If you’re struggling to decide between choosing Solana or Ethereum to mint your Non-Fungible Tokens (NFTs), you have come to the right place. In this guide, we’ll explore each blockchains’ strengths, capacities, weak points, and overall differences so you can make a better decision that suits your goals in the NFT market.

Ethereum: ecosystem, marketplace and security

There’s no doubt that Ethereum is the largest ecosystem in the DeFi (decentralized finance) sector, with thousands of projects of all kinds building on it – so it’s no surprise that the vast majority of NFTs run on it, like ERC-721 tokens.

To be accurate, roughly 95% of all the NFT ecosystem uses Ethereum, so it’s no coincidence that when investors look for an NFT marketplace, the first one they usually run up to is OpenSea, Rarible, Nifty Gateway, and more.

When it comes to size, Ethereum takes the lead with a much larger pool of buyers and sellers – or in other words, trading volume. So if you make NFTs on an Ethereum-based marketplace like OpenSea, you might get more exposure and people willing to buy or bid on your NFTs. On the other hand, everyone knows that there is also a huge supply of NFTs that no one would ever want to buy or bid on.

Ethereum’s attributes place it as one of the top ecosystems to start a DeFi project. Its data architecture and security components are the reason why so many developers are building on top of its blockchain.

However, when network activity increases exponentially (which is something common), the network suffers from a large backlog of transactions, which leads to a huge increase in transaction fees that usually exceed the figures per transaction , which could affect how many users can afford to mint NFTs.

This has prompted NFT creators and collectors to seek alternative blockchains with higher throughput, scalability, and lower gas fees. One option that has become a very serious competitor is Solana —a high-performance blockchain that leverages different cryptographic mechanisms to scale its network (we’ll discuss this later.)

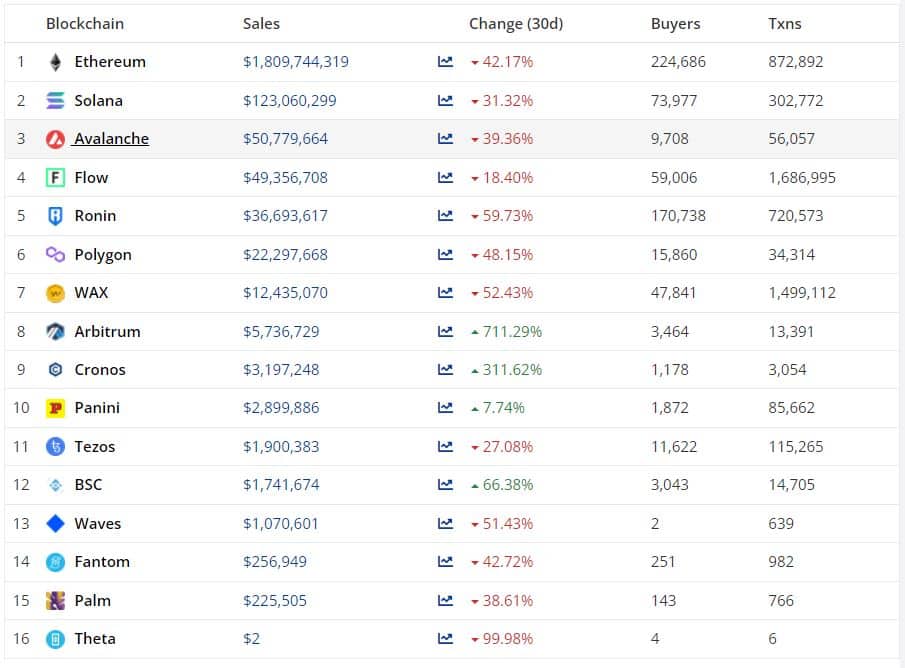

While paying high gas fees can sometimes be a crippling experience, the upside is that there is more money flowing into Ethereum, so the rollover cap is much higher. Data from CryptoSlam shows that Ethereum saw a massive sale volume of over $1.8 billion in the past 30 days, compared to $120 million on Solana-based exchanges.

As per current data from CryptoSlam, we can see that the most popular NFT collections in the market exist in the Ethereum blockchain. These include CryptoPunks, the Bored Ape Yacht Club (BAYC), the Mutant Ape Yacht Club (MAYC), and so forth.

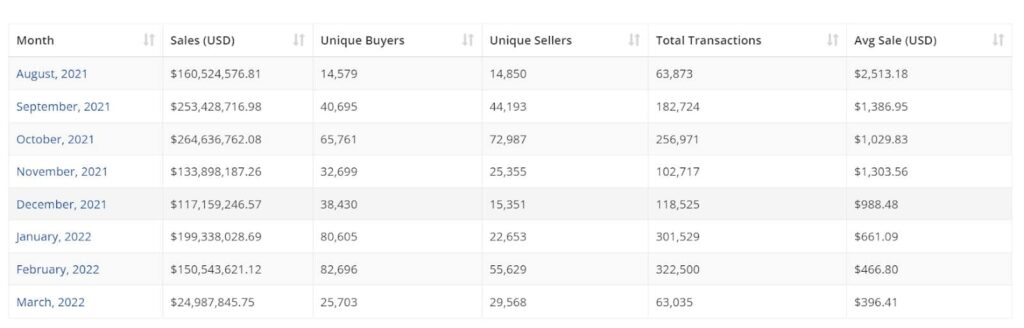

Additional data shows that the average sale price of NFT to Ethereum (as of Q4 2021) was around $3,000 compared to Solana’s $1,000.

Solana: Throughput, Low Fees, Growing Ecosystem

In terms of technology, functionality, and versatility, Solana takes the lead here.

Solana is a high-performance blockchain that uses a consensus mechanism called Proof-of-History, which leverages a set of protocols to execute high-speed transactions – over 60,000 transactions per second (TPS).

In Solana, transaction costs are usually less than a dollar. Many NFT projects and collectors are migrating to Solana to benefit from the scalability and cheap transaction fees. They have more freedom to build their projects without suffering from technical limitations, a reason why Solana is turning into a hub for general NFTs.

Hitting NFTs with a Solana-based market like Solsea is remarkably cheap, quick, and easy to pull off once it hits the secondary market. Usually, Solana mints are bought up quickly, and royalties on Solana-based marketplaces are also often higher than Ethereum-based ones.

While Solana’s ecosystem isn’t near as big as Ethereum’s, it doesn’t mean it isn’t growing. In fact, Solana’s user base has been growing at a much faster pace since the beginning of 2022, and even analysts from investment bank JP Morgan have claimed that it could overtake Ethereum in the long run.

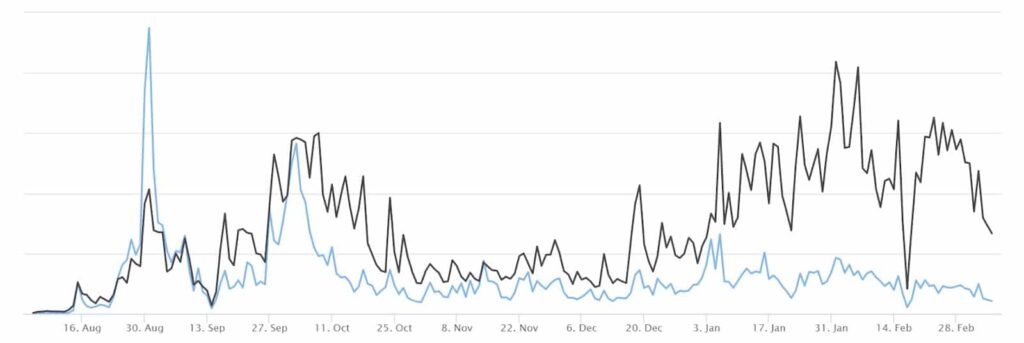

The NFT market in Solana gained a lot of momentum throughout the third quarter of 2022, according to data from CryptoSlam. At the end of January, the sales volume in the ecosystem crossed the $1 billion mark.

One of the most popular collections on the Solana blockchain is the Degenerate Ape Academy, a collection of 10,000 unique NFT Apes.

Although they may resemble Ethereum’s Bored Apes, they have their own set of unique traits.

They can be pretty expensive, too – the highest sale for a Degen Ape was of $1.1 million in September 2021. However, in mid-December, an NFT from the Solana Monkey Business collection was sold for over 13,000 SOL, or about $2 million.

Growing ecosystems are often a great opportunity for early adopters to establish themselves at the top of the list as they reach a wider audience. However, one of their problems is that the risk is usually higher. Since the beginning of 2022, the Solana network has suffered several downtimes, forcing users to liquidate their positions as they were unable to top up their collateral during the outages.

Another concern that has been addressed lately by developers is the rise of rugpulls in Solana. This is usually the problem with emerging technologies, as scammers will try spot and take advantage of any weak points they can find. However, rug pulls and scams can happen on both sides of the story, so it’s not only about security issues but rather making sure you make good research before investing in an NFT or any DeFi projects.

Rugpulls are the most common type of scam in the DeFi ecosystem. If you want to learn how to spot them, check out our latest guide on the subject.

Closing Thoughts

Each blockchain has its own pros and cons, so it really comes down to what you want to do with each one. If you’re looking for a high-throughput blockchain with scalability and low gas fees, then Solana might be more suitable for you.

Solana

Benefits:

- Higher throughput and scalability.

- Growing ecosystem.

- Low fuel costs and environmentally friendly.

- Minting NFTs is cheap and relatively simple.

The inconvenients:

- Less secure network.

- Lower exposure with a smaller market.

- Stops are more frequent.

Now, if you want to expose yourself to a bigger market and benefit from the security aspects, then you might be better off with Ethereum.

Ethereum

Pros:

- Access to a larger market.

- High network security.

- NFTs are sold for a much higher price on average.

Cons:

- Network congestion can cause transaction delays.

- Lower throughput and scalability.

- Transaction fees can become unpayable for a good percentage of users who want to mint NFTs.