Bitcoin’s price continues to struggle in an attempt to recover. The action during the weekend was choppy at best, and the cryptocurrency even lost some of its value. With this said, it’s worth looking at the most probable scenarios for BTC following the recent events and the critical levels in each case.

Technical analysis

Daily period

The price failed to record a higher price action pattern in the daily timeframe, and the range top and 100-day moving average rejected it. Currently, Bitcoin is above a critical support zone around the $36.3K-$37.3K region. The cryptocurrency needs to maintain the mentioned support zone to start another push up the range.

On the other hand, if BTC breaks below this substantial level, this might propel further declines. In this case, the next support level will be at the range’s bottom, which is the $34K to $35K area.

4 hour delay

The chart shows that Bitcoin is now consolidating between two obvious areas of supply and demand. The immediate resistance level is near $45,000, while the significant support level is around $34,000.

The price has been plummeting with strong bearish momentum, which indicates that the bears have taken control. However, a clear divergence between the price and the RSI indicator has decreased the bearish momentum and may lead to a reversal. In contrast, Bitcoin has formed a bearish continuation correction pattern (Yellow trendlines). Another extreme bearish move will be expected if the bottom trendline does not hold.

On-chain analysis

Reserve of all minors (EMA 30)

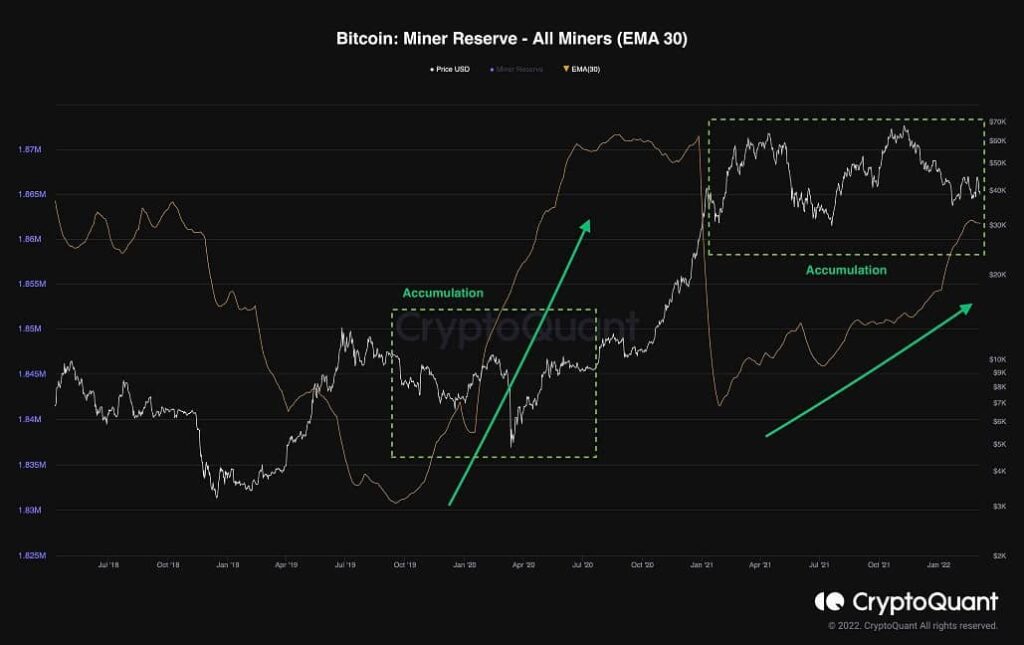

Miners continue to hoard bitcoin amid all the uncertainty surrounding the global economy and politics. They are considered influential entities when it comes to network security and broadcast integrity.

Analyzing their behavior could also prove very useful in predicting where the price might be headed next. They were also accumulating Bitcoin aggressively before the 2020-2021 bull run when the cryptocurrency ranged between $5K-$10K. After the bull run started, their accumulation rate became flat, and then, they rapidly distributed their supply in late 2020-early 2021, which significantly weakened the uptrend.

After this mass distribution, a slow and steady accumulation began again, which continues today. This behavior is very similar to early 2020 and pre-bull run price consolidation, indicating that miners expect higher prices in the medium term and do not view current rates as appropriate to sell their coins. .

However, this could also be because most of them have migrated to the U.S. from china over the last two years and have more financial support and security, and are not under a lot of pressure to sell their coins amid the intense volatility of the price over the last year.