Report highlights RippleNet, a network of institutional payment providers

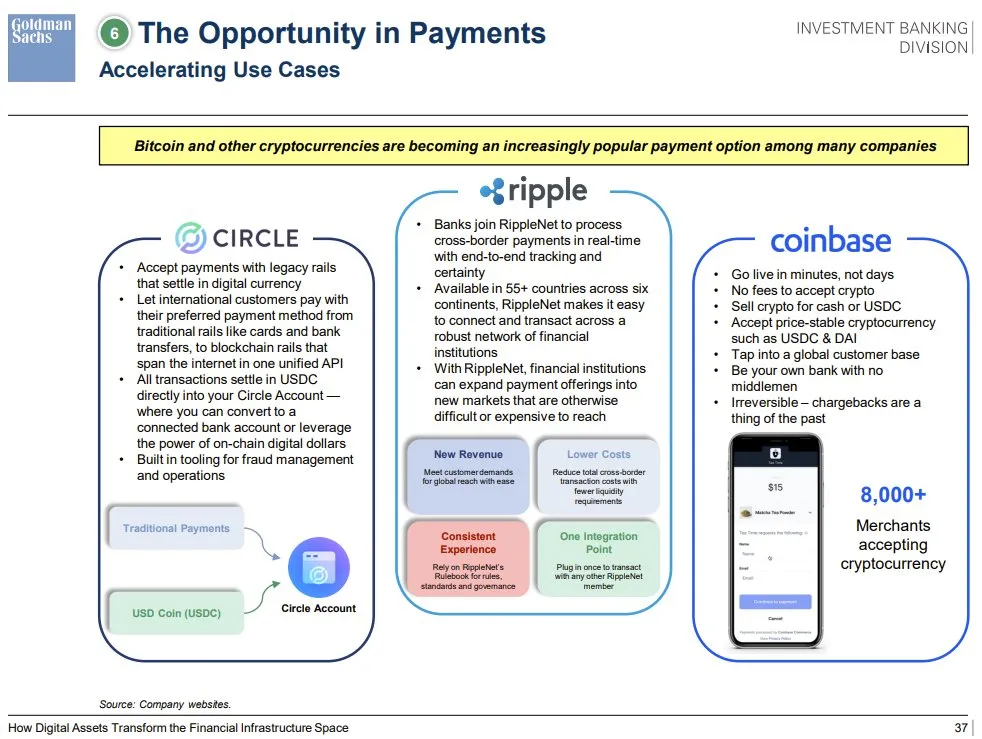

A recent report by Goldman Sachs’ Investment Banking division, “Digital Assets and Blockchain Overview,” identifies Ripple as a “payments opportunity,” alongside Circle, a peer-to-peer payments technology, and Coinbase. The report strong points RippleNet, a network of institutional payment providers like banks and money transfer services that use solutions designed by Ripple.

As crypto’s presence in the consumer mainstream grows more conspicuous, the financial industry continues its march toward crypto. Previously, Warren Buffett, a well-known crypto critic, invested $1 billion in Nubank, a Brazilian digital bank specializing in cryptocurrency. Binance also announced plans for a new payment processor that will allow customers to use digital assets to make retail purchases.

Ads from crypto companies such as Coinbase and FTX can now be spotted everywhere on sports venues, and earlier this year the industry staged a virtual Super Bowl takeover.

As previously reported by U.Today, legendary footballer David Beckham has entered the Metaverse as a blockchain ambassador. One thread runs through it all: growing consumer interest in cryptocurrency.

A growing shift towards blockchain-based payments

A recent Ripple Insight report notes that “a survey by Cornerstone Advisors found that among consumers who already hold crypto, 60% would “definitely” use their bank to invest in cryptocurrencies. Additionally, a report from PYMNTS.com revealed that 78% of millennials and 82% of Gen Z crypto owners want to use it to make contactless purchases. ”

Countries in Asia and the Pacific have risen to the top of the world in offering instant payments using digital banking systems. APAC has risen to dominate the digital banking business in recent years, accounting for 20% of the world’s approximately 250 digital banks.

Instant Payments are digital transactions between participating banks that use a messaging/instant payment layer to enable real-time settlements and great end-user experiences. To make a transfer in real time, several non-encrypted instant payment networks require pre-funding beneficiary accounts. Ripple’s On-Demand Liquidity (ODL), on the other hand, eliminates the need for pre-funding.