The price of Terra has reached yet another record peak after Luna Foundation Guard (LFG) made a series of a major Bitcoin purchases

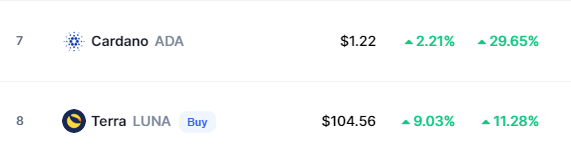

The price of Earth (LUNA) hit another all-time high of $105.91 earlier today on the Binance exchange. The cryptocurrency has jumped over 10% in the past 24 hours. It remains in eighth place by market capitalization (just behind Cardano).

Singapore-based Luna Foundation Guard (LFG) purchased $135 million worth of Bitcoin on Monday, according to a report recently published by Bloomberg.

It has been confirmed that the address associated with the foundation currently holds approximately $1.32 billion worth of Bitcoin.

Rumors about Terra buying Bitcoin as a reserve asset started circulating last week. Eagle-eyed on-chain analysts started noticing purchases associated with the non-profit, but there was no official confirmation.

Speculation around the size of buys is pushing the price of the biggest cryptocurrency higher, proving to be one of the main bullish catalysts. Consequently, many began to speculate that only Terra carried the ongoing rally on her shoulders.

As reported by U.Today, the Bitcoin price recently topped the $48,000 level for the first time in months.

On February 22, Do Kwon, Founder and CEO of Terraform Labs, announced plans to increase the size of Bitcoin’s reserves to $10 billion. However, the technical infrastructure is not yet there to make it happen.

Kwon claims that Bitcoin has already proven itself, which is why it is difficult for someone within the cryptocurrency industry to question it. UST has become the first cryptocurrency to adopt the Bitcoin standard.

LFG decided to create a bitcoin-denominated reserve in early February to support the value of the UST stablecoin by keeping the cryptocurrency’s dollar peg intact.