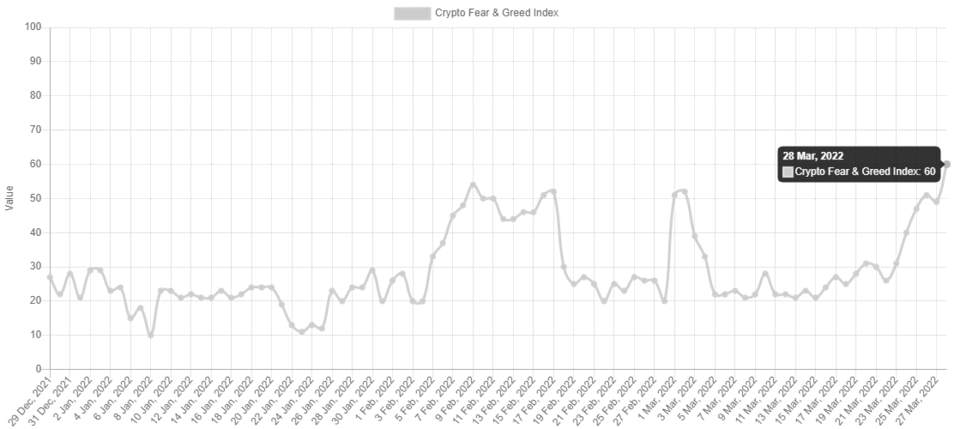

With Bitcoin finally breaking above the $45,000 resistance level that held it down for months, the market is finally reflecting overall optimism. The Crypto Fear & Greed Index has now reached 60 – the highest reported number since Bitcoin’s all-time high in November.

Back in bullish territory

The Crypto Fear and Greed Index is an overall measure of crypto market sentiment as measured by Alternative.me – a software login platform. Its basket of indicators includes Bitcoin price volatility, market dynamics, trading volume, Twitter interactions, surveys (currently on hiatus), Bitcoin dominance, and Google search trends.

The index is measured on a scale of 0 (extreme fear) to 100 (extreme greed) with 50 being neutral. The figure has remained well below 60 until today, with only occasional spikes above 50 in both February and March within the last 4 months.

The bullish push follows similar behavior with the price of Bitcoin, which eventually rallied back to $47,000 for the first time since Jan. 3.

Following the pump, price analysts are backing up the market’s newfound enthusiasm. Will Clemente – Lead Insights analyst at Blockware – noted that price has surpassed the short-term holder cost basis (the average price at which coins were bought in the last 155 days) for the first time since December 3rd. “It’s hard to bearish as long as BTC is above,” he adds.

Fellow analyst Willy Woo thinks the same. He complaints that the “fundamental buying pressure” for Bitcoin has returned to bull market territory, as evidenced by on-chain holder flows, on-chain exchange flows, long-term futures, and perpetual trades at short term.

All Thanks to Terra?

In fact, a popular altcoin network may have something to do with it. Terra – a decentralized finance blockchain for stablecoins – recently decided to shift the collateral backing TerraUSD into Bitcoin, rather than LUNA.

As such, the team has been buying thousands of Bitcoins daily to put into its reserves, reducing the available supply on exchanges, which usually drives prices higher.

Terra now owns about $1 billion in Bitcoin, but plans to purchase $9 billion worth of the asset. Should it follow through on the plan, this would make Terra a larger holder of Bitcoin than MicroStrategy.