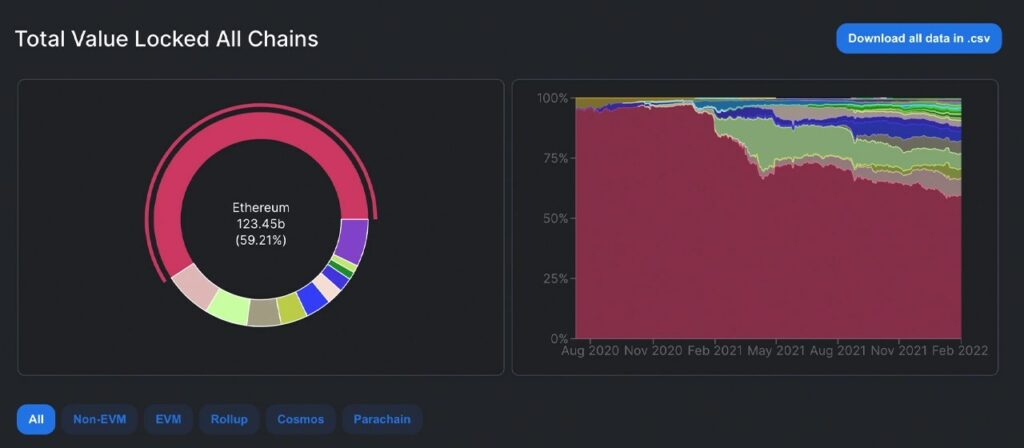

On February 15, the total value locked (TVL) in decentralized finance (defi) platforms is just above the $200 billion range, after a brief slump below that region last week. Out of the entire TVL in defi today, Ethereum commands 59.22% of that value with 532 defi protocols. Metrics during the last seven days show a number of relatively unknown defi protocols have attracted significant TVL percentage gains.

Defi TVL climbs over 3%, $4.5 billion in 24-hour Dex trading volume

Total Value Locked (TVL) in defi today is up ~3.3% over the past 24 hours to $208.45 billion. The defi protocol with the largest TVL is Curve Finance which leads by 9.48% with $19.75 billion.

Curve’s TVL is up 1.22% this week across eight different blockchain networks. Curve’s TVL is followed by Makerdao, Aave, Convex Finance, WBTC, and Lido respectively.

While Ethereum owns 59.21% of the TVL in challenge today with $123.45 billion, the second largest TVL blockchain in challenge is owned by Terra. The Terra blockchain network has $15.05 billion locked and the defi Anchor protocol commands 55.81% of that value.

Terra is followed by Binance Smart Chain (BSC) with $13.36 billion, Avalanche with $10.8 billion, Fantom with $8.46 billion, and Solana with $8.07 billion total value locked.

As of February 15, there are 362 decentralized exchange (dex) platforms with a combined TVL of $70.24 billion that allow people to trade tokens in a decentralized manner.

Today, there’s $4.5 billion in dex trade volume across the globe and over the last 30 days, dex platforms have seen 168,095,541 visits. The top dex today is Uniswap v3 followed by Pancakeswap, Serum, Uniswap v2, Spookyswap, and Trader Joe.

There are 110 challenge loan applications with $45.62 billion in value locked and 11 cross-chain bridges with $24.34 billion. There are 45 staking apps with $12.88 billion and 295 protocols which provide yield and command a TVL of around $24.02 billion.

A Number of Relatively Unknown Defi Protocols See Large TVL Percentage Gains

The top ten smart contract platforms in terms of market cap are all in the green today. Avalanche is the biggest gainer, jumping 14% during the last 24 hours, while the rest have seen percentage gains between 5.8% and 11.5%.

Relatively unknown challenge platforms have also seen significant percentage gains over the past seven days. Hakuswap’s TVL, for example, is up 11,497% this week. Wigoswap’s TVL jumped by 10,163% and Acumen saw its TVL increase by 5,174%.

These three defi protocols were followed by Cougarswap (2,290%), Dopex (1,990%), Polkex (551%), and Dehive (471%).