With the substantial growth of the Ethereum network, many similar systems enabling the deployment of smart contracts have emerged trying to compete. While many of them continued to sketch out brilliant plans to become Ethereum killers, some remained silent and focused on growth instead of bragging.

This seems to be the case with Tezos – a decentralized open-source blockchain executing peer-to-peer transactions that saw the light of day nearly four years ago. It has stayed below the radar for a while without making any groundbreaking promises, but it kept building and developing its software, attracting new users, signing new partnerships, and everything in between.

Tezos blockchain upgrades

Since its launch, the Liquid Proof-of-Stake (LPOS) network has undergone seven upgrades via on-chain voting due to its self-amendment mechanism. This on-chain voting was specifically designed to avoid the potential risks of a hard fork, which has happened to many other blockchains before.

The latest one announced in September 2021 and called Hangzhou promises to deliver a “new era” for the network.

“The Hangzhou upgrade will help set the stage for a consensus upgrade expected in 2022, Tenderbake, and introduce a number of new tools and technical fixes.”

Some of the new additions will incorporate a feature allowing smart contracts to read the storage of other smart contracts. Another one will provide countermeasures against Block Producer Extractable Value, while context flattening will enable future optimizations to speed up blocks processing, and others.

Tezos takes DeFi market share

The ability to allow developers to deploy smart contracts on its blockchain means that Tezos is among the growing number of platforms that will be heavily involved in the decentralized finance space.

DeFi became a hot topic in the summer of 2020 when the total value locked across all projects stood around $1 billion. That same metric exploded in the following months and stands at just shy of $200 billion as of now, following the recent retracements in the cryptocurrency space.

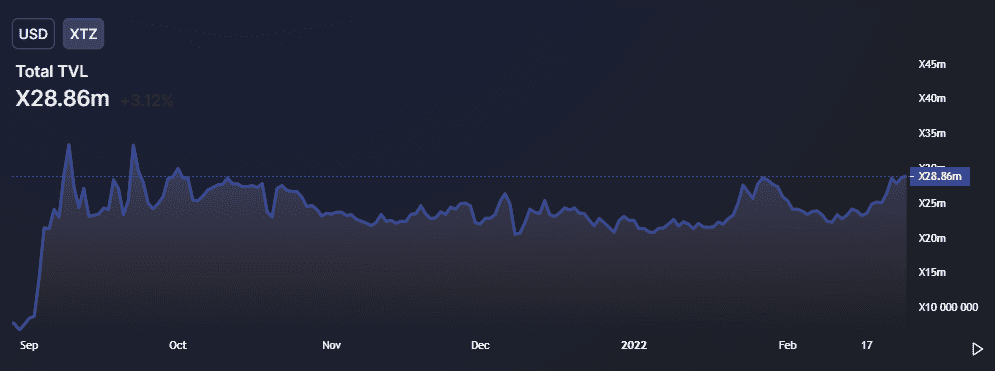

Despite its relatively recent foray into the DeFi space, Tezos has already started attracting players to its ecosystem, and the number of locked XTZ tokens is close to ATH at the end of 2021.

A recent report from Tokeninsight informed that there’re over 100 dApps on Tezos with a primary focus on DeFi or NFTs. The project also aims to become the home of many protocols focusing on GameFi and the Metaverse.

Tezos network activity

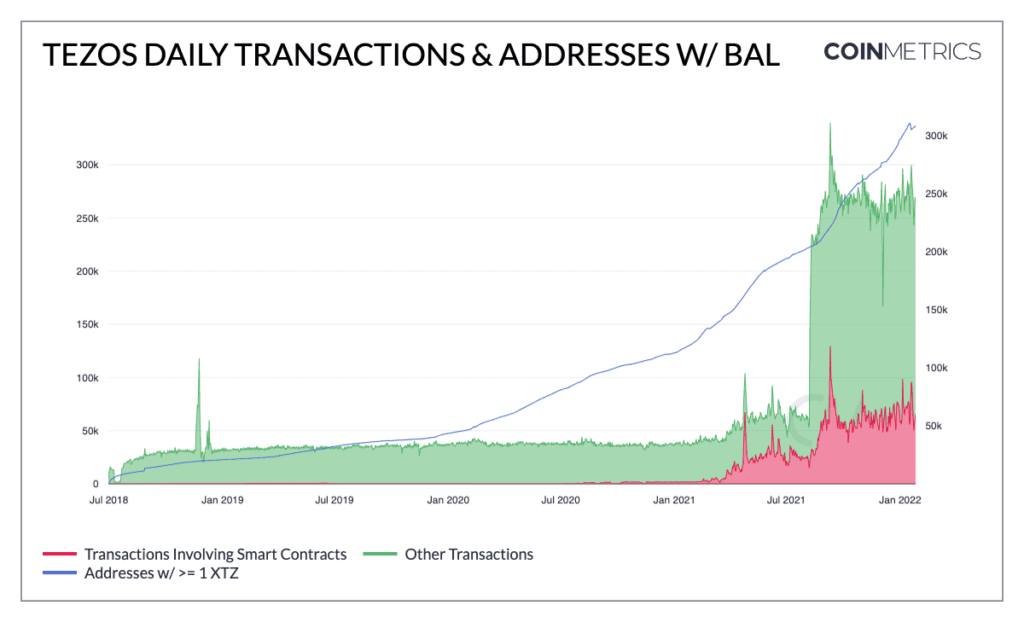

Another Coinmetrics report highlighted the substantial growth of the Tezos network in terms of activity and number of transactions. The chart below shows the peak of regular transactions (in green) and those involving smart contracts (in red).

The most significant increase came in the summer of 2021 when Tezos released a network upgrade cutting average block times in half. Transactions involving smart contracts saw an uptick as NFT protocols on Tezos started seeing enhanced adoption, such as FX Hash.

XTZ token holders are moving in line with the aforementioned increases. Wallets containing at least one coin have almost tripled in about a year and are well over 300,000 at present.

Tezos Partnerships Part One: Banks

The project has inked numerous partnerships in the past year or so and was particularly active with global banks. One of the first came in April last year when the third-largest French banking organization – Societe Generale – tapped the Tezos blockchain to issue a structured product as a security token.

The French institution also revealed plans to begin offering crypto-asset structuring, issuance, trading and custody services to professional clients this year.

Another partnership with a banking company – this time with Arab Bank Switzerland – allowed the latter’s institutional clients to store, stake, and trade the native cryptocurrency of Tezos – XTZ.

The 60-year-old entity also said it selected the blockchain project to develop a new set of “innovative and compliant” on-chain digital financial products.

Shortly after, the crypto bank SEBA released a yield farming service for clients, allowing them to stake and earn rewards in a few digital assets, one of which was XTZ.

A collaboration with digital bank EQIFI, on the other hand, has seen Tezos launch a number of lending and yield products.

Part Two: Sports, Clothing, NFTs

While the partnerships with banks deserve special attention, so do Tezos’ collaborations with sports teams, companies, and clubs.

Esports team Vitality has chosen the Tezos blockchain to launch a three-year fan engagement program on its blockchain to improve the connection between star gamers and their supporters.

FloSports, a subscription video streaming service, followed suit and signed a multi-year deal with Tezos as well. As such, the blockchain protocol will become the Title Sponsor for FloSports’ owned-and-operated grappling events and other high-profile motorsports racing series to be announced later.

Among the biggest partnerships was earlier this month between Tezos and British soccer team Manchester United. Thanks to the $27 million deal, the club will put the crypto project logo on its training clothes.

A collaboration with the Formula 1 team McLaren Racing led to the creation of a non-fungible token (NFT) platform on Tezos. Similarly, the large US clothing brand Gap launched a digital collection on Tezos with Brandon Sines.