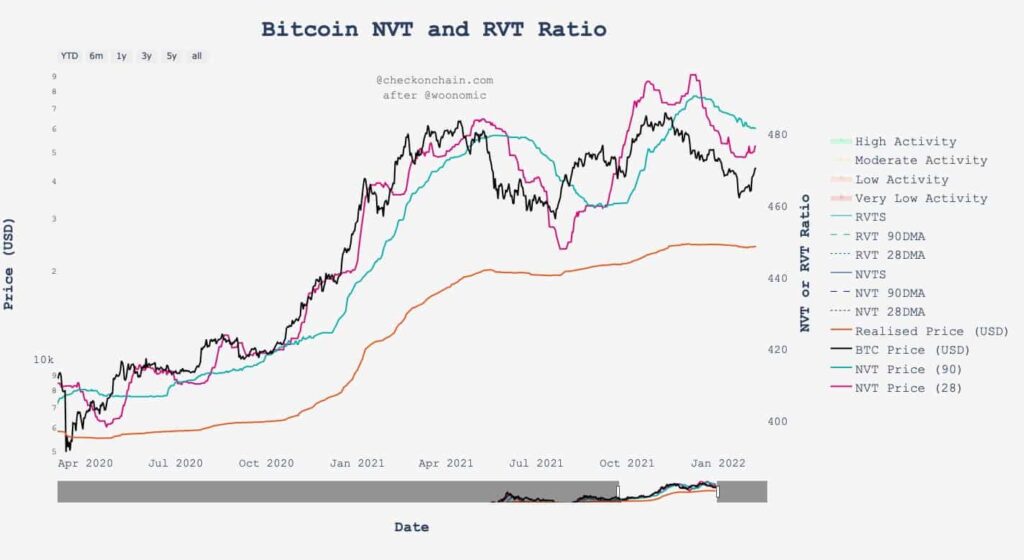

The NVT Ratio (Network Value to Transactions) illustrates the relation between market capitalization and transfer volume. It’s similar to the PE (Price to Earnings) ratio utilized in equities markets.

NVT is a metric that determines whether Bitcoin’s blockchain network is overvalued or not.

Historically, when the price dropped below the 90-day and the 28-day MA NVT price, it was an excellent opportunity to follow the DCA strategy to accumulate Bitcoin.

Currently, the price is below both NVT prices, indicating that the network is undervalued and is considered the perfect time to start an accumulation of DCA. Additionally, a day trader can start making profits whenever the price breaks above NVT prices.