After the green days, Bitcoin encountered resistance at $45,000. Along with the negative momentum in global markets, Bitcoin was strongly rejected and retraced below $42,000.

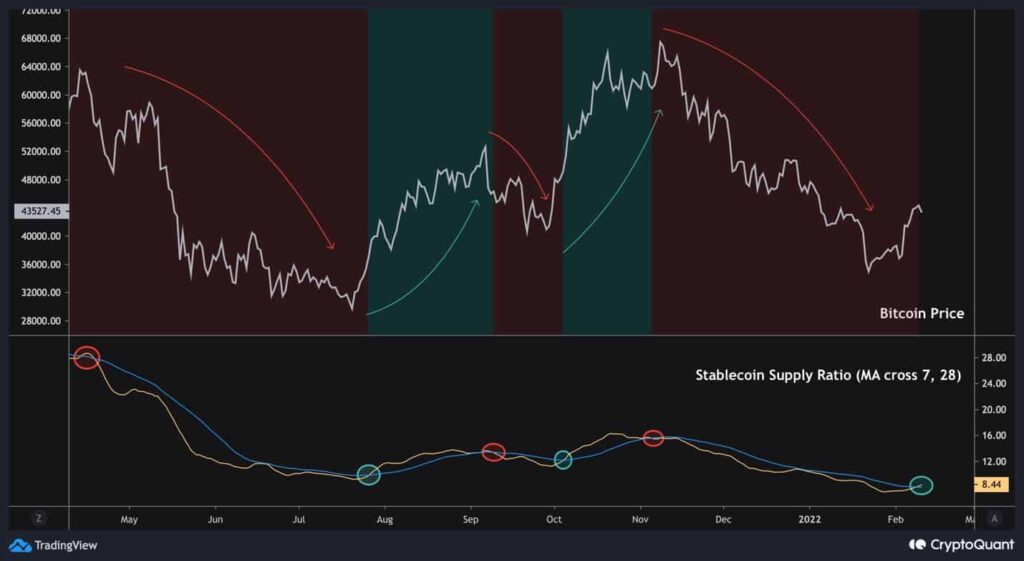

Looking at the Stablecoin Supply Ratio, there is a substantial amount of ‘dry powder’ sitting aside, indicating the potential buying power. Meanwhile, the price action sees a pullback phase back to the latest crossed dynamic resistance level. All in all, this short-term correction is a healthy step for a reliable price recovery.

Technical analysis

Long term: the daily chart

Bitcoin started a mini-rally from $37.2,000, with a series of strong daily green candles.

However, the bullish momentum has weakened. On Thursday, the price was rejected by the descending purple trendline along with the $45K resistance zone.

Currently, BTC is experiencing a correction phase and testing the 50-day cross MA (~$42.2K), resembling a pullback pattern. Despite the latest correction, overall and following a long-lasting downtrend, BTC finally hit a higher high, increasing the chances of a trend reversal event.

Regardless, Bitcoin must establish a higher low during the ongoing corrective phase to complete the healthy reversal structure.

Short-term: the 4-hour chart

The price charted a double top pattern, which is a frequent bearish sign, after hitting its previous key pivot at the $45,000 resistance zone. Two possible scenarios now:

- As mentioned before, the price will get rejected at resistance, deepen the correction, and drop to lower price levels to form a higher low.

- The price will get supported and break above the descending trendline, spike to higher levels and target the next key resistance around the $52K area.

Given the bearish double top pattern and diminishing bullish momentum, the first scenario seems more likely now.

Onchain Analysis

The following chart consists of bitcoin price (white), 7-day MA (yellow), and 28-day MA (blue) of Stablecoin Supply Ratio (SSR).

The SSR metric is calculated by dividing the market cap of BTC by the aggregate market cap of all stablecoins. The SSR indicates when there is enough liquidity available to buy in the market or, on the contrary, when there is not enough buying power to drive the price up, relative to the market capitalization of BTC.

Using the MA Cross indicator, potential bullish and bearish waves have been signaled with decent accuracy over the last year. Now, following a few months of correction (since November’s ATH), SSR MA Cross has finally painted a bullish signal, possibly indicating an end to this bearish leg.

Of course, this indicator should not be considered solely for decision-making, but it has proven to be accurate over the past few months.