Ethereum price has breached above the symmetrical triangle and is comfortably hovering above a stable support area with no signs of weakness. Despite the recent flash crash, the downside risk for ETH also seems to be capped due to a plethora of footholds. So, investors should not give up the smart contract token hitting significant psychological levels.

On-chain metrics reveal optimism?

Ethereum’s price crashed around 12% as Bitcoin turned around on March 6. This sudden downtrend also caused many altcoins to flee south. However, for ETH, on-chain metrics favor a bullish outlook.

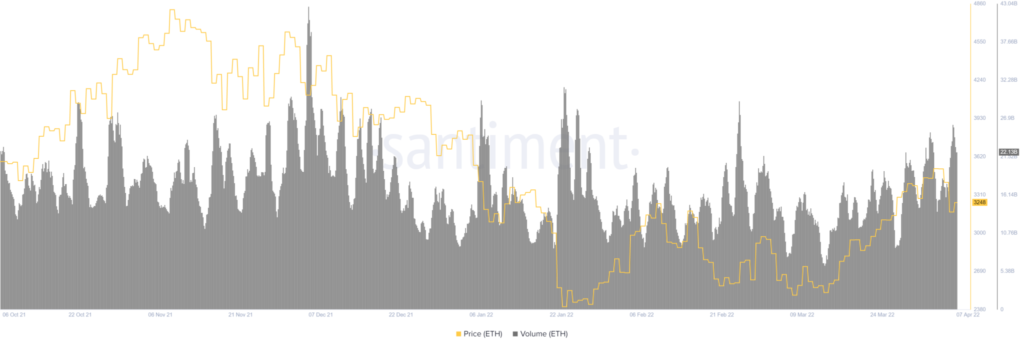

The most bullish index for the short-term outlook is the on-chain volume and its recent uptrend. This metric has been producing higher highs since 16 March and has risen from 17.19 billion to 24.25 billion on 7 April.

Despite the recent drop in Ethereum’s price, the volume seems to be increasing. Thus, indicating that market participants might buy the dips.

The supply of ETH on exchanges seems to be declining steadily despite a minor uptick in February. Currently, the number of ETH held on centralized entities has hit 15.08 million, denoting a 6.1% decline or an outflow of nearly one million since 1 March.

This decline indicates that investors are increasingly confident in Ethereum and expect a bullish price performance in the near future.

While the on-chain volume and supply on exchanges indicate that the investors are bullish, the 30-day Market Value to Realized Value (MVRV) mode reveals that a sell-off is less likely. This indicator is used to assess the average profit/loss of investors that purchased ETH tokens over the past month.

A value below -10% indicates that short-term holders are selling at a loss and this is usually where long-term holders jump to accumulate since the risk of a massive flash crash is close to zero. Therefore, a value below -10% is often referred to as an “opportunity zone”, because the risk of selling is lower.

Although the 30-day MVRV reached 16% on 29 March, it has since dropped to near-zero. Thereby, indicating that short-term holders have been booking profits.

Therefore, these three on-chain metrics suggest that a bullish regime awaits the price of Ethereum and the sell-off could be done at the moment.