After years of doubts and concerns, is it finally Ethereum‘s time to shine? On-chain metrics indeed point in this direction. Although, it might be too early to say anything promising.

holding on to you

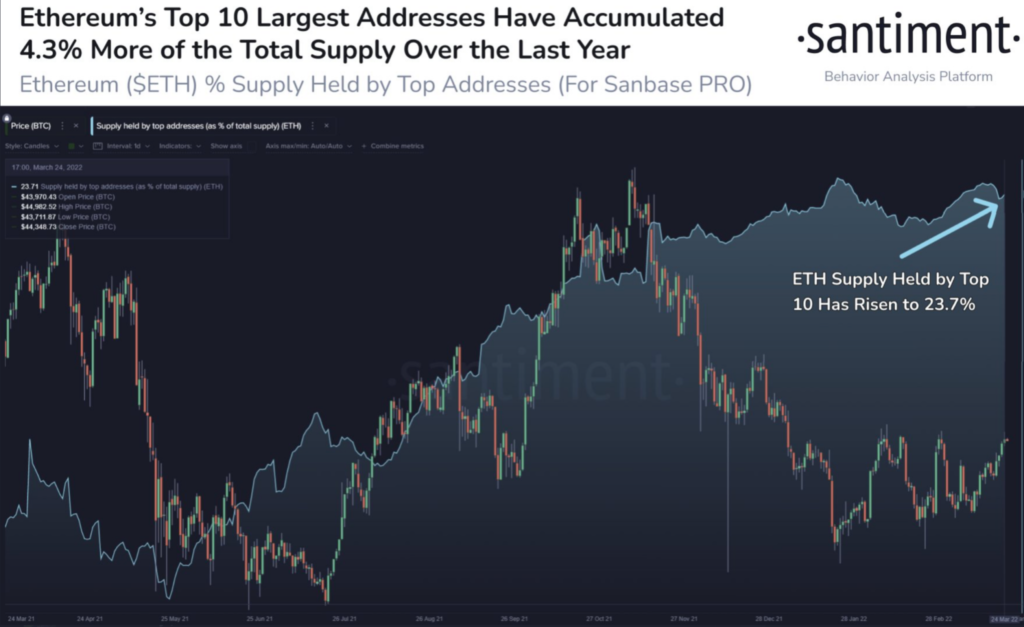

Despite the volatility, ETH investors continued to accumulate, according to data provided by Santiment. In fact, at the time of writing, the top 10 whale addresses held 4.3% more of the total supply than a year ago. Moreover, according to the data, the 23.7% of all $ETH held by these portfolios remain very close to the 5-year highs they first broke through at the end of January.

This indicates that major Ethereum addresses are still accumulating ETH in the market despite the cryptocurrency’s subdued performance.

Besides the increase in the number of long-term investors, there are important developments – the ETH/BTC chart below presented a bullish scenario. In fact, Ethereum has started to gain traction, emerging from the long-term period of BTC dominance that began in November 2021.

The turnaround in Ether price over the past couple of weeks was succinctly addressed by crypto analyst Justin Bennett, who posted the following chart highlighting the trend reversal.

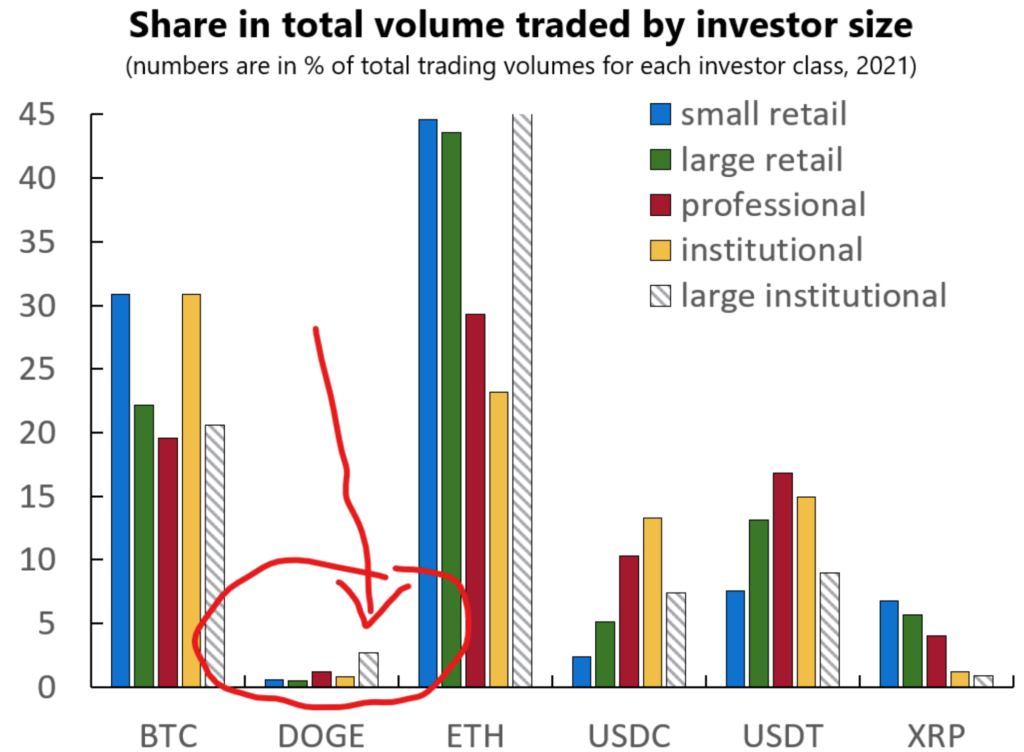

The aforementioned development was complemented by a tweet that shed light on Ethereum surge adoption. Compared to other “trendy meme-coins”, the altcoin king remains popular among top investors.

A crypto enthusiast, Tasha Che, in a 25 March tweet asserted: “In case you think meme coins are a “grass-root movement”. It turns out largest investors are the biggest traders of Doge. BTC and ETH are the real retail tokens.”

Additionally, further analysis of the effects of the upcoming merger for Ethereum would have a huge impact on its price. Analysts at independent macro and crypto research house MacroHive noted that the merger “will have bullish implications for Ether.”

According to MacroHive, “the prospect of being able to make a passive return on staked Ether will attract more investors into the space,” while the transition to proof-of-stake “will reduce Ethereum’s energy consumption by 99.95%.”

try to move on

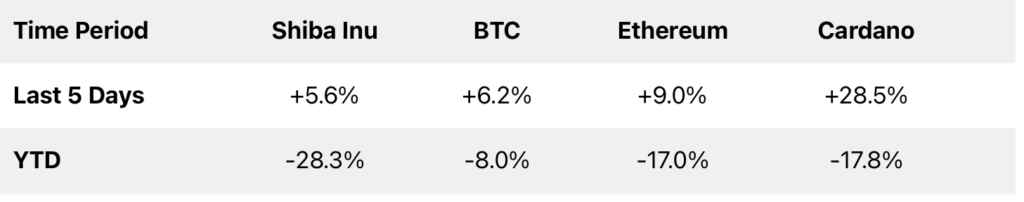

Ethereum’s performance in 2022 was out of sync with the market. The crypto market remained vulnerable as it corrected several times this year. As mentioned below, ETH is down nearly 17% in value since January 2022.

Nonetheless, at press time, ETH crossed the $3k mark and was trading at the $3.1k mark with a 1% surge in the past 24 hours.