The past few weeks have not been kind to the cryptocurrency industry and the financial markets. In line with the fear of a growing conflict in Ukraine, the civil unrest in Canada, and the Fed’s decision to raise interest rates, the prices of most assets significantly declined. Bitcoin, for one, dropped to $36,000, which is its lowest price since February 3rd.

With these events in mind, many have envisioned the start of another cryptocurrency bear market. In its recent report, blockchain data provider Glassnode highlighted some of the bearish signals that bitcoin price may continue to fall.

What Are the Signals?

The analytics company noted that bitcoin’s on-chain activity failed to make any progress last week, which is the first sign of decreasing interest and demand for the asset.

This receives support from non-zero balance BTC addresses, which typically display retail investor behavior. Glassnode informed that in the last 30 days around 220,000 of these wallets have been completely emptied. By comparison, when the major cryptocurrency was trading at around $60,000 in November, non-zero addresses hit an all-time high of nearly 39 million.

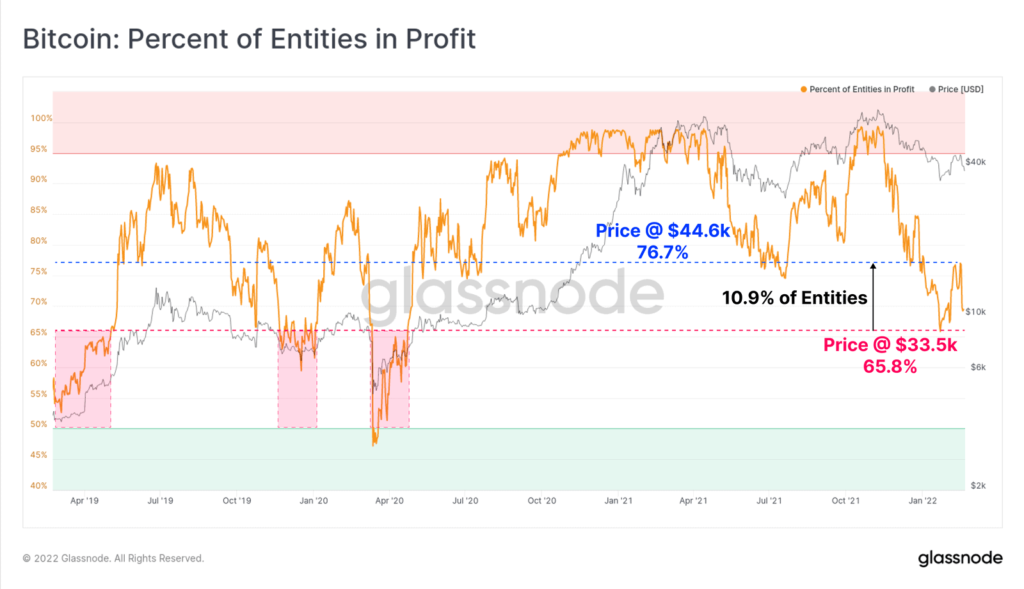

The percentage of entities in profit is also on the decline, which is somewhat expected as the asset’s price is way below its peak. According to Glassnode’s estimations, 10.9% of BTC investors accumulated more coins at prices between $33,500 and $44,600.

As most of them entered the market in the last few weeks, Glassnode determined that they could be the first to sell their portions if the price of BTC continues to fall.

STH Vs. LTH Behavior

The chain metrics provider touched upon long-term holders (holding their assets for more than 155 days) and short-term ones (less than 155 days). It is estimated that most STHs have an average on-chain cost basis of $47.2k, which at the time of writing (BTC price $38K) is an average unrealized loss of around 20%.

As such, the report pointed out that the profit percentage of entities is between 65.78% and 76.7%.

Somewhat unsurprisingly, Glassnode concluded that short-term holders don’t possess the so-called “diamond hands” and tend to dispose of their positions as soon as BTC’s volatile nature strikes. The firm indicated that such investors have already started or most likely will begin selling bitcoins if the asset fails to reverse its recent downtrend.

In contrast, long-term holders, who entered the market before the rise towards $69,000 in November, tend to remain calmer without overselling.

However, Glassnode determined that more than half (54.5%) of the total BTC underwater (4.7 million coins) is held by STHs. This could be another worrying sign for the asset’s short-term price movements, as these investors are “statistically more likely to spend” their holdings.