Large Ethereum volume being removed from exchanges despite positive price performance

Ethereum traders and investors moved a massive volume of Ethereum from various centralized exchanges, according to Glassnode data.

The large inflows over the past 24 hours fall under the general trend of outflows fueled by the growing popularity of DeFi applications. In addition to the DeFi industry’s resurgence in popularity, Ethereum staking is facing massive inflows of funds, with more ETH locked up in staking contracts every day.

DeFi on the rise

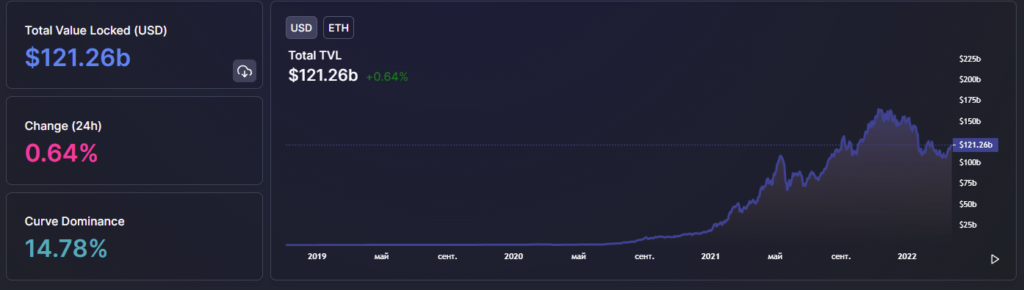

According to DeFi apps and blockchain tracker DeFiLIama, the total value of funds locked on the Ethereum network increased from approximately $107 billion to $121 billion in the last 10 days.

Alternative networks like Cardano and Solana are also facing a massive increase in DeFi solutions. Cardano’s TVL hit a new all-time high after another major project was released on the Minswap channel. The network’s TVL currently stands at $310 million.

Since Ethereum holds the largest number of DeFi apps on its network, traders and investors may choose them over traditional holding or active trading on centralized exchanges. One of the most popular solutions that traders and investors usually use is the liquidity providing service that DeFi platforms offer.

Ethereum staking attracts more investors

Ethereum 2.0 staking contracts that have already earned over 10 million ETH in total value continue to grow as more Ethereum investors and traders choose stable 12% APY options over hold their funds in the stock market.

In addition to the increased popularity of the staking option, cryptocurrency enthusiasts have become more cautious about holding digital funds on centralized exchanges as they may block or seize users’ assets in order to comply with the laws of the countries they function in.