The Indian government has revealed that 11 cryptocurrency exchanges have been under investigation by the country’s tax authority. About 95.86 crore rupees ($12.6 million) have been recovered from them.

11 Crypto Exchanges Investigated for Tax Evasion

The Indian government answered a few questions regarding the taxation of cryptocurrency exchanges on Monday in Lok Sabha, the lower house of parliament.

Parliament member S. Ramalingam asked the finance minister “whether it is true that some cryptocurrency exchanges were involved in evasion of goods and services tax (GST) and it was also detected that other cryptocurrency exchanges and major investors in digital currencies are under investigation by the government.”

Furthermore, the MP questioned the Minister of Finance on “the measures taken or proposed by the government against cryptocurrency exchanges which have been detected in the GST evasion”.

The minister of state in the ministry of finance, Pankaj Chaudhary, replied:

Few instances of Goods and Services Tax (GST) evasion by cryptocurrency exchanges have been detected by central GST formations.

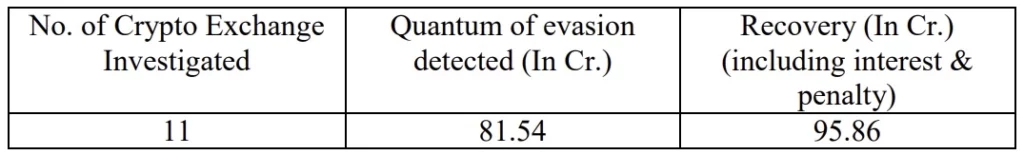

He revealed that 11 cryptocurrency exchanges were investigated and tax evasion in the amount of 81.54 crore rupees were detected. The tax authority has recovered 95.86 crore rupees, including interest and penalty.

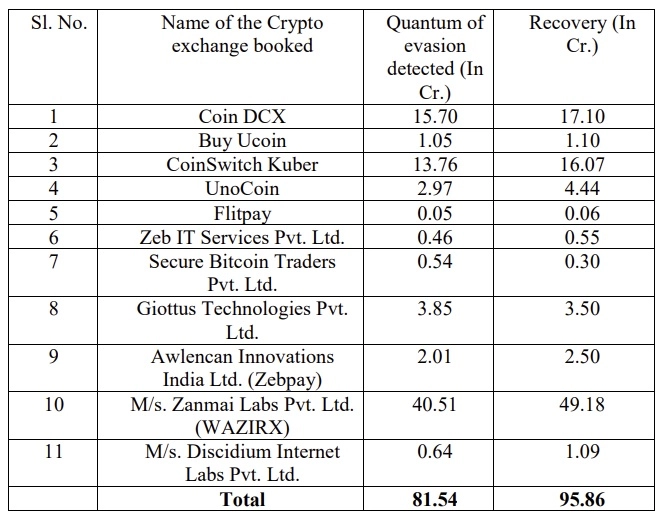

The minister of state provided a list of the 11 exchanges investigated: Coindcx, Buyucoin, Coinswitch Kuber, Unocoin, Flitpay, Zeb IT Services (Zebpay), Secure Bitcoin Traders, Giottus Technologies, Awlencan Innovations India, Wazirx, and Discidium Internet Labs. The exchanges with the most evasion detected were Wazirx, Coindcx, and Coinswitch Kuber, according to the list.

Ramalingam, a member of Lok Sabha, also asked the finance minister “if the government has any data regarding the number of cryptocurrency exchanges currently involved in cryptocurrency exchange activities in the country.”

Minister Chaudhary replied:

The government does not collect any data on cryptocurrency exchanges.

Meanwhile, Indian Finance Minister Nirmala Sitharaman has proposed taxing crypto income at 30% and imposing a 1% withholding tax (TDS) on every crypto transaction. A member of parliament recently urged the government to reconsider imposing the 1% TDS, pointing out that it would kill the crypto asset class.