Shortly after dipping below $41,000, bitcoin went on the offensive once again and briefly exceeded $43,000. The altcoins are also in the green today, with ADA nearing $1 and Ethereum touching $3,000.

Bitcoin’s 20-day high

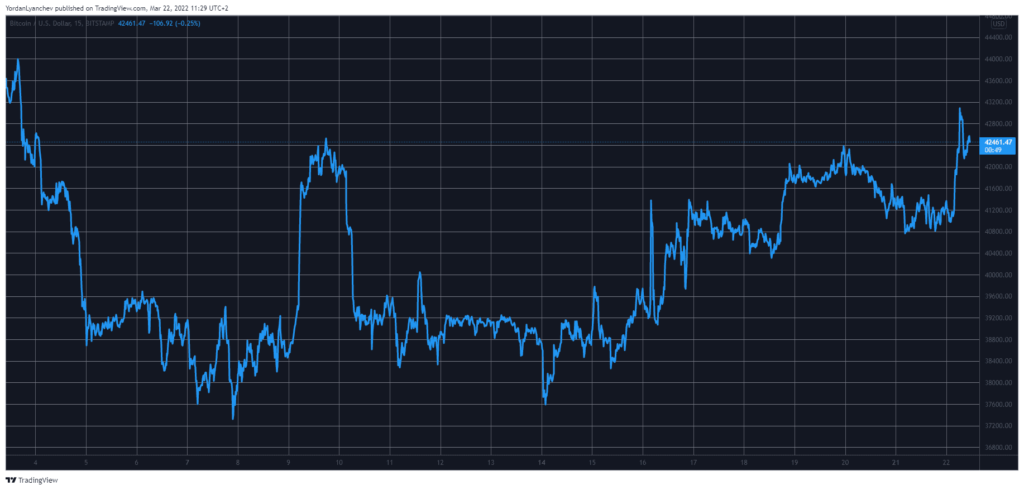

CryptoPotato yesterday reported bitcoin’s brief retracement that took the asset from $42,500 to below $41,000. This came after several relatively positive trading days in which the cryptocurrency recovered $40,000 after a week, sitting below that coveted level.

However, this price dip was somewhat short-lived. The BTC bulls regained control over the market and pushed it north again. This time, the primary digital asset added more than $2,000 in hours and spiked to over $43,000.

As such, BTC painted its highest price since March 3. Right now, bitcoin has lost ground and is around $42,500.

Nevertheless, its market capitalization has reclaimed the coveted $800 billion mark, and its dominance over the alternative coins has gone to 42%.

Alts in green: ETH at $3,000

Alternative coins have largely mimicked BTC’s performance lately, and most have turned green today.

Ethereum is among the prime examples. The second-largest crypto tried its hand at $3,000 a few times in the past few days but to no avail. Yesterday’s market correction pushed ETH south to just over $2,800. Since then, though, the situation changed, and the asset jumped to $3,000, where it’s situated now as well.

Binance Coin is up over 3% in one day and is trading above $400. Ripple, Solana, Polkadot, Dogecoin and Shiba Inu all posted similar gains.

Ethereum Classic is once again among the best performers, with a notable 14% surge to $44. Bitcoin Cash, Algorand, and EGLD are also well in the green.

The cumulative market capitalization of all crypto assets rose by $60 billion in one day and recovered to the $1.9 trillion level.