In recent months, macro factors have had a bearish impact on the price of cryptocurrencies. Even though the past three weeks have seen a bullish price movement on the charts for Ethereum, it was unclear whether Ethereum can climb back towards the $4000 mark. The latest CoinShares report highlighted that positive sentiment could be seen once again for Ethereum, despite the sharp drop in transaction fees and demand for Ether in the past four months. Will this shift in sentiment see a shift in market structure on the charts as well?

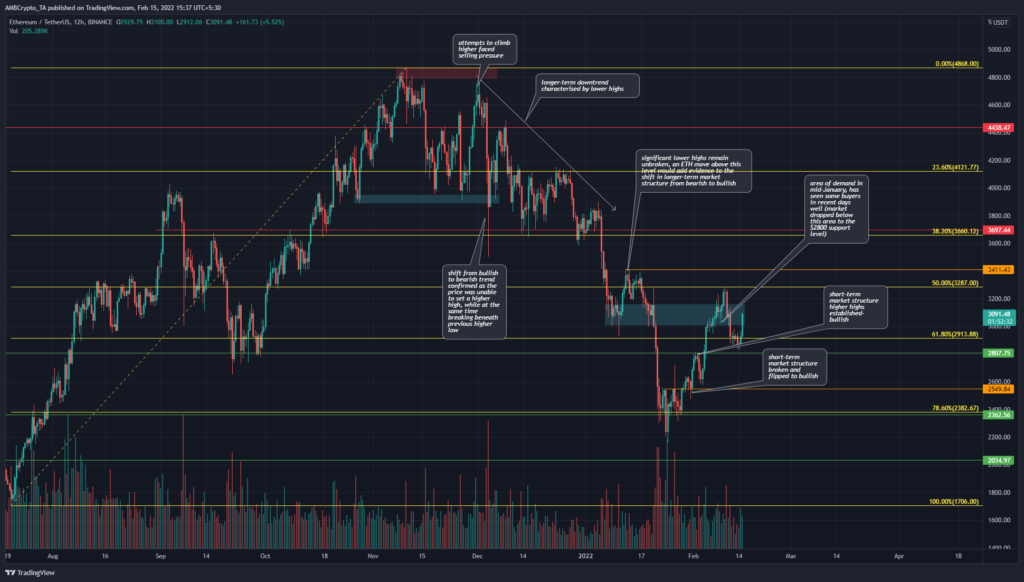

ETH- 12H

As the charts highlight, the downtrend established when ETH fell below $4121 in December was followed by additional and steeper declines that took ETH to $2171 in January. Since then, some demand has been seen and has pushed prices towards $3,000.

The $3411 level was marked (orange) as the previous lower high to beat to flip market structure to bullish on a longer-term outlook. The market structure was already bullish in the past two weeks, despite the sharp, recent pullback from $3283 to $2829. $2807 was a long-term horizontal support level, while $3287 was the 50% Fibonacci retracement level (yellow).

The $3150 to $2950 (cyan box) was highlighted as a buying opportunity. ETH fell lower than this zone, but also rebounded afterward.

Rationale

The RSI on the 12-hour chart rose just above 70 in recent days, pullback to 45 and has since then climbed back above neutral 50. While this was highly volatile, this was also a sign of strong recent bullish momentum. The MACD also climbed above the zero line, and stayed in bullish territory despite the pullback.

OBV has also been on an uptrend over the past couple of weeks but, like the price, has been on a downtrend since November.

The market structure remained bearish, but momentum has been turning in recent weeks.

Conclusion

Indicators have been showing bullish momentum to the upside recently, but the $3411 level needs to be broken and retested as support to provide evidence that the bulls are likely back in command.