All you need to know about ‘developed’ Ethereum network’s (Almost) 300K validator nodes

The crypto market has seen significant price corrections since the geopolitical uncertainties of Eastern Europe gripped the world. However, Ethereum has recovered after dropping well near $2,300 on the charts on February 24. At the time of writing, ETH was trading above $2700 after posting losses of just 1% over the past week.

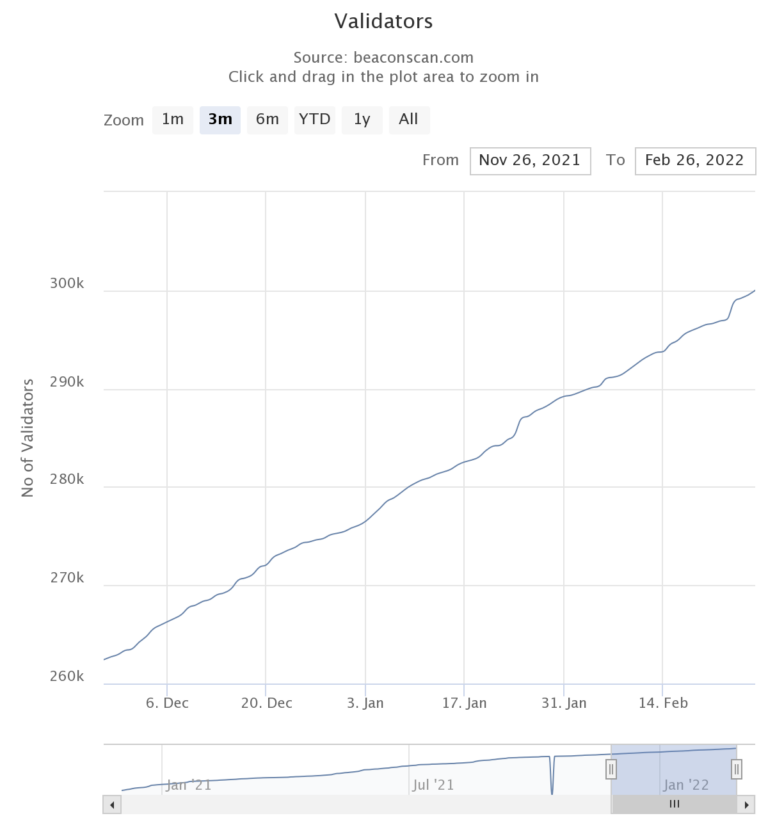

Meanwhile, what is worth noting here is that the network has also (almost) signed up 300,000 validators nodes as it makes its ultimate proof-of-stake shift. The figures for the same, as of 26 February, were 299,998.

Moreover, the amount of Ethereum staked also exceeded 9,596,399 ETH while the network has 65,400 unique depositors.

With the milestone approaching, there were again community members who urged the idea of decentralization and client diversity, especially among pools.

Also worth noting is the staking APR (Annual Percentage Rate). As the Shanghai upgrade looms on the network, Ethereum’s mainnet merger with the Beacon chain is expected in the second quarter of this year. And the Shanghai hard fork will be a crucial upgrade to the ETH merger. Especially after the phasing out of ETH2 terminology before the merger into a single chain.

Meanwhile, Coinbase anticipates that staking yields could rise from 4.3-5.4% APR to 9-12% APR post the Merge. This is because more rewards will go to the increasing validators on the network. Similar to how fees are allocated to the miners in the PoW ecosystem, staking will involve transaction validation on PoS.

That said, Chris Burniske, co-founder of Placeholder, considers ETH, along with BTC, a mature market. He recently took Twitter to call the rest of the market “emerging”, while qualifying the two projects as “developed”.

Alas, ETH’s gas fees remain high and volatile. The network has paid 4.35k ETH in total gas fees over the last 24 hours alone. At press time, the median gas fees was close to 30, after witnessing a major spike to 135 ETH a few hours back.

Meanwhile, ETH’s major competitors are making bigger strides in the market, eroding its share. Ethereum, which a few months ago dominated over 70% of DeFi TVL, currently controls 54.78% in terms of total value locked.

As far as its price is concerned, co-founder Vitalik Buterin doesn’t look too worried about the crypto bear market. In an interview with Bloomberg, Buterin argued that the crypto price fall might be supporting projects’ sustainability. He added,

“People who are deep into crypto, and especially into building things, a lot of them welcome a bear market.”