Terra’s price is presently attempting a rebound from the prior day’s low at $75.60

According to data from CoinMarketCap, Terra (LUNA) is down 3% in the past 24 hours and has seen a weekly decline of almost 11% to a current price of $80.72. Terra price is currently trying to rebound from yesterday’s low at $75.60.

According to a prominent crypto analyst, Terra’s pullback might be nearing completion as it prints a bullish signal on its daily chart. As indicated by the analyst, the TD sequential indicator has flipped bullish for the now seventh largest cryptocurrency.

Terra saw a significant price gain in late February as it rose from lows of $48.97 on February 21 to reach highs of $97.30 on March 2 before the bulls caught their breath.

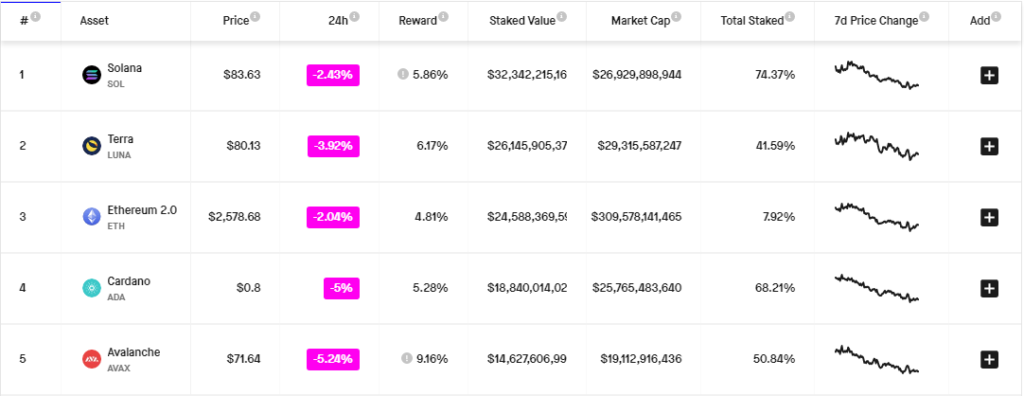

The price gain led to an increase in Terra’s market capitalization, causing it to flip Solana and Cardano to grab the seventh spot per CoinMarketCap data. Terra is also the second-largest staked asset among all major cryptocurrencies in terms of total value staked, likewise in TVL (total value locked).

Solid fundamentals

LUNA’s price jumped in late February on strong fundamentals and community support for Terra. According to Staking Rewards, over $26.14 billion worth of LUNA has been staked directly across multiple platforms. Annual returns for participants are over 6.17%.

Staking is a process in which token holders deposit, or lock away, several tokens to become active participants in the network’s operation for rewards. The rewards, known as “yields,” are typically higher than those paid by traditional financial institutions on deposits.

Terra also currently ranks the second largest smart contract platform by total value locked, after Ethereum, according to data provided by DeFi Llama. With a current total value locked (TVL) of $22.79 billion, Terra ranks ahead of Binance Smart Chain, Avalanche, and Fantom.