Ethereum price is in a tough spot after the recent bounce from a support level. Although the uptick is bullish, there might be a revisit or perhaps a sweep of the said barrier before a full-blown uptrend begins.

Ethereum must survive the test of faith

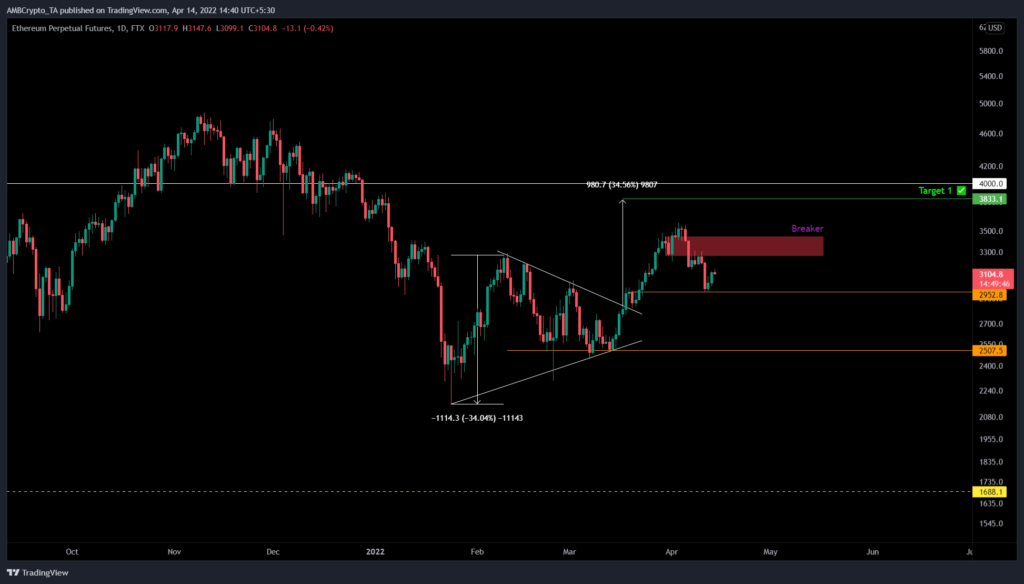

Ethereum’s price action between January 24 and March 27 created a symmetrical triangle pattern, obtained connecting the three lower highs and the four lower lows formed. This technical formation calls for a 34% move to $3,818, determined by adding the distance between the first swing high and the swing low at the breakout point.

On 27 March, Ethereum price breached this setup at $2,837 and rallied 22%. While the initial upthrust was impressive, it faced exhaustion leading to a 17% pullback to tag the support level at $2,952.

A bounce off this barrier has led to a 7% rise so far with a minor retracement on the charts. Due to the current state of BTC, this move could send ETH revisiting the April 11 low at $2,947.

If sidelined investors step in, causing a sudden spike in buying pressure, another leg-up is likely to will propel ETH to retest the 200-day Simple Moving Average (SMA) at $3,493.

Due to the importance of this hurdle, a successful overshoot will signal a resurgence in buying pressure and catalyze a run up to $3,833, the predicted objective of the symmetrical triangle.

Although unlikely, a highly bullish case could see ETH tag the $4,000 psychological barrier, bringing the total gain to 25%.

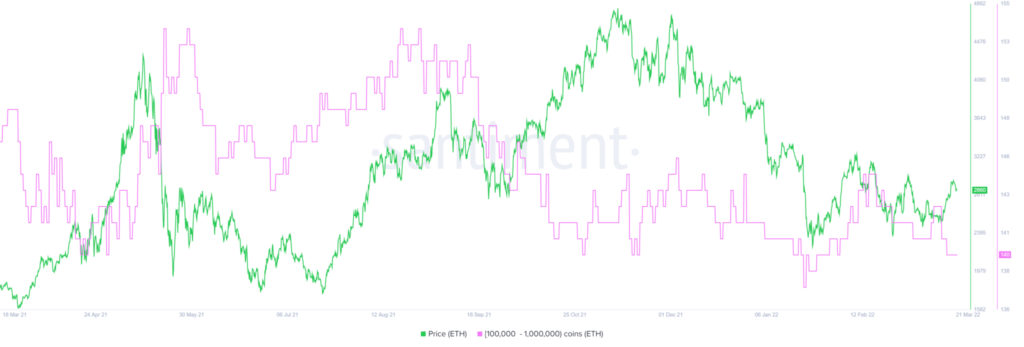

The supply distribution chart based on the number of addresses supports the short-term correction in Ethereum price. Whales holding between 100,000 and 1 million ETH have been on a downward trend since August 2021.

These holders’ numbers have dropped from 154 to 140 over the last eight months. This decline indicates that the investors are unsure about the performance of ETH in the near future. Furthermore, market participants need to exercise caution as a breakdown of the $2,952 support level could trigger a crash to $2,500.

A daily candlestick close below $2,500 will trigger a crash to $1,730, where buyers can hoard ETH at a massive discount, triggering another surge.