Total market capitalization has shrunk by $65 billion over the last day

According to recent data from Coinglass, 60,062 traders were liquidated as the entire crypto market plunged. The cryptocurrency market fell under pressure from sellers after failing to maintain its bullish momentum. Total market capitalization fell by $65 billion over the past day, slipping below $1.8 trillion.

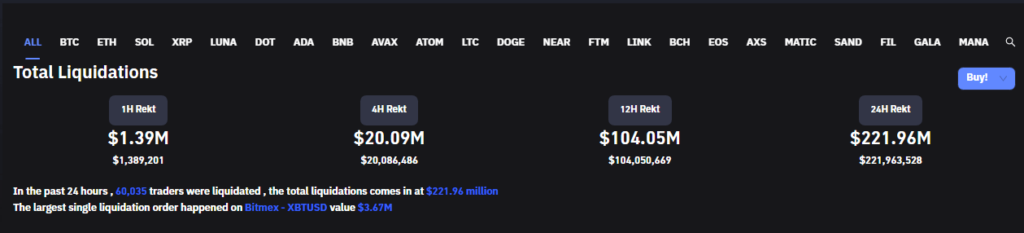

Over $221 million was liquidated in the last 24 hours, with roughly $20 million occurring in the last four hours; nearly $93.12 million of it was tied to Bitcoin trading positions. On the BitMEX exchange, the largest single liquidation order was placed.

Liquidations of trade positions related to Ether (ETH), the native coin of the Ethereum blockchain, totaled $58 million. Liquidations tend to occur when a trader runs out of sufficient funds to satisfy a margin call or a request from the exchange for additional collateral to keep the trading position funded.

Bitcoin hit a low of $40,800 on March 4 after the largest cryptocurrency by market capitalization had been steadily declining since March 2, presumably due to fears that the Federal Reserve might tighten monetary conditions quickly in the face of rapidly growing inflation.

The Crypto Fear and Greed Index which measures market sentiment measured “fear” at the time of publication.

Crypto market dips

Altcoins likewise fell as the cryptocurrency market tumbled under selling pressure. Solana (SOL), Avalanche (AVAX) and Ethereum (ETH) have taken the biggest losses, plunging by more than 6%. Meme coins, such as Shiba Inu and Dogecoin, are also down more than 3%.

Bitcoin, the world’s leading cryptocurrency, fell to $40,800 on March 4 before bouncing back to $41,661 at press time. The cryptocurrency is now down nearly 4.59% in the past 24 hours, suggesting the bears may be back in control. Bitcoin fell to $34,324 on February 24, hitting a one-month low.

However, it then managed to stage an impressive rebound and ended up reclaiming the $45,000 level for the first time. The lead crypto had risen to highs of $45,332 on March 2 before tumbling down.