The adverse price developments in the crypto market continued, with bitcoin dropping below $40,000. Most altcoins are deep in the red as well, with Terra losing 7% and BNB dropping to $380.

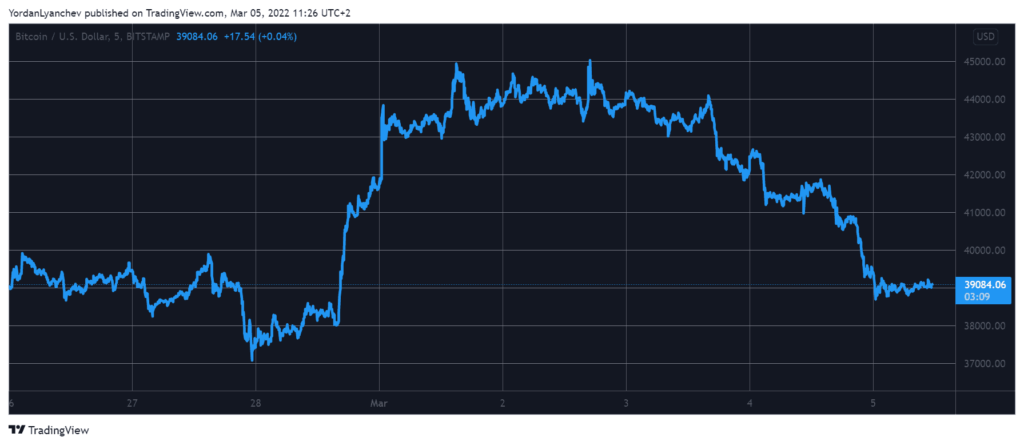

Bitcoin lost $6,000 in 3 days

The ongoing war between Russia and Ukraine hurt all financial markets from its inception, but bitcoin managed to recoup all losses immediately when the West refused to get directly involved.

It kept climbing, reclaimed $40,000, and even soared to a three-week high at just over $45,000 on March 2nd. However, this is where the bears stepped up and didn’t allow the asset to go upwards.

The leading cryptocurrency has started losing value gradually, despite on-chain data revealing that retail investors and even whales have been accumulating significant shares lately.

In the past 24 hours, bitcoin went from around $42,000 to just under $39,000 and still sits close to that line. This means that the cryptocurrency has lost more than $6,000 since its local peak three days ago.

Top of Form

As a result, bitcoin’s market capitalization has fallen below $750 billion after touching $850 billion a few days ago.

Altcoins See Red

The alternative coins also suffered in the past few days after charting new local highs during the week.

Ethereum briefly surged above $3,000, but the market-wide retracement sent the second-largest cryptocurrency down over $350. Right now, ETH is struggling at $2,650.

BNB Chain (formerly known as Binance Coin) lost 4% in a day and stands at $380. Solana, Cardano, Avalanche, Polkadot, Dogecoin, and Shiba Inu are also in the red from the larger-cap alts.

Terra and ATOM have lost the most value now. The bottom two high-flyers are down 7% and 11.5%, respectively.

The cryptocurrency market cap is down by $90 billion in a day and $200 billion in three days to $1.750 trillion.