Ethereum never seems to lose investors’ interest. Even in a bearish market, the altcoin king has managed to make its presence felt. Here, it’s worth noting that the positive sentiment of investors could play in favor of the altcoin moving higher.

Ethereum buyers are back

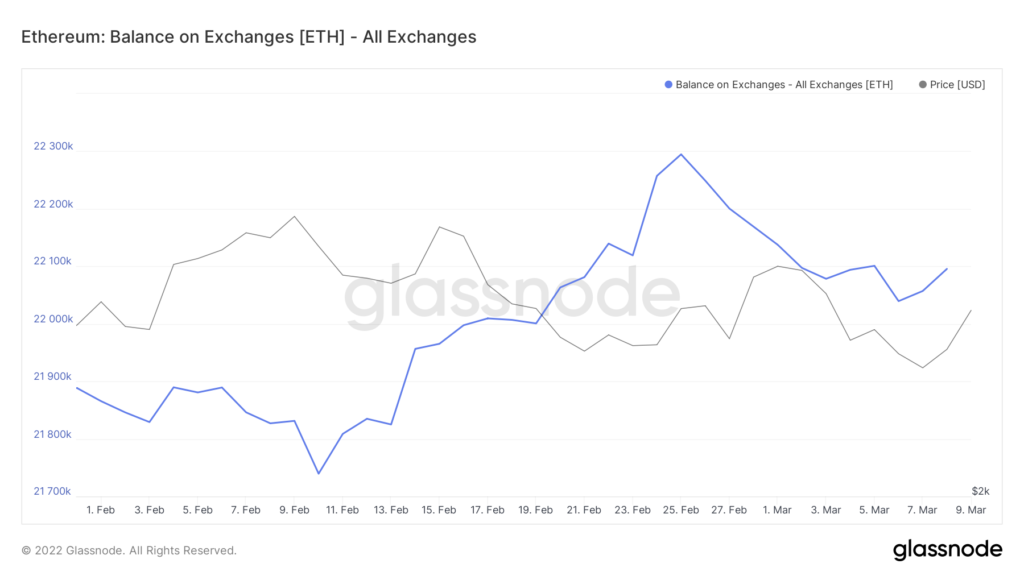

The tendency to “buy the dip” sometimes benefits the holders of the coin immensely. Well, in the case of Ethereum, people who bought around $54 million worth of ETH in the last 20 days can reap benefits in the days to come. However, it should be pointed out that before February 25, around 500,000 ETH worth approximately $1.3 billion were resold in the market.

ETH traced a downtrend from 14 February to 24 February. However, after 24 February, it followed the bulls to go up the price charts. Now, it remains to be seen if ETH will hold the $2592-area or go down to its recent floor of $2392.

At the time of writing, ETH was fighting a brave fight against market bears. If the bulls exert pressure, ETH may hit a local high of $3200.

However, for ETH to perform better on the price charts, investors will have to stay away from FUD.

Notably, according to the metrics, Ethereum HODLers acquired a huge amount of ETH in anticipation of earning profits in the future. The supply aged between three months and two years has steadily increased. Currently, it represents 55 million ETH – 46% of the total circulating supply.

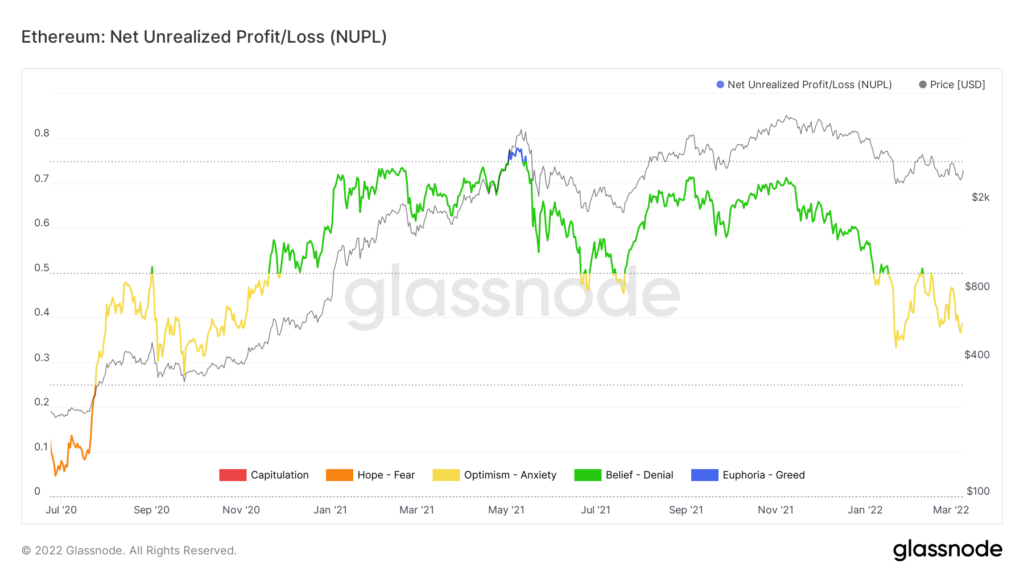

Plus, as long as the NUPL is in the Optimism zone, it could continue driving investors towards ETH with the promise of a hike soon.

However, as the indicator seemed to be equidistant from the bearish and bullish zones, it cannot be said whether a rally will follow in the near future.

The other side of the story

Well, the uptick in Ethereum’s volatility remains a major concern. Down by 5.47% over the last 24 hours, ETH can move either towards $3200 or slip back down to test $2300 as support.

Additionally, investor support and confidence plays a huge role in any recovery. Alas, this may not be the case with Ethereum in the coming weeks.

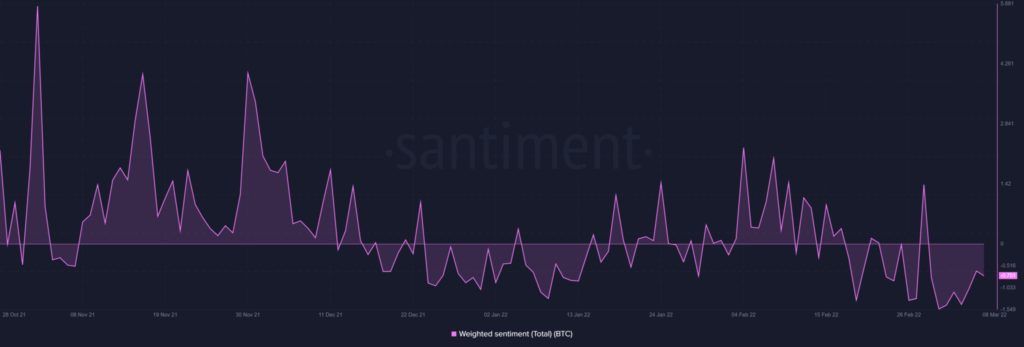

Ethereum’s social presence has been dwindling since mid-February too, with dominance across social platforms dropping from 17% to 7.23%.

Additionally, community sentiment has also been surprisingly negative. Ergo, weighing both sides of on-chain activity paints an incomplete and inconclusive picture.

How the price action plays out over the next few days would provide a clear sense of direction to the market.