Cardano has been an integral part of the blockchain technology space since its launch in 2017 by Charles Hoskinson. It’s one of the most promising protocols that continues to reach new milestones. Although the project lacked use cases in the first four years, 2022 saw Cardano reach new milestones.

This comes after the completion of the Alonzo Hard Fork upgrade in September 2021.

Bring it on

Crypto intelligence firm IntoTheBlock reported that the number of large transactions on the Cardano blockchain hiked by more than 50x this year. The volume of on-chain transactions >$100k, i.e. large transaction volume (LTV) increased from 1.35 billion ADA per day to 69 billion ADA (worth $81.4 billion) on 28 March.

In a March 29 tweet, the company said such a high volume indicated “increased institutional demand”.

In fact, the total value locked in Cardano’s DeFi protocols stood at $300.56 million as per DefiLlama. While only seven DApps appear on DefiLlama currently, co-founder Charles Hoskinson said many more were expected following due to a hard fork expected later this year.

Two protocols (MiniSwap and MuesliSwap) have stood out in recent days towards the end of March.

Santiment picked up on similar network activity. The behavioral analytics platform recorded a 1.7% increase in the number of whales on the Cardano network.

About 42 new addresses contain 1,000,000 to 10,000,000 ADA created as a result of this increase. These whales holding between $1.2 and $12 million in ADA, the sudden spike in buying pressure could translate in millions of dollars.

Any problems?

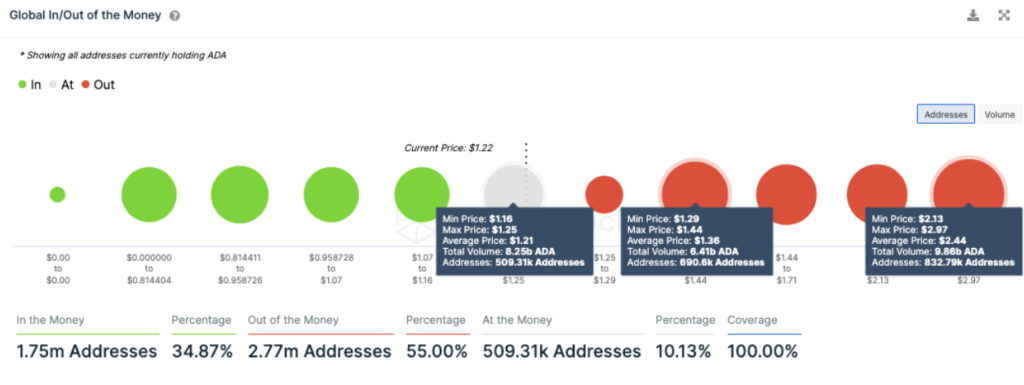

Well, with every milestone, there are some setbacks that the protocol did suffer in the past and even now. Firstly, only 34% of addresses are ‘in the money’ while 55% are ‘out of the money’.

In fact, Cardano’s native token, ADA, suffered another 1.5% correction in 24 hours. At press time, it was trading below $1.2 according to CoinMarketCap.

Despite the growth of Cardano this year, the network’s TVL still pales in comparison to that of its layer-1 competitors in DeFi such as Ethereum and Solana.