The nonprofit organization focused on the Terra ecosystem Luna Foundation Guard (LFG) now holds almost 28,000 bitcoin, which translates to $1.3 billion out of its $10 billion total target aimed to back TerraUSD (UST).

Why Terra Is Buying BTC

“The reason we are particularly interested in Bitcoin is that we believe that [it] is the strongest digital reserve asset,” Terra Founder Do Kwon told Bloomberg and added that “UST will be the first internet-native currency to implement the Bitcoin standard as part of of its monetary policy.

The algorithmic stablecoin UST is Terra network’s most popular native token because of the several benefits it provides through its minting mechanism.

Two weeks ago, Do Kwon announced that it had opted to build BTC reserves to support UST. This prevents the stablecoin from crashing for not having enough collateral. The accumulation process began on Monday and moved quickly.

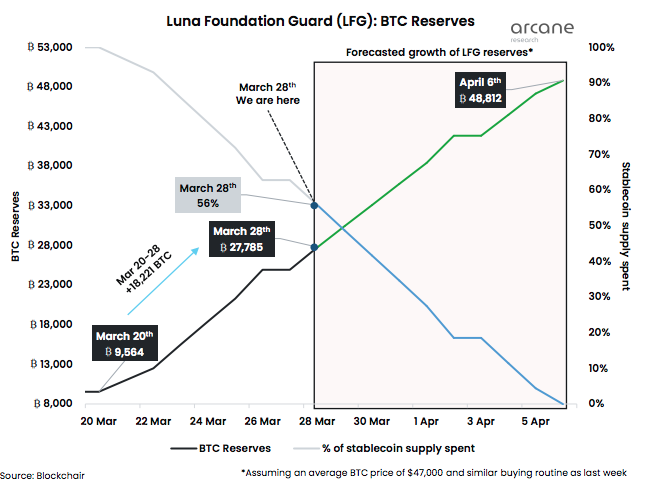

Data from the latest Arcane Research weekly report shows that “Luna Foundation Guard has now built BTC reserves of 27,785 BTC after adding 18,221 BTC over the last week.” The organization has used the funds raised from burning Luna to mint TerraUSD (UST) to make the purchases.

The news has garnered a lot of attention and excitement as Bitcoin proponents see it as a sign that the coin will become the new digital global reserve currency as many other protocols may start to do the same. The accumulation not only propelled Terra’s LUNA higher, but is likely behind the recent uptrend in the crypto market and Bitcoin’s yearly high.

“This massive BTC accumulation is likely contributing to lifting the market and should be monitored closely once it nears its end. Pay attention to the ETH address and BTC reserve address,” notes Arcane Research.

LUNA reacted on the upside by testing an ATH at $106.15 and breaking above it. Additionally, Terra’s Total Locked Value (TVL) increased from $26 billion to an all-time high of $28.7 billion, making Terra TVL’s second-largest DeFi protocol.

Luna’s BTC Reserves Day By Day

LFG’s confirmed address shows how their balance changed from the 9,564 BTC previously held by the organization since late January to the latest 27,785 BTC.

Trading company Jump Trading LLC was tasked with executing the BTC transactions. Luna Foundation Guard began sending the company $125 million worth of USDT each weekday and $160 million last Saturday. The persistent accumulation drove the price of BTC higher and the organization would have to buy many more to reach an initial target of $3 billion and $10 billion in the future.

As per the report, in the last eight days, LFG has already deployed 44% of the original stablecoin reserves on their wallet destined to buy bitcoin for its reserves. This leaves current holdings of $988 million worth of stablecoins, and data points out that around $800 million more could be raised by converting UST to USDT.

Illustrated in the chart below, Arcane estimates that if the buying spree continues at similar rates and the $800 million is not converted, the organization will finish building up its bitcoin reserves by the 6th. April.

“Assuming a stable BTC price of $47,000 until April 6th, LFG will have 48,800 BTC in its reserve once finished,” the report adds. But if LFG were to use those $800 million of UST reserves as well to buy BTC, then Arcane forecasts the purchases to end around April 14th, with a reserve of roughly 65,000 BTC (buying the coin at $47k).

Analysts are watching these moves closely as a bullish trend could materialize if BTC crosses the $48,000 level. If these purchases in fact drive the price of BTC higher, the pursuit could turn into a future uptrend of the entire crypto market.