Dogecoin accumulation begins as more whales start trading the asset

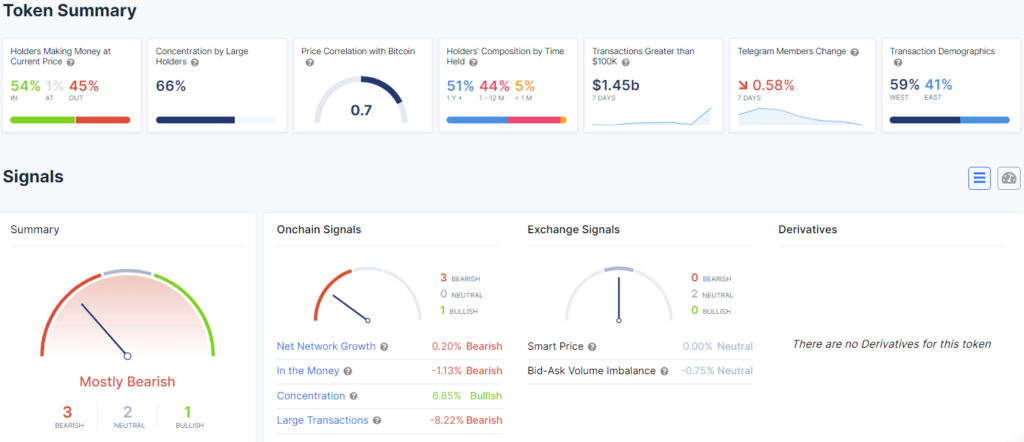

The accumulation rate of Dogecoin increases as the concentration of coins in whale-level wallets increases by 6.8%, according to IntoTheBlock. The increase in the accumulation rate is most likely related to the high discount Dogecoin is trading with.

As data from IntoTheBlock suggests, the asset became less profitable compared to the previous cycles. At press time, only 54% of all traders or investors are profiting from holding DOGE, while the same metric showed at least 70% only one month ago.

The sudden drop in profitability is most likely related to the concentration of “buy” orders placed by traders after the first peak in the price of Dogecoin in April 2021. During the run, DOGE reached its latest high of 0 $.74 and dropped after.

Why whales are accumulating

The main reason behind the increased buying power is most likely tied to the massive discount of the cryptocurrency. As most of the market, Dogecoin lost more than half of its value, which allows steady, progressive and cheap accumulation for whales.

Usually, the growing volume of funds concentrated in whale wallets is considered an uptrend, as whales only take profits at or near the top of the bullish rally on various coins.

If retail traders dominate the holder’s composition, assets face more selling pressure, hence, moving further down instead of consolidation and recovery. The same thing happened with DOGE since most whales exited the market in May 2021 and redistributed their assets to private traders that moved the asset into a prolonged downtrend.