Dogecoin approaches crucial support level where turnaround might be possible

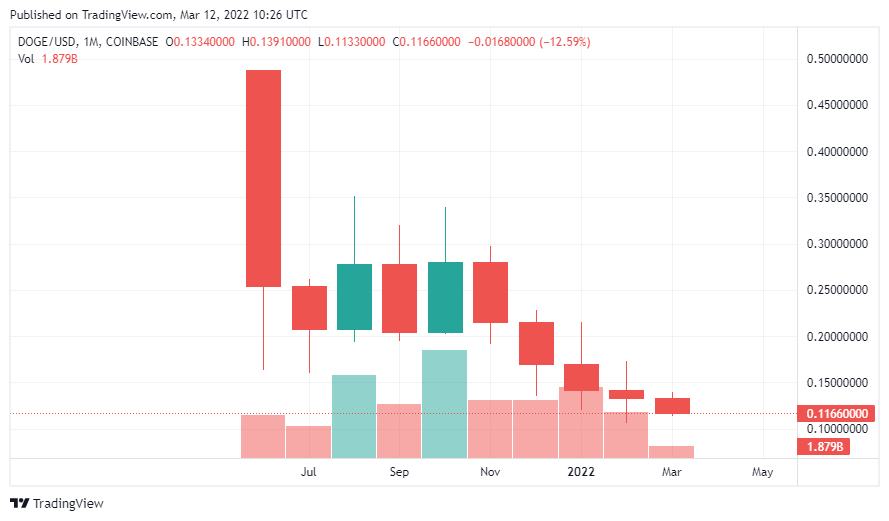

For the fifth month in a row, a red candle appears to be forming for Dogecoin (DOGE), which is currently trading around $0.11 and marks the continuation of the bearish streak for the biggest meme token.

A red candle implies that the price is trading lower than the opening price recorded at the start of the month. This happened four months in a row in the case of Dogecoin, and it appears to be on track for a fifth one.

Dogecoin has been on a downward trend since May 2021 when it hit all-time highs of $0.76. The price has rallied slightly and consolidated as evidenced by the two monthly green candles marked in August and November 2021 before another round of declines.

Starting from May 2021, Dogecoin has only marked two green candles out of eleven monthly candles, in comparison to the long streak of greenish candles recorded before that time.

On the monthly time frame, Dogecoin is approaching a crucial support level at which a reversal might be possible. The RSI indicator hints at this, while also hinting at further consolidation ahead of a major price surge. At press time, the price of Dogecoin is at $0.114, down slightly over the past 24 hours.

Dogecoin accumulation continues: a positive sign

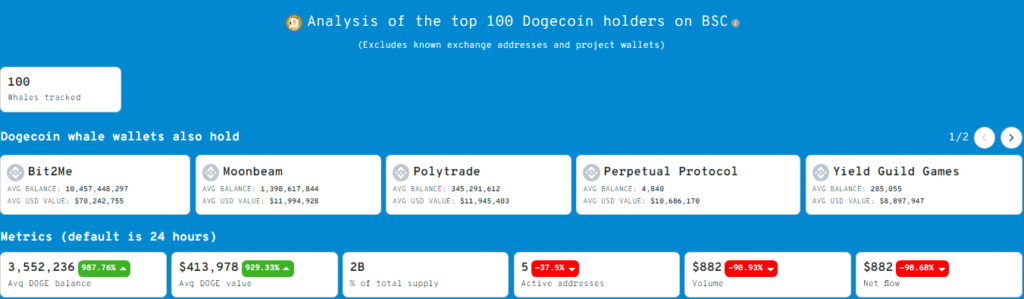

Dogecoin’s top holders appear to be scooping up tokens at a discount amid the present market volatility concerning the short-term price action for cryptocurrencies. It might be worth noting that every market cycle has an accumulation phase, during which prices flatten and contrarian investors see an opportunity to buy at a discount.

When this market cycle is over, the next one, the “mark-up phase”, begins. It refers to a phase in which the market has been stable for some time and begins to rise.

Over the last 24 hours, the top 100 Dogecoin holders have increased their portfolios, as WhaleStats reports a 987.76% rise in the average DOGE balance of this category of investor. The average DOGE value of their portfolio has also grown by 929.33%.

Dogecoin’s profitability, according to data from IntoTheBlock, remains at 53%. More in-the-money addresses should benefit the network as holders are less inclined to sell to break even their positions.