High-level EVM-enabled blockchains will have an additional interoperability bridge

While cross-blockchain interoperability remains one of the most sensitive bottlenecks for DeFi, Seesaw Protocol with its SSW token is going to address this issue in a novel way.

Bridging the Gap Between Ethereum, BSC, and Polygon: What is the Seesaw Protocol?

Introduced by seasoned Web3 developers in late 2021, Seesaw Protocol comes with a one-of-a-kind concept of a blockchain-agnostic holistic interoperability vehicle.

As stated in Seesaw Protocol’s whitepaper, it is designed as ‘a fully on-chain liquidity protocol that can be implemented on any smart contract-enabled blockchain’. As such, in future releases, Seesaw Protocol has all chances to become a Polkadot-style interoperability layer for mainstream programmatic blockchains.

Unlike major “bridges” (Solana-Ethereum Wormhole, Anyswap, etc.), Seesaw Protocol is an open-source standard for liquidity pools. With its instruments, traders and liquidity providers can choose the most resource-efficient blockchain from all those available.

In inaugural versions of Seesaw Protocol, users can choose between Polygon, Ethereum, and Binance Smart Chain, three most popular blockchains compatible with Ethereum Virtual Machine. Thus, Seesaw is a one-stop end-point for DeFi-centric liquidity primitives: AMMs, lending/borrowing, stablecoins, and so on.

Users can move value between integrated blockchains for a fee of just 1%, which is far more cost effective than competitors. Additionally, Seesaw Protocol is more resistant to attacks than its alternatives, so users should no longer worry about the safety of their funds locked away in bridge smart contracts.

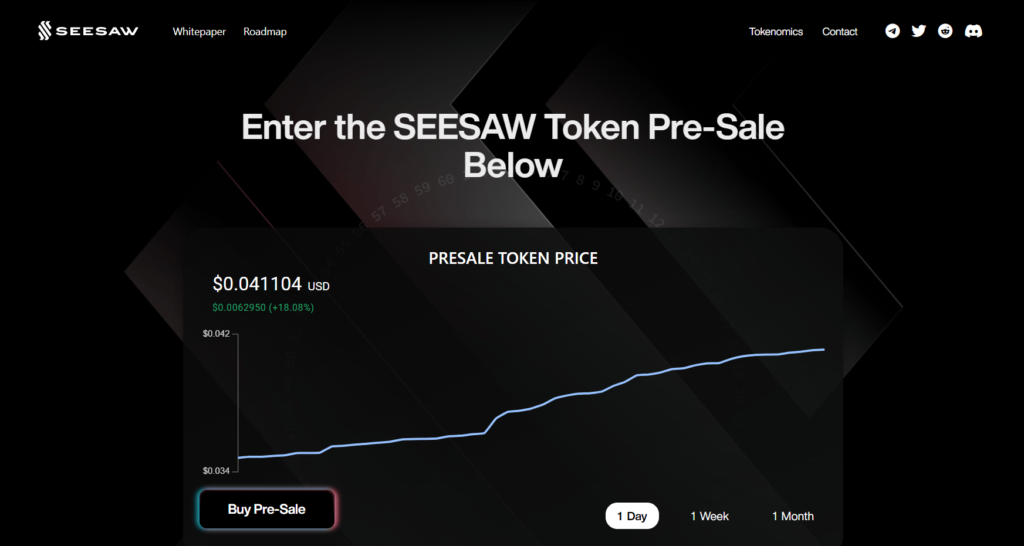

Pre-sale campaign is live

SSW token is a backbone element of the Seesaw Protocol’s technical and tokenomical architecture. It will be crucial for all users of the new product, so the team of Seesaw Protocol has released a detailed roadmap for the tokensale and listing of SSW.

PancakeSwap (CAKE), one of the leading decentralized cryptocurrency exchanges on Binance Smart Chain (BSC), is chosen as the main listing platform for SSW. Initially, a 3% buy-in fee and a 5% sell fee will be applied to all PancakeSwap users.

During the pre-sale, the price of SSW token increased from $0.005 to over $0.025; ‘paper PnL’ for ‘early birds’ therefore eclipsed 400 percent.

Presale participants will be eligible for 5% referral bonuses. 297 million SSW tokens will be minted and offered during a presale phase.

According to Seesaw Protocol’s cliff and vesting policy, tokens will be distributed between buyers only upon the launch of the protocol in its mainnet version.

The current presale status can be checked on the Seesaw Protocol main page; Moreover, here users can claim the tokens through a one-click dashboard.

Currently, the codebase and smart contracts design of Seesaw Protocol are undergoing a third-party security audit. High-profile blockchain-focused cybersecurity auditor CertiK was chosen as a partner for this. CertiK team is checking Seesaw Protocol with AI-powered instruments to spot and fix all possible flaws and bugs.