Ethereum’s rollups were pitched as airlines and super highways to make transactions faster within the ecosystem and solve congestion problems. However, reality hasn’t quite panned out the way many rollup enthusiasts predicted it would.

I want to talk to your manager!

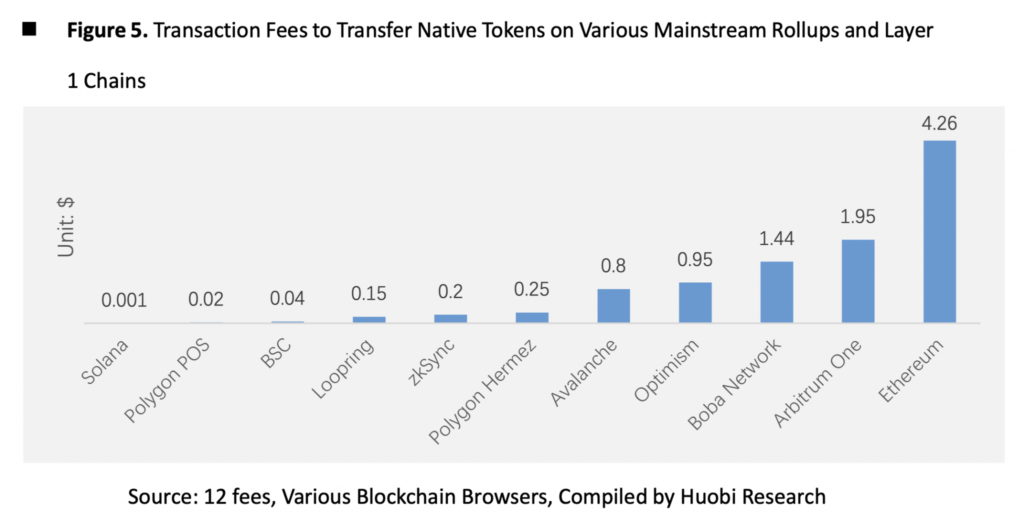

A Huobi Research report by Barry Jiang looked at some issues with rollups that could be the root of their slow adoption rate and relatively low total value locked. [TVL] to share. One of the main factors, he found, is an unsatisfactory user experience. For example, less-than-ideal transaction fees and the long time it takes to make withdrawals likely make users anxious when dealing with volatile assets.

Furthermore, Jiang also cited security risks and a lack of interoperability between rollups.

The report went on to state,

“According to a rough estimate of addresses published publicly from several Rollup blockchain browsers, there are 1 million Rollup addresses, compared to 185 million addresses on Ethereum (less than 1%).”

It’s also worth noting that other blockchains seem to offer cheaper options.

Discount not applicable?

Some solutions proposed by Huobi Research’s report included improving the overall user experience to increase rollup adoption. He proposed increasing the speed of bridges while reducing fees and making the system more decentralized for security reasons. However, the report also offered a dAMM, or fake L2 exchange to facilitate the transaction process.

Huobi Research added,

“Various projects, including Arbitrum, Optimism, Metis, and StarkEX, etc., have proposed a working target on decentralization in their roadmaps or white papers. Sieged by all kinds of Layer 1 chains, Rollup has no excuse to not approach decentralization.”

Also, more bridges and links between stacks could improve interoperability. This in turn could make the user experience more enjoyable.

“Additionally, cross-chain bridges could cement interoperability between Rollups. The greater the flow of capital volume on Rollup, the wider the bridges between Rollups and the smoother the transaction for assets to cross the chain.

On the other hand, Ethereum’s falling gas fees need to be considered. The sudden drop in prices could further harm the adoption of rollups if a significant number of users decides to return to the mainnet, driving up fees again.

Here is the comment box

While cumulative TVL has recovered significantly from the low of the late January 2022 crash, total TVL is still far from its highs of $6.8 billion at the start of 2022.

Additionally, Arbitrum, with a TVL of $2.86 billion, has fallen by 4.58% over the last seven days.