Bitcoin price could be on track to see a major drop to $26,000

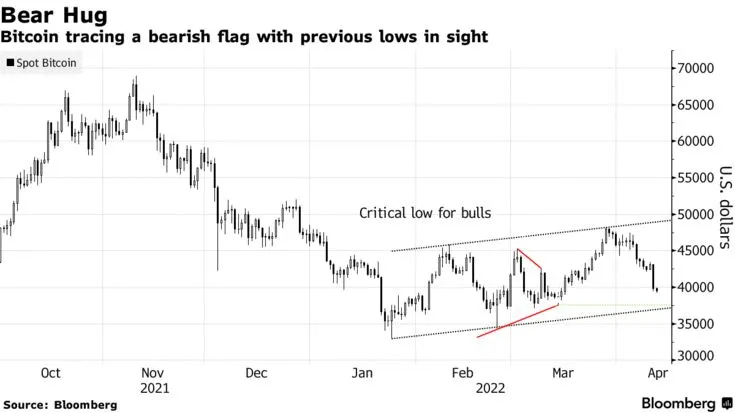

Bitcoin price could drop as low as $26,000 if a technical “bearish flag” pattern occurs, according to a recent Bloomberg Report.

The largest cryptocurrency has had a rough start to the week, plunging below the $40,000 level for the first time since mid-May on Monday.

According to a Coinglass report, approximately $439 million worth of cryptocurrencies have been liquidated in the past 24 hours, with long positions accounting for 88.03% of the wipeout. Bitcoin futures traders parted with $160.19 million.

The Federal Reserve’s hawkish U-turn has reignited the dollar rally while simultaneously exerting pressure on risk assets of the likes of Bitcoin. The U.S. dollar index (DYX), which measures the strength of the greenback relative to a basket of foreign currencies, recently spiked above 100, hitting a fresh two-year peak. The U.S. stock market also closed in the red on Monday, with the benchmark Dow Jones Industrial Average index falling 1.89%.

According to the report, Bitcoin may now be on track to test a pivotal support level of around $37,500. A failure to find a place here could prove disastrous for the bulls.

At press time, Bitcoin is trading at $40,121, struggling to recover after recording a string of substantial losses. It is down 41.81% from its record peak.

Oanda’s Jeffrey Halley told Bloomberg that the biggest cryptocurrency continues to trade within the established range, the lower limit of which is set at $36,500. If Bitcoin falls below this level, it will likely lead to significant losses. Conversely, if Bitcoin breaches the upper boundary of $47,500, a new all-time high could well be within reach, according to Halley.