They say you can’t always be the most talented in the room, but you can be the most competitive. Well, the Ethereum network seems to have embraced the same narrative. It looks like in 2022, one of the biggest stories in crypto investing will be blockchain players set to eat into Ethereum’s market share.

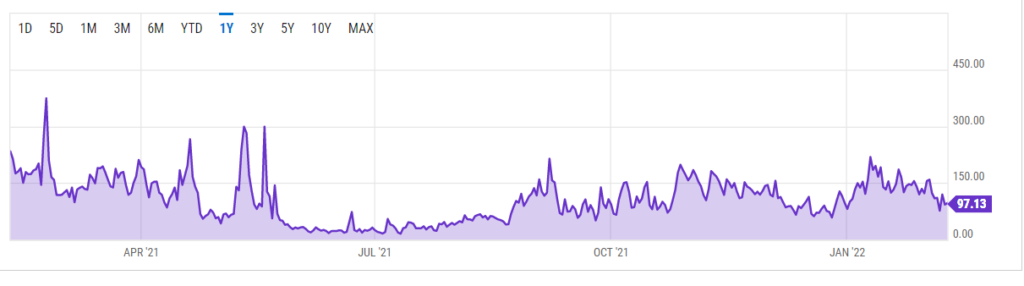

Even so, Ethereum is set to complete its biggest protocol change in history. Proof of Work (PoW), the environmentally unfriendly consensus mechanism will be replaced by the much more eco-friendly Proof of Stake (PoS) consensus mechanism. However, the problem of gas fees remains constant. In fact, Ethereum’s average gas price stood at 97.13 Gwei on 9 February, down from the recent high of 218.55 Gwei on 10 January.

Dear ETH?

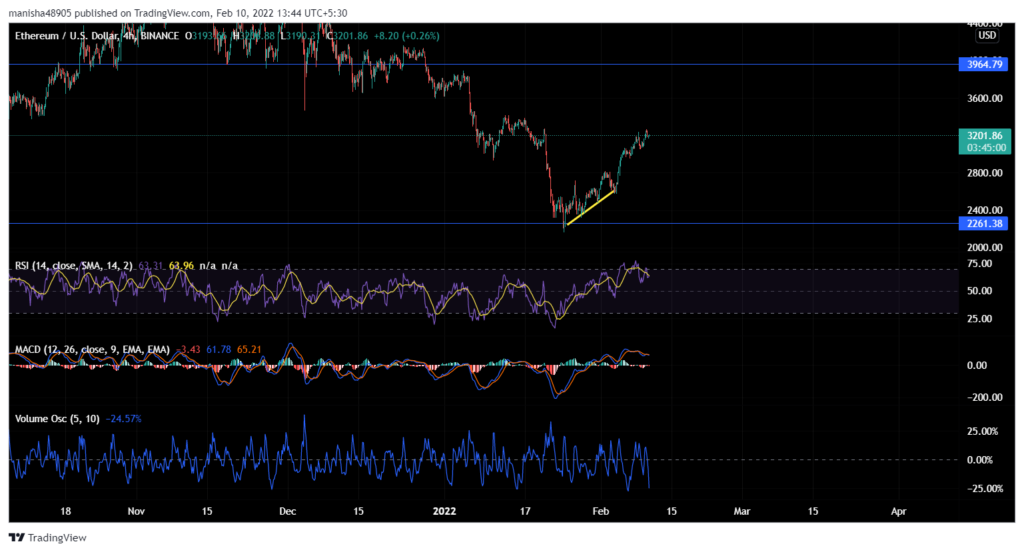

The network seems to be integrating massive changes in order to keep pace with its rivals. However, the price was not misleading of the general market trend. After the coin fell from its high of $4,000, the bulls struggled to get demand. ETH saw a massive sell-off after Jan. 20, signaling that investors couldn’t believe it at the time.

However, the selling pressure couldn’t sustain itself for long as ETH climbed up to its psychological level of $3,000 within a few days. While the RSI was hinting at buyer’s interest, the volume oscillator flashed a red flag with a reading of -23.85%, at the time of writing.

Expectations under control

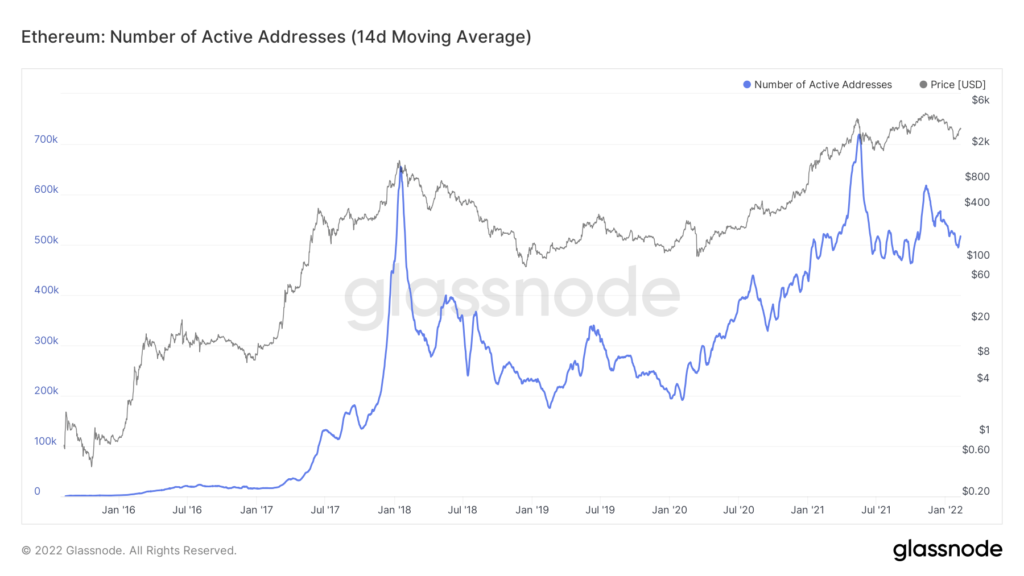

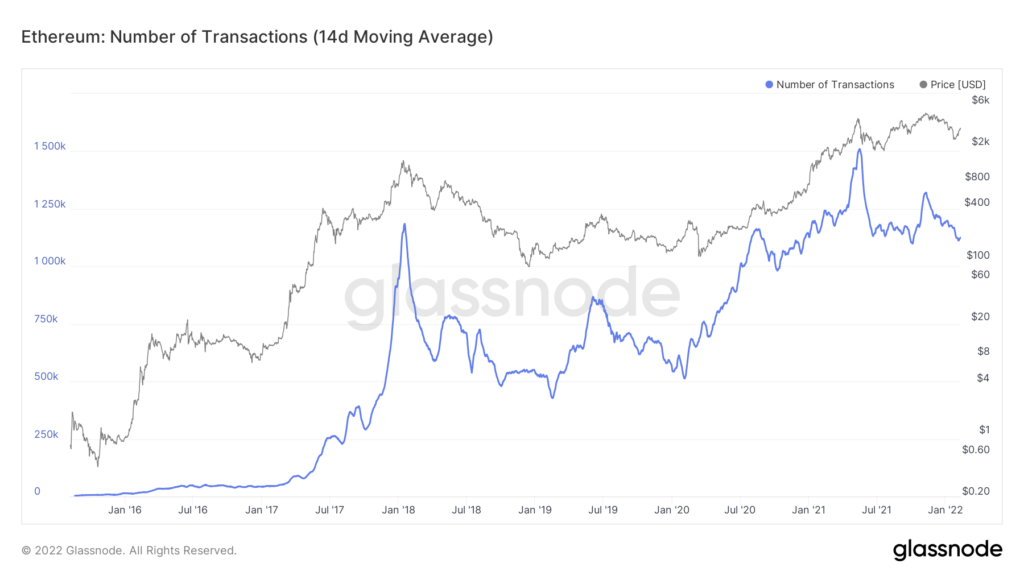

Notably, the more relevant question remains: Will Ethereum break above the $4,000 mark on this rally? Well, the on-chain metrics say it all. In the table below, a fairly simple metric has been considered. Additionally, the 14-day moving average has been applied here to smooth out daily noise.

Post January 2020, the number of active addresses has risen even on the back of a bearish price move. However, since the beginning of 2022, investors’ interest seems to have waned a little. It appears, investors who came in just for the hype and the gains have been flushed out of the market.

Interestingly, the level of activity in this bear market was higher than the activity in previous bear market lows. All of this potentially suggests that there has been adequate demand, despite the downward trend.

In fact, the number of transactions has been decreasing even when ETH seems to be making a recovery post 24 January. This can be an area of concern as it speaks of a potential reversal in price, one that might happen going forward.

As of this writing, 5.18 million addresses are out of money. This suggests that investors have already cut their losses. However, many preferred to open their short positions, despite a recent rise.

It is also to be noted that Ethereum’s correlation with BTC has seen a rise lately. This might come off as a piece of good news to investors since BTC is on an upward trajectory too.

Notably, at the time of writing, 24.68 million ETH remained with the whales. And, there has been no significant movement from their side. On-chain metrics as a whole seem to be giving mixed signals at the moment. However, the decline is certainly not coming to an end with prices rising straight to their all-time high.