JP Morgan CEO Jamie Dimon prepared an annual letter to investors this week, warning of major risks to traditional banking.

In his 2022 letter to JP Morgan investors, Jamie Dimon warned of a confluence of risks for JPM shareholders that creates an “unprecedented” threat to corporate earnings.

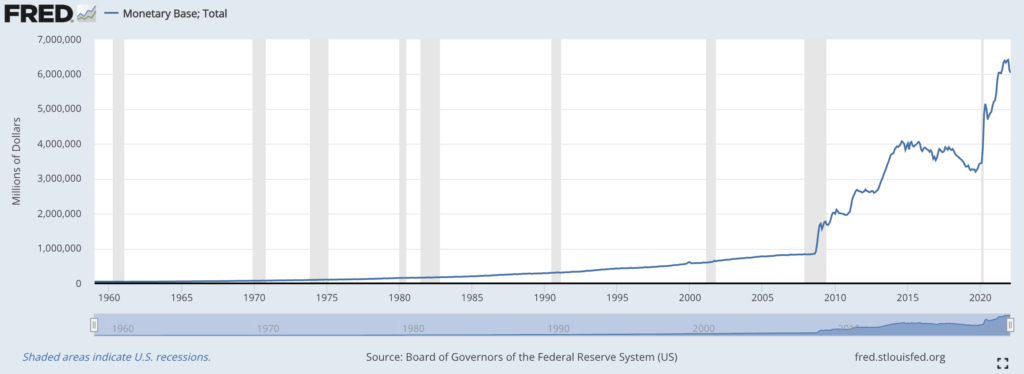

These include the Russian invasion of Ukraine and soaring inflation across the board after the central banks and legislators created more new fiat money over the last two years amid the coronavirus pandemic than the Fed’s QE program in the aftermath of the 2008 global financial crisis.

Jamie Dimon’s 2022 Note to JPM Investors

In his letter to shareholders, Jamie Dimon reported that with a fairly static view of the war in Ukraine, JP Morgan economists cut European GDP projections for 2022 by more than half after the Russian military went through the frontier.

But there were massive capital inflows during March to Bitcoin (BTC), Ethereum (ETH), and some burgeoning altcoins. Crypto investors piled up coins even as the war in Ukraine ramped up, and the Fed hiked interest rates by 0.25% to contain drastic inflation. UBS is forecasting a USD price inflation print for March that will stagger financial markets— a shocking 8.5% rate of inflation.

The gains made by these coins in March during a confluence of factors that Jamie Dimon calls “unprecedented” in their danger to traditional banks like his prove once again the enduring value of crypto as a macro hedge. global strategy and resilient industry growth in the face of these global financial threats.

Calling Out Fintech

Jamie Dimon specifically called out fintech’s competition from “neobanks,” “shadow banks,” and “digital upstarts” as a threat to JP Morgan’s profits in his letter.

In a quote that could have been written by the most zealous bitcoin maximalist, or anti-central bank cryptopunk, Dimon wrote:

“The growing competition to banks from each other, shadow banks, FinTechs and large technology companies is intensifying and clearly contributing to the diminishing role of banks and public companies in the United States and the global financial system.”

(This might remind some in the crypto community of a recent tweet by Twitter and Block founder Jack Dorsey exposing the role of corporations in centralizing the internet we use today).

Loathe to credit Bitcoin or cryptocurrency, the JP Morgan CEO did not use the terms crypto or blockchain. But interestingly enough, for the cryptocurrency business, he made a surprisingly candid statement acknowledging that the importance of corporations in the global financial system is now on the wane.

He even said he wondered why “so many companies and so much capital is taken out” of corporate capital.

The admission of a threat from emerging fintech and the wane of corporate growth in this era seems to run completely counter to Jamie Dimon’s inveterate skepticism of cryptocurrency. Those factors together have been one of the major theses of crypto bulls since the Bitcoin whitepaper.